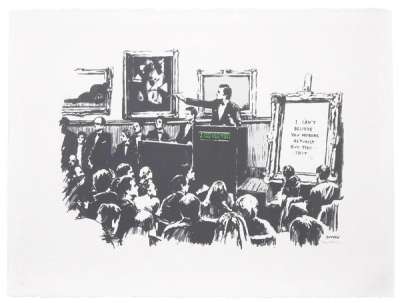

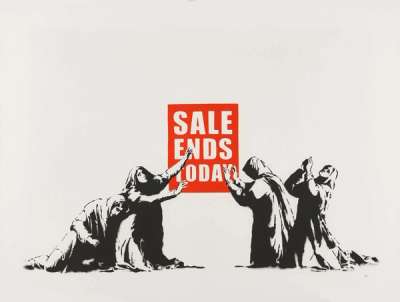

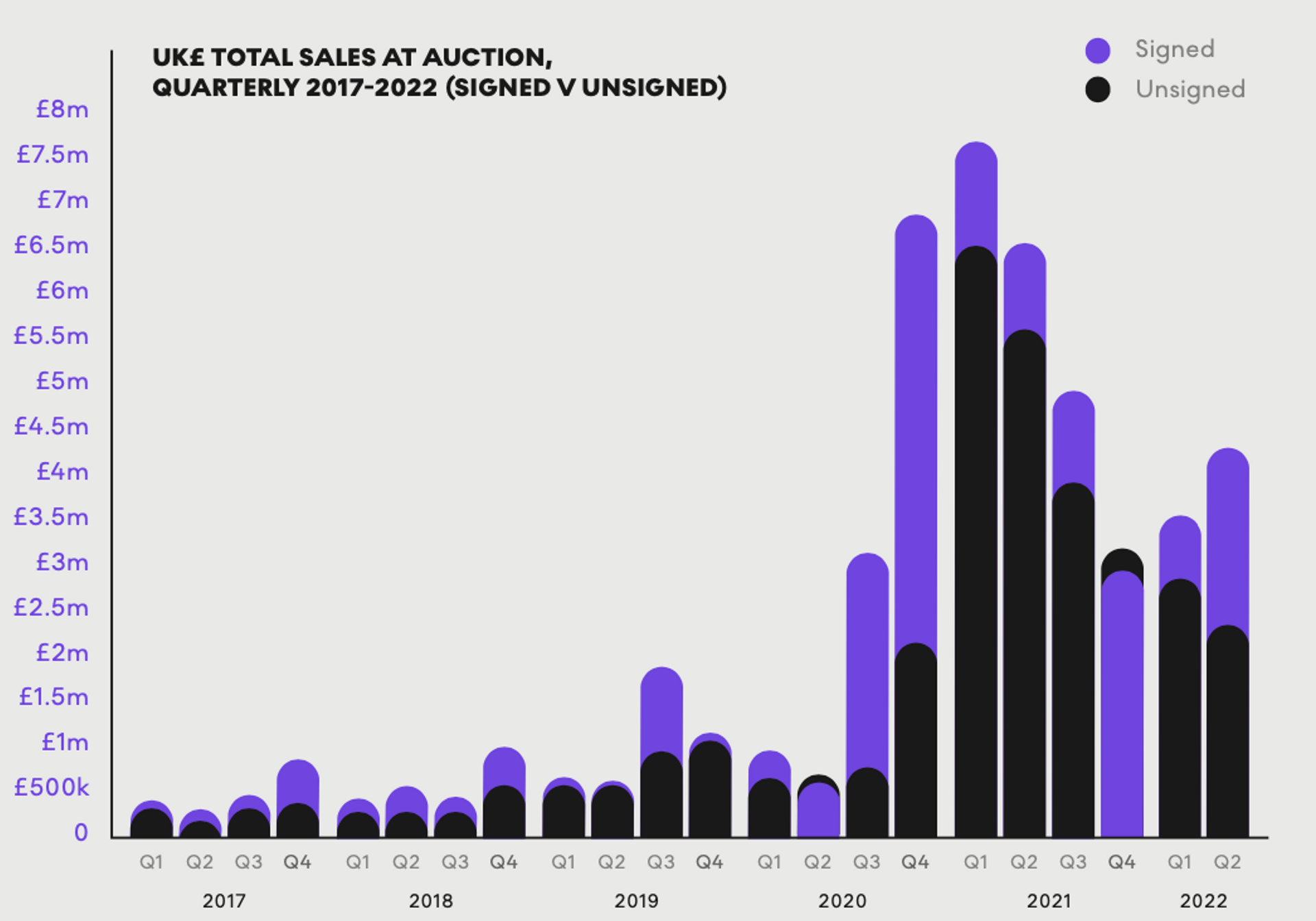

Banksy print sales account for over 60% of the contemporary prints and multiples market value, securing the artist's unrivalled monopoly in this category. £12.8 million worth of Banksy prints have been sold in the first six months of 2022. With more than £6.5 million generated in sales in the past three months. Q2 2022 has confirmed that the market is correcting itself following the boom of 2021 and growing into a place for long-term investments.

UK £ Total Sales at Auction, Quarterly 2017-2022 (signed v unsigned)

UK £ Total Sales at Auction, Quarterly 2017-2022 (signed v unsigned)In this report, we analyse some of the most noteworthy highlights of Q2, comparing them with Q1 and with the performance of the Banksy market in previous years. We also offer you some advice from our team of specialists on key things to check to ensure that your Banksy print is of the best possible quality.

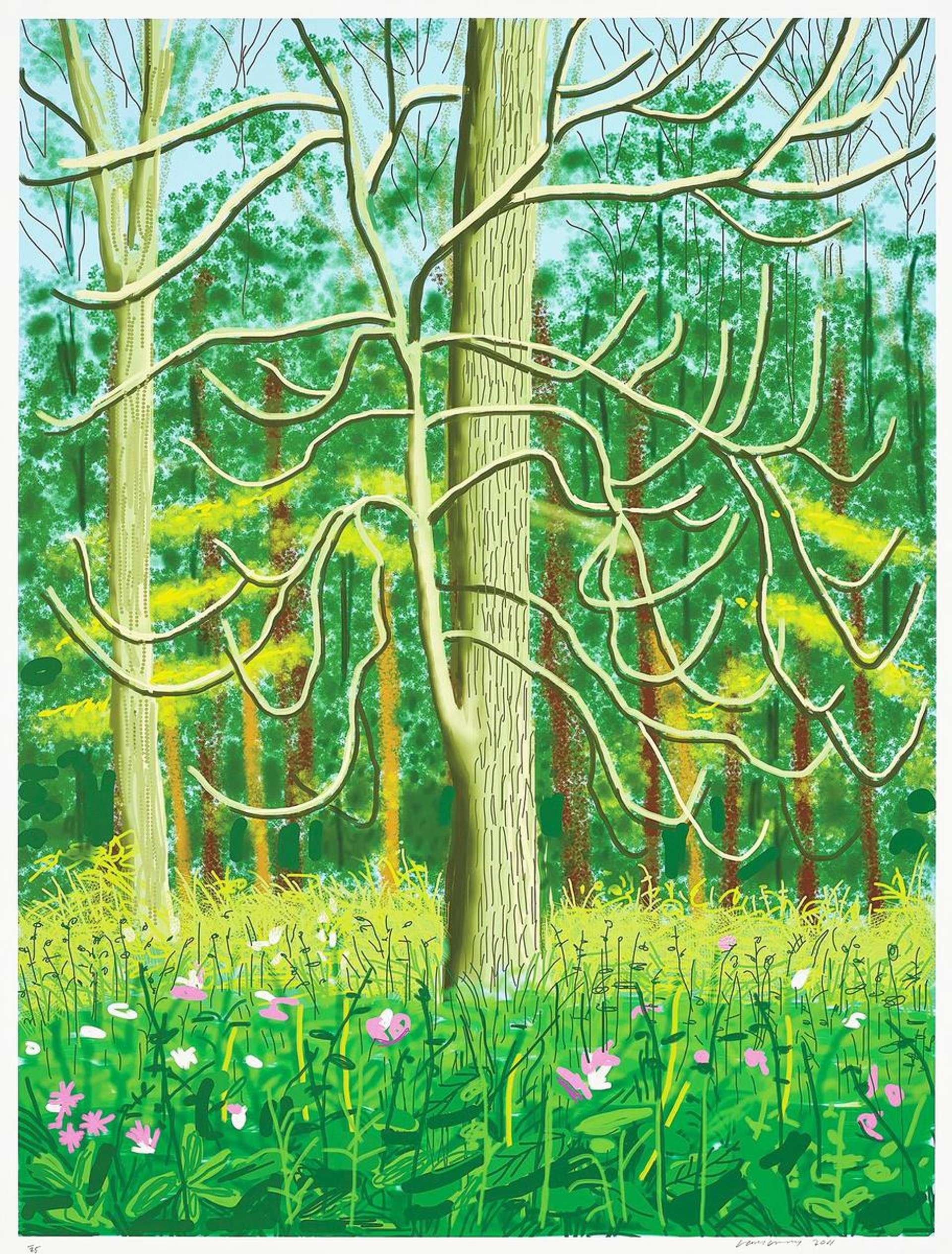

Our report also includes a comparison between the two greats of the Prints and Multiples market: Banksy and Andy Warhol. Through our specialists’ insights, we single out what has turned these two artists into household names within this segment of the market.

Find out what we’ve learned about the market in Q2 2022 in our new trend report, filled with advice from our Banksy specialists.

Take a deep dive into what we’ve learned about the market in Q2 2022 in our new trend report, packed with insights and advice for Banksy buyers and sellers.

Download our Banksy Market Guide Q2 2022.