How Experts Value Prints & Editions

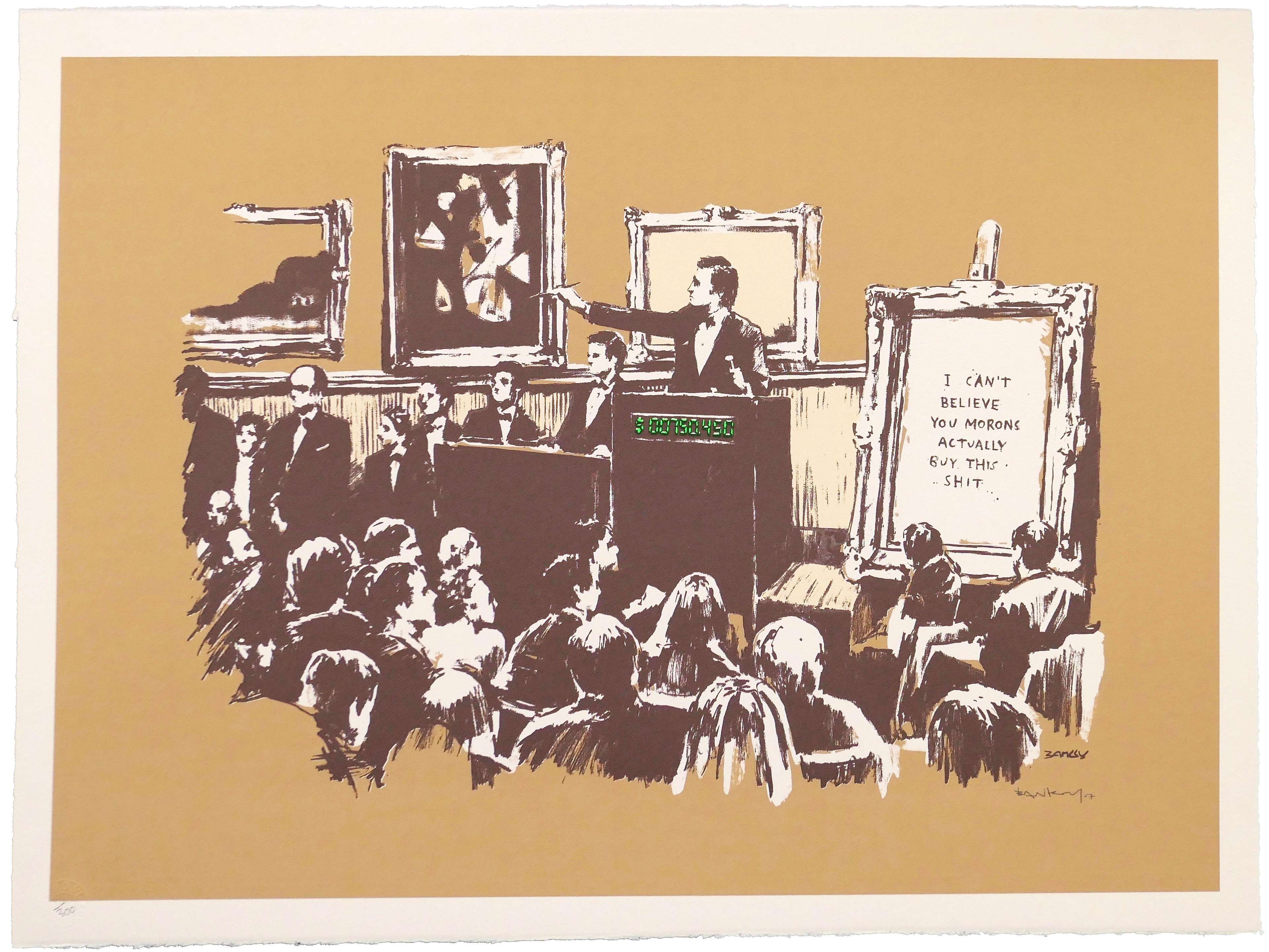

From Warhol soup cans to Banksy’s stencilled rebellion, the world of prints and editions is full of nuance. Despite what online estimates might suggest, valuing prints is never as simple as checking the latest auction results. It requires specialist insight, a rigorous understanding of condition and provenance, and fluency in an evolving market.

So how do art experts actually arrive at a fair, accurate valuation? According to Louisa Earl, Head of American Pop Consignments at MyArtBroker, it’s a process built on precision, research, and experience.

“My blueprint for the valuations process when looking at artwork is twofold. There’s the micro avenue – looking at the object itself. And then the macro – what’s happening in the market.”

Today, MyArtBroker’s expert-led approach has been made even more powerful by proprietary technology. We’ve built a valuation engine that mimics the thinking of a specialist like Louisa – but real expertise remains essential.

Two Lenses, One Valuation: The Micro and the Macro

At the core of every accurate valuation are two angles of investigation: examining the artwork as a physical object, and analysing where it sits within the current market.

The Micro: Analysing the Print Itself

Every print that comes through MyArtBroker is inspected closely. For editions by blue chip artists, this means examining:

● Evaluating paper quality and printing methods

● Looking closely at ink saturation, screen printing layers, and colour vibrancy

● Inspecting signatures and edition numbers, whether on the front or reverse

● Measuring dimensions to ensure consistency with catalogue raisonné entries

● Comparing the work to other known authentic examples

“You’re also going to compare it to other examples to make sure what you're looking at is the right thing,” Louisa explains.

A key part of this process is provenance. The history of the work – who has owned it, whether it has been exhibited or published – adds value. Exceptional backstories can enhance both interest and price.

The Macro: Market Context Matters

Once the object is understood, it must be placed into a broader market context. That includes:

● Current collector demand

● Recent auction and private sale prices

● The rarity of the edition and how often it surfaces for sale

● Wider artist trends in the secondary market

“We’re looking at market trends, artist popularity, and the price of comparables that have been sold already,” Louisa adds.

MyArtBroker’s valuation specialists work across both public auction records and a deep bank of private sales data. In fact, over 38% of print sales now happen privately, meaning many key benchmarks are unavailable on open databases. Our platform bridges that gap – giving collectors real-time pricing that reflects both markets.

The Technology That Mimics a Specialist’s Brain

While human expertise is irreplaceable, MyArtBroker has spent years building a valuation tool that captures the decision-making logic of print specialists.

Our Instant Valuation engine uses structured data and machine learning to replicate the thought process of an expert. It compares your print’s details with hundreds of similar examples, factoring in edition size, signature, condition trends, artist-specific demand curves and more.

The result? A fast, reliable valuation estimate based on real market intelligence – within moments.

But this tool is not designed to replace specialists like Louisa. It’s a starting point. Complex factors like paper type, colourway, and repair history still need a trained eye.

“I might rely on instinct in terms of authenticity, and then go back and do my due diligence. I might rely on the data a bit more to make sure my pricing is correct against market trends.”

The synergy between data and expertise is what gives MyArtBroker its edge. You can begin with an instant valuation, then speak to a real specialist who will fine-tune it for your exact print.

Why Condition Still Matters

One of the most significant variables in print valuation is condition – but it’s also one of the hardest to quantify.

“A Banksy with a tear to the edge, because it's a newer work, is going to have a more critical effect on the price. A Warhol – there's a bit more flexibility.”

Contemporary collectors tend to demand perfection, especially for recent releases. That means works that have never been framed or handled can attract a premium. By contrast, collectors of more vintage Pop prints may accept minor flaws, especially if the edition is rare or early in the artist’s career.

“The older an artwork is, the more flexibility there is in terms of relating condition to price point – because nothing is perfect forever.”

Even MyArtBroker’s valuation tool flags condition issues that can affect price – but only a conversation with a specialist can capture the nuance behind light fading, conservation work, or historic framing.

Print Valuation Is Not a Formula

“The biggest misconception people have about valuing art or prints in general is that it's straightforward. It’s not.”

No two editions are the same, even when produced by the same artist. A signed David Hockney print may differ dramatically in value from an unsigned one. A rare Banksy trial proof might fetch far more than a standard edition. Condition, provenance, popularity, and scarcity all play interlocking roles.

Print valuation is a blend of science and interpretation – and one that requires both a strong foundation of data and a specialist’s touch.

Thinking of Selling or Insuring a Print?

Whether you are looking to sell, update your insurance, or simply understand the current value of your collection, MyArtBroker offers a fast, transparent and specialist-led process.

“The best advice I can give to a collector looking to value your print or collection,” says Louisa, “is to come to MyArtBroker, use our Instant Valuation Tool, and speak to a specialist. We can’t wait to hear from you.”

Start with our Instant Valuation Tool, then explore how your print compares to others in the market. Or browse available works by Warhol, Banksy, Haring and more to understand the landscape.