Top 10 Luxury Collectible Assets: Alternative Investments for Collectors

Image © Sotheby's / William Koch's Wine Cellar 2016

Image © Sotheby's / William Koch's Wine Cellar 2016Market Reports

For collectors and investors, diversifying a portfolio is essential as it largely protects your investments from fluctuations in the market. Traditional mediums such as stocks, bonds and real estate are some of the most common choices, but alternative investments have been gaining traction in recent years. Luxury collectibles in particular have become a popular option, thanks to their unique appeal and potential for significant returns. Categories such as art, cars, handbags, watches, jewellery and rare whiskey bottles all saw the most-expensive ever examples of each class being sold in 2022. This article explores the top 10 luxury collectible assets of the past few years, delving into their investment potential, market trends, and notable sales records.

Image © Christie's / Shot Sage Blue Marilyn © Andy Warhol 1964

Image © Christie's / Shot Sage Blue Marilyn © Andy Warhol 1964Art: The Top-Performing Collectible Asset

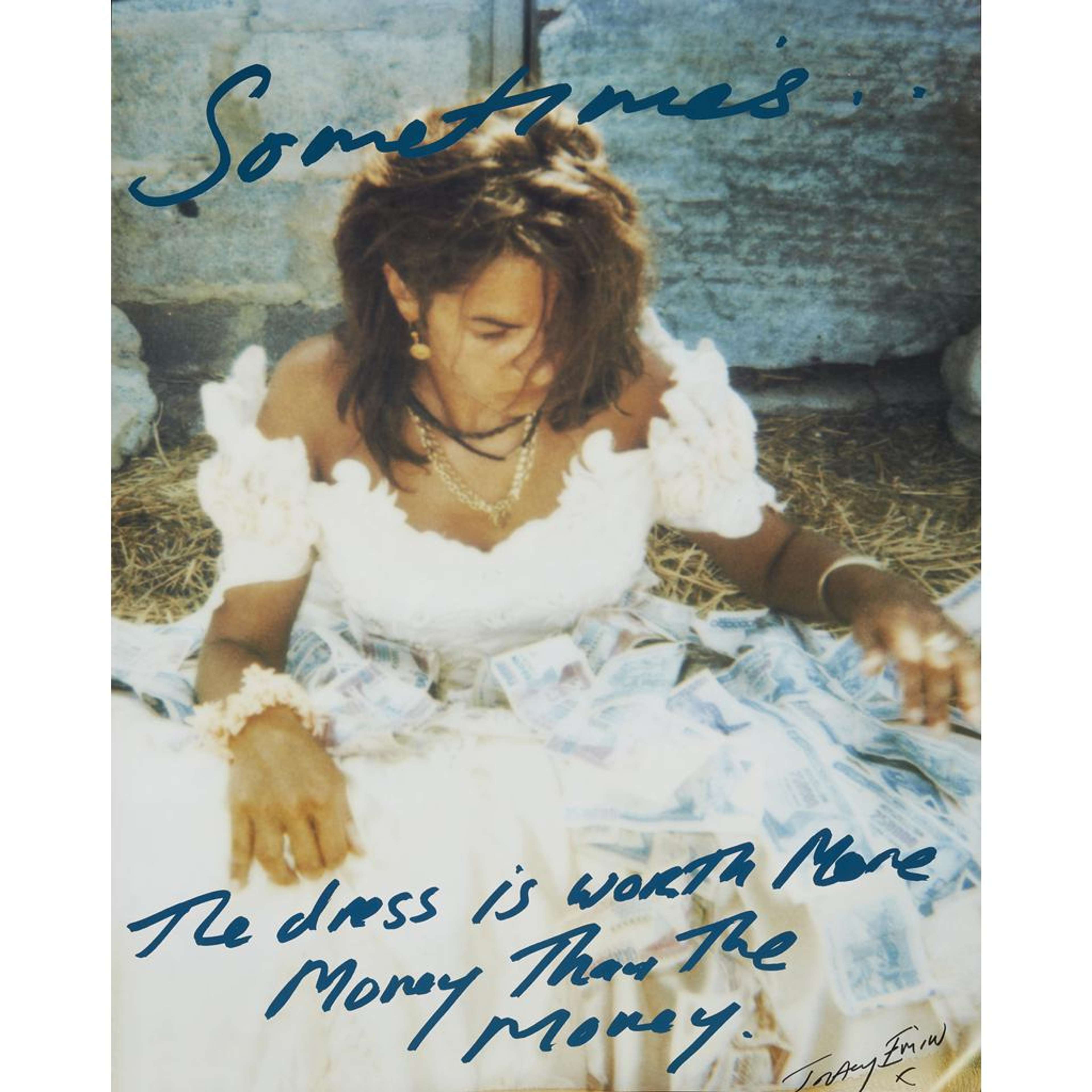

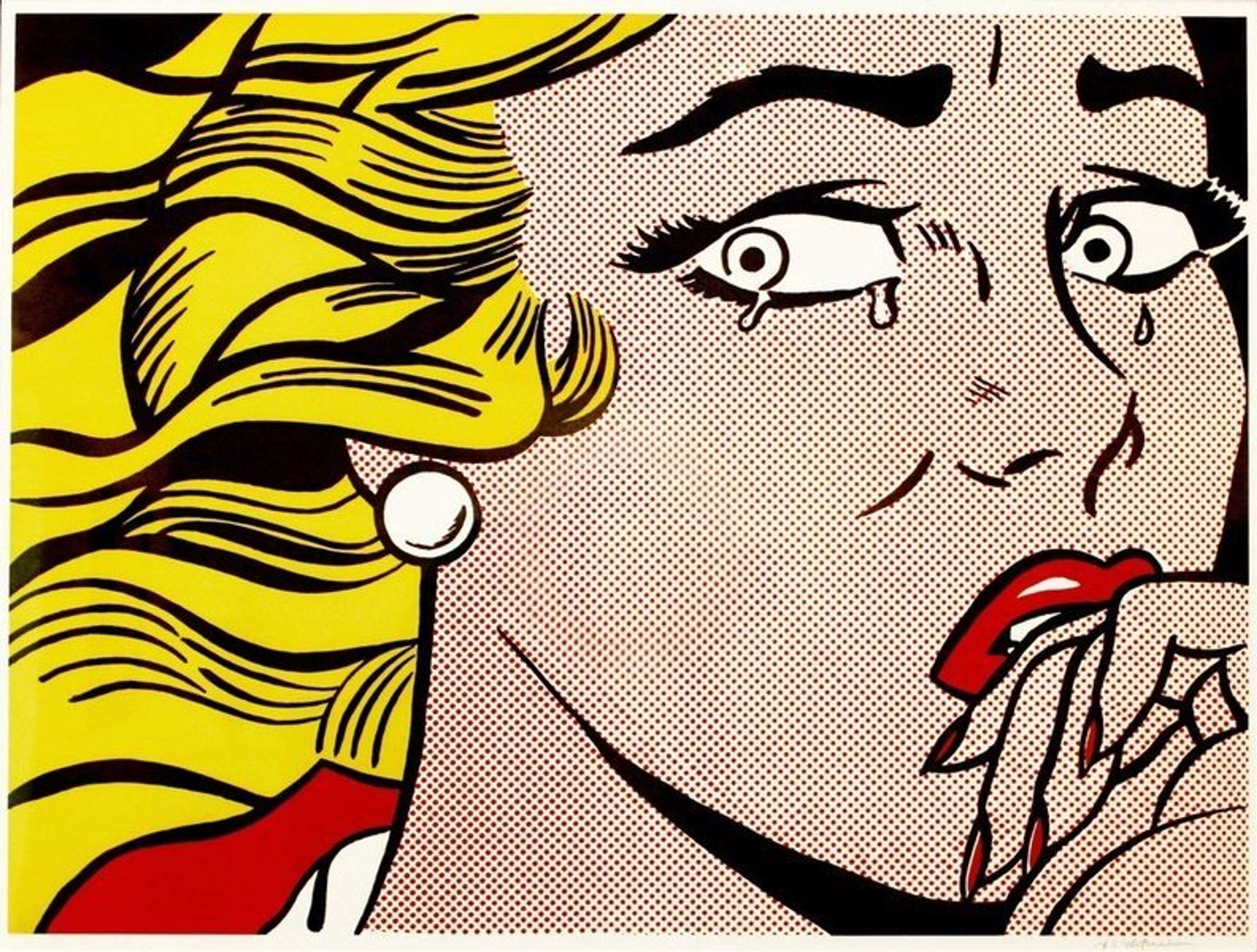

Art has historically been considered a valuable and prestigious investment. In addition to its aesthetic appeal fine art has the potential to appreciate significantly over time and, according to the Knight Frank Luxury Investment Index, has been the top-performing collectible asset class for the past decade. Art investments rose by 29%, despite economic instability and general market insecurity. In 2022 alone, auction houses and dealers achieved over £50 billion worth of sales. The most expensive painting at auction last year was Andy Warhol’s Shot Sage Blue Marilyn, which also became the most valuable 20th-century artwork ever when it sold for £158 million in May.

The past few years also saw NFTs enter the market, generating significant value. Beeple’s Everydays: The First 500 Days sold at Christie’s for over £55 million in 2021, and is still the most expensive NFT sold to date. This demonstrates art’s ability to adapt to new circumstances and thwart market expectations, and rebound quickly after the general recession experienced due to the pandemic in 2020. Our guide to investing helps you get started on your fine art investments, including NFTs.

Image © Champagne Avenue Foch / Bored Ape Yacht Club © Mis 2022

Image © Champagne Avenue Foch / Bored Ape Yacht Club © Mis 2022Vintage Wines

For many, investing in fine wines combines a passion for winemaking with the potential for financial returns. The wine market has experienced significant growth in the past few years and experts have predicted for it to expand to a value of £368 billion by 2028. In 2022, the market experienced a growth of 10% – slightly down from the 16% it achieved in 2021, but still a commendable appreciation and to be expected within the market trends. Last year, the most expensive bottle sold was a Methuselah bottle of Romanée Conti 2007 Domaine de la Romanée-Conti, which fetched £291,000 at auction at Sotheby’s.

The wine market, however, has also shown signs of adaptability: in the summer of 2022 a magnum of champagne Avenue Foch 2017 sold for a staggering £2 million. However, it was not simply the drink that buyers were paying for. Instead, it was for the coveted digital tokens attached to it, a collaboration with NFT artist Mig, famous for his Bored Ape Yacht Club artworks. The eventual buyers declared they would not be opening the bottle, considering it to be a good investment.

Image © Barrons / 300 SLR Uhlenhaut Coupé © Mercedes Benz 1955

Image © Barrons / 300 SLR Uhlenhaut Coupé © Mercedes Benz 1955Classic Cars

Classic cars are more than just a mode of transportation: they are a symbol of status and style, but can also be a solid investment. The market appreciated 25% last year, the highest value for the past nine years. Vintage automobiles from brands like Ferrari, Aston Martin, and Porsche have become highly sought-after collectible assets. In 2022, the most expensive car was a 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupé that sold for almost £120 million.

It is worth noting, however, that the classic cars market tends to not follow market trends, instead defining their own. This is something that appeals to collectors within that sphere, but an important information to have if you are simply looking to make returns on your diverse portfolio.

Image © Sotheby’s / Williamson Pink Star Diamond

Image © Sotheby’s / Williamson Pink Star DiamondFine Jewellery

Fine jewellery has long been a symbol of wealth and status and, paradoxically, the market seems to defy economic trends. Investment-grade jewellery often appreciates in value over time, and iconic brands like Cartier, Tiffany & Co., and Harry Winston are especially sought after. Individual gems also fall within this market, and are often the ones to fetch the highest prices at auction. In 2022, the Williamson Pink Star – an incredibly rare natural pink diamond weighing 11.15 carats – sold for a record-breaking £46.5 million at Sotheby’s. It became the second most valuable jewel or gemstone ever sold at auction, and the most expensive by value per weight.

Although investing in fine jewellery may feel like a reach after seeing these prices, there are many places where you can start to build a collection that is sure to appreciate over time.

Image © Sotheby’s / Late Ming Folding Chair

Image © Sotheby’s / Late Ming Folding ChairAntique Furniture

Investing in antique furniture allows collectors to own a piece of history, and potentially reaping financial rewards. High-quality craftsmanship, rarity, and provenance are essential factors that contribute to the value of antique furniture. It is especially important to work with renowned sellers to ensure your antique furniture has been ethically sourced and authenticated.

That being done, antique furniture can be a valuable investment: in 2022, a Late Ming period folding chair set a new auction world record after selling for almost £13 million. This made it the most expensive Chinese chair ever sold, going for over eight times its estimate. This is illustrative of how collectors continue to invest in furniture, constantly pushing the limits of auction estimates.

Image © Sotheby’s / Louis Vuitton Nike Air Force 1s 2022

Image © Sotheby’s / Louis Vuitton Nike Air Force 1s 2022Sneakers

The sneaker market has exploded in recent years, reflecting a growing interest in Urban and Street Art. Limited-edition releases and collaborations have been driving up demand and prices, despite a slight decline seen last year. In 2022, Sotheby’s auctioned off a collection of Nike’s Air Force 1’s in collaboration with Virgil Abloh, the head designer for Louis Vuitton who had passed away the previous year. The online auction was a resounding success, with 200 pairs of sneakers bringing in a total of £20.4 million. Most pairs sold for over £80,000, while a single pair in size five reached an astonishing £284,400.

Image © Sotheby’s / 2499 © Patek Philippe 1957

Image © Sotheby’s / 2499 © Patek Philippe 1957Watches

Luxury timepieces from brands like Patek Philippe, Rolex, and Audemars Piguet have long been considered valuable collectible assets beyond their ability to display status and wealth. With a combination of craftsmanship, prestige, and limited production, these watches often appreciate enormously over time, reaching 18% growth in 2022. The most expensive watch at auction last year was a Patek Philippe 2499 at Sotheby’s, a possibly unique edition made in 1957, which sold for a considerable sum of £6.21 million.

Despite these staggering figures, experts have warned that the market increase is being led by demand for only a few models: notably, the Patek Philippe Nautilus, Audemars Piguet’s Royal Oak and the Rolex Daytona. It remains to be seen whether their value will continue to appreciate, or whether buyers will begin to search for less common exemplars – as was the case with the 2499 in 2022.

Image © Sotheby’s / Michael Jordan 2022

Image © Sotheby’s / Michael Jordan 2022Sports Memorabilia

Sports enthusiasts have driven up the value of memorabilia, from game-worn jerseys to autographed equipment. The market, now estimated to be worth £21 billion, is expected to keep appreciating over the next few years. In 2022, Sotheby’s set two back-to-back records for game-used sports memorabilia: the first was the shirt worn by Diego Maradona during his infamous “hand of God” goal in the 1986 Fifa World Cup quarter finals, which sold for £7.5 million; a few months later came the second, a jersey worn by Michael Jordan during his “Last Dance” 1998 NBA finals, which sold for £8.14 million.

If auction records are anything to go by, it is clear that the sports memorabilia market is experiencing significant growth, and is something that can only be expected to appreciate within the next few years.

Image © Sotheby’s / Double Eagle Coin 1933

Image © Sotheby’s / Double Eagle Coin 1933Collectible Coins

Coins have been collected for centuries, and rare, historic coins can command hefty price tags. They can be both a hobby and an investment, and require due diligence in ascertaining provenance and authenticity. Despite these challenges, in 2022 the market experienced significant growth, with many coins breaking previous price records. Values can be hard to find as most of these transactions are carried by specialists away from auction houses like Christie’s or Sotheby’s, but in 2021 the latter sold a 1933 Double Eagle coin for £15.24 million.

Image © Sotheby’s / Kelly 25 © Hermés

Image © Sotheby’s / Kelly 25 © HermésLuxury Handbags

Designer handbags from iconic brands have been making waves and become highly sought-after collectibles, especially after a recent report by Credit Suisse and Deloitte states that both handbags are “recession-proof.” Limited-edition and rare pieces can appreciate significantly over time, and their association with status is not lost on collectors. The handbag market has appreciated 15% over the past year and is predicted to reach £80 billion in 2026, with most of the growth coming from makers such as Hermès and Chanel. In fact, the most expensive handbag ever sold at auction happened in 2022, when Sotheby’s offered a Himalayan Kelly 25 for over £290,000. This eye-watering amount is an indication of the boom that the marketing is experiencing, with no signs of decreasing in 2023.

As we have seen, the world of luxury collectible assets is vast and varied, offering a diverse array of investment opportunities. From traditional collectibles like art, wine, and classic cars to emerging trends like digital and NFT art and sneakers, these assets can provide cultural and financial rewards for collectors seeking alternative investments. As with any investment, conducting thorough research and seeking expert advice is crucial for success in the world of luxury collectibles.

Ultimately, carefully selecting and curating these assets allows investors to combine their passions with the potential for significant financial returns, and their market shows no sign of slowing down.