A Guide To Auction v Private Sale In The Art Market

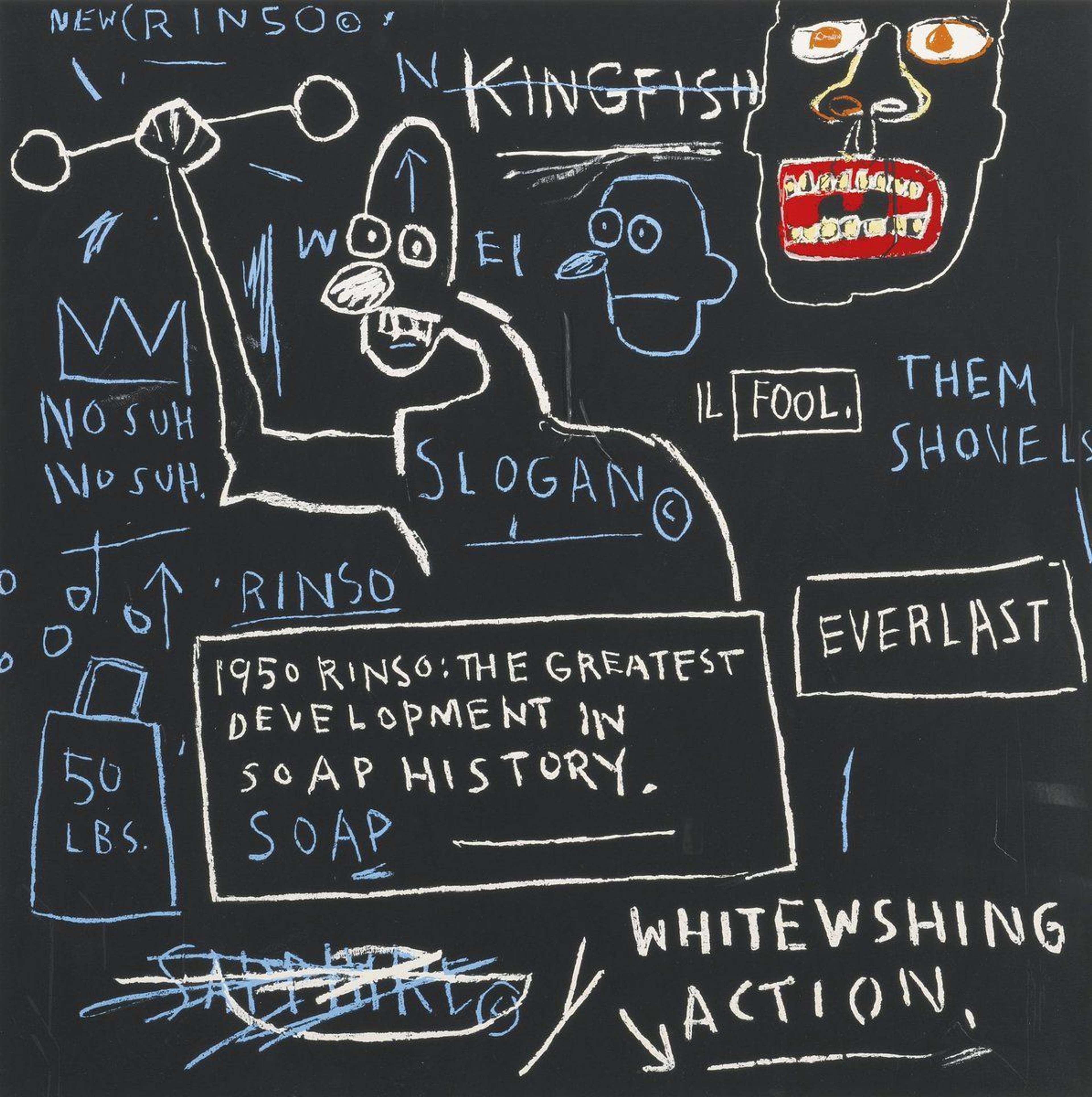

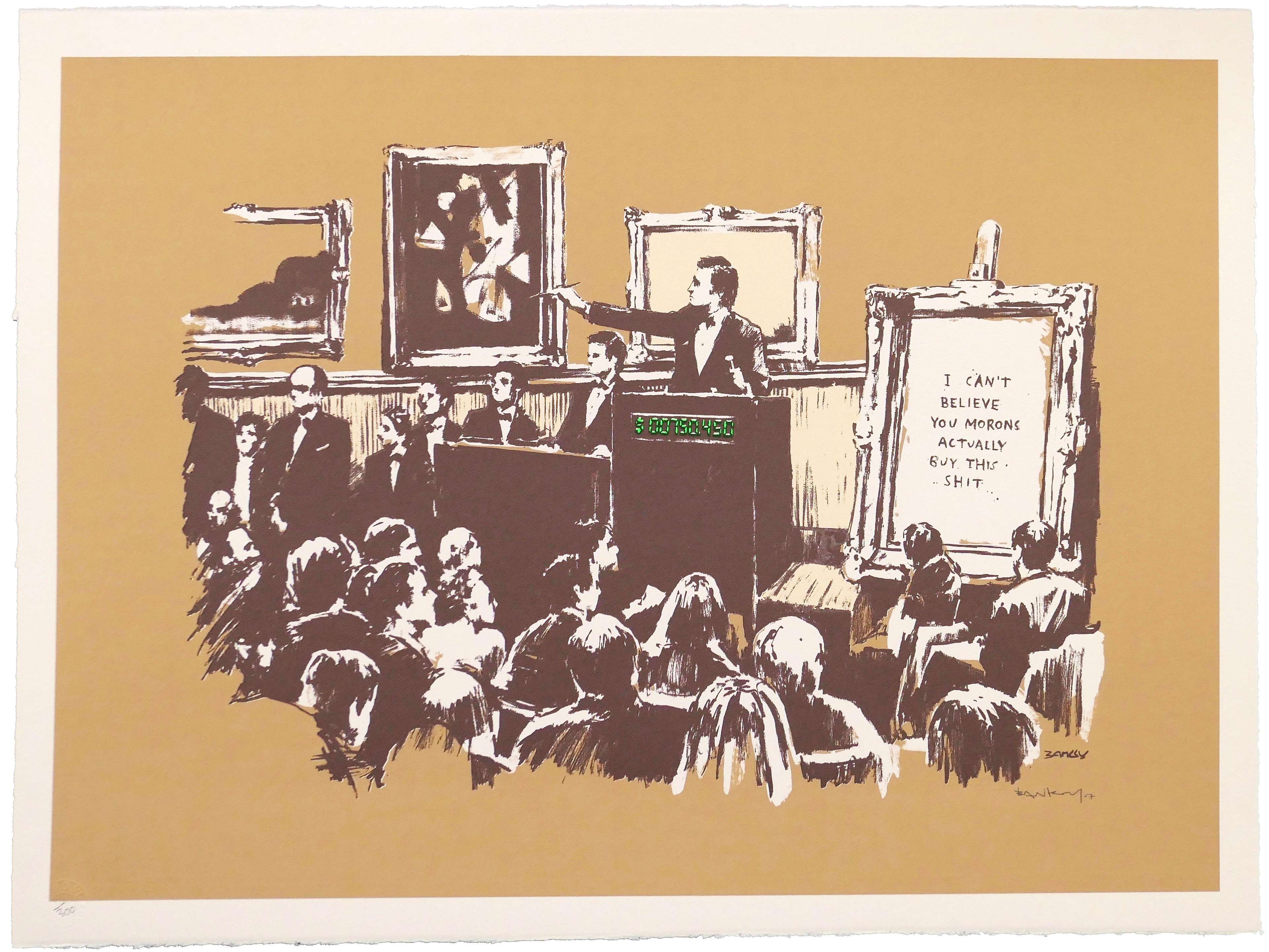

Morons (sepia) © Banksy 2007

Morons (sepia) © Banksy 2007Market Reports

Key Takeaways

The Auction Model:

Pros:

- Potential for record-breaking prices: Masterworks with exceptional provenance can break records on the public market raising the profile through publicly listed results.

- High-profile exposure: Auction houses provide global visibility for the most important works through centuries of tradition.

- Competitive bidding: A live auction can drive prices up if multiple bidders are highly engaged, this works particularly well for unique works that are given precedence in high profile sales.

Cons:

- High seller fees: Vendor commission rates can reach 15% plus marketing, insurance, and storage fees.

- Unpredictable returns: No guaranteed sale price; if bidding is weak, the work may sell below expectations at reserve, or indeed below that if sold without reserve.

- Reputational risk: If an artwork goes unsold, it can be “burnt,” diminishing its market appeal and reputation, and making it very hard to return the works value upon re-offer. Buyer’s premium increases costs: Buyers must pay 25% on top of the hammer price, as well as VAT on that premium, making the final price 30% more than the hammer price.

- Strict timelines: Sellers must adhere to auction schedules and may wait months for a sale.

- Saturation: There is no way of knowing ahead of the sale what company your work will have in that auction. Your could be the best work by that artist, or the least desirable, affecting the demand without your knowledge on the day of the sale.

- Unsold fees: If your work fails to sell via the auction, it may be subject to ‘BI fees’ this means the auction will ask for a fee to cover their losses in the marketing and cataloguing of the sale, even though the return is zero.

Private Sale: The MyArtBroker Model

Pros:

- 0% seller’s fees: No hidden costs, ensuring sellers return the full price agreed upon consignment.

- Guaranteed net return: Sellers agree on a return in advance, avoiding unpredictability. This is not a reserve, it will be the agreed price in line with fair market value. The objective is directly to return you more than you would elsewhere.

- Private, secure transactions: The work is sold privately, only a qualified small group of potential buyers are party to the edition number, meaning there is no risk of a work being publicly “burnt” if it doesn’t sell immediately.

- Flexible timing: No waiting for an auction; sell when you decide is the right time, and the market is at the right point.

- Direct access to collectors: Your artwork is marketed to a network of 35k category specific collectors.

- Transparent specialised print market sales data: MyArtBroker provides clear insights into past auction results, current market trends, and demand for specific works, allowing sellers to make informed decisions.

Cons:

- No high-stake bidding wars: A private sale doesn’t create the same competitive frenzy as an auction when a work is truly unique and it offers a once in a lifetime opportunity to own a unique work, an auction offers that sense of demand.

- Not always suited for unique, historic masterpieces: The auction model may be preferable for singular museum-quality works, and for collectors looking for a spectacle of a sale.

- Price and Condition: Lower value, sub £10,000 and works or works with considerable condition issues often do better in public auctions where the work can be offered to market as part of a curated selection. These works need the stage that auction provides.

As the owner or potential buyer of a masterpiece, auction is a wonderful place to buy and sell truly unique original paintings. But an online-first private sale will always trump traditional auction when it comes to buying and selling prints and editions, and here's why.

The sale of original masterpieces, such as large scale canvases by Pablo Picasso, René Magritte and Leonardo da Vinci are wonderful examples of how the spectacle of auction works its traditional magic.

You only have to watch the Evening Sales at Christie's, Sotheby's and Phillips to see how the salesroom, telephone and internet full of bidders create drama to allow prices to soar for collectors looking for once-in-a-lifetime opportunities to acquire a specific work - these sales are significant moments in history. Watch the breathtaking $450 million (including buyer's premium) sale of Salvator Mundi, before it generated headlines across the world:

However, while auctions can yield impressive results for unique works, they present substantial risks for sellers, particularly in the prints and editions market. The increasing fees, risk of works going unsold, limited control over timing and saturation make auction houses a less attractive choice compared to the flexibility of private sales.

The Risk of Auction for Prints and Editions

The nature of editions ensures that there is rarely just one opportunity to acquire a work, making the auction model’s appeal of “once-in-a-lifetime” bidding far less compelling for both buyers and sellers.

With editions, if the price isn’t right for the buyer at that moment of sale and doesn’t align with the fair market bracket for the work, there is little motivation to keep bidding. A prints and editions auction - whether live or online - lacks the sense of rarity and exclusivity that accompanies a masterpiece that may have remained in private hands for generations and is truly one-of-a-kind. For prints, another opportunity to acquire a work from the same series is always just around the corner.

One can draw parallels between the print market and the designer jewellery or handbags market; the wine and watches market too. The truth is, once bidding surpasses fair market value - unless the edition number holds personal significance - only a reckless buyer would keep pushing. All the more reason to understand the value, scarcity and condition of the print you're looking to bid on.

With major Contemporary art collectors looking for the best return on their investments, it’s no wonder the trends are favouring online platforms offering the same global reach and world-class expertise as leading auction houses, for a fraction of the price backed up with the assurance of the exact return, and the exact price tag.

If you are looking to sell your print exactly when you want, without costs, and with assurance of the end result, then auction houses simply can’t accommodate the request, due to their pre-planned calendar and the overheads of running a traditional and expensive auction house model.

Private Sales Advantages

At MyArtBroker, our objective is to return you more or the same as you would have at auction, as fast as possible on your terms, and without risk. Our seller’s fees are always at 0%. You have the ability to sell whenever you want, but we advise on the very best time to release the value of your work.

As the largest dedicated prints and editions network in the world, and as a specialist online platform, that audience is undiluted and focuses primarily on getting our clients a better deal.

How Does Auction Work?

How Does Auction Work?

Auctions work by taking food off both sides of the table: firstly a commission off the seller: to sell, you’ll pay 15% of the hammer price sometimes plus marketing, cataloguing, shipping, insurance and storage fees which you can have waived for higher value works; and to buy, you’ll pay 25% of the hammer price plus VAT on that Buyers Premium. If the artwork sells for well over the high estimate you could also be subject to a 1-2% performance commission. The traditional auction model takes food off both sides of the table.

For a expert insights into how the art auction process actually works, read our comprehensive guide.

If you want to buy at auction:

- Wait for the auction date and either be there in person, on a pre-arranged call with a specialist, or you can be logged in online at the right time at the right lot (they recommend allowing 60-100 lots per hour). Or you can leave an absentee bid and keep your fingers crossed.

- Be in the right place, on the right bid, at the right time, it is essential.

- Remember to have done your research on the price and the work you're bidding on, and know the top bid that you’re willing to pay, (add 30%) and stick to it.

If you want to sell at auction:

- Choose an auction house and email them, or submit an online form. First off is the task of finding the right auction for your print, this will be in consultation with one of the house’s specialists, who will normally want to see your work in person. They will advise on pricing strategy, and then suggest which sale would be best for it.

- Once everything is decided between you and the specialist, an administrator will contact you with your paperwork. It will then be up to you to manage and pay for your work to be shipped to the auction house’s storage facility ahead of the auction.

- The next auction will likely be a few months down the line as auction seasons are static. Even if the auction is soon, consignment deadlines are usually 2 to 3 months prior so be prepared to wait.

- You may be asked, particularly with a print sale, to wait until the next auction after the one upcoming, especially if the house has a print from the same series already consigned. This is in order for two prints from the same series or portfolio don’t depreciate each other in the same sale.

- If your work sells at auction, you'll be notified at what amount and you will receive payment a few weeks after the sale completes. Auction houses such as Christie’s also charge a 2% Performance Commission fee in the event that your print sells for above the high estimate you agreed upon consignment.

- If your work doesn’t sell, you’ll be expected to manage and pay for the safe return of your work, and pay the unsold fees to the auction house – often 1.5% of the average of the high and low estimate they list it at. You will then have anything from two weeks to one month to collect the unsold work from their storage facility before it starts accruing storage fees which can be hefty.

For further insights into how valuations are determined and how external factors influence pricing, read How Auction Houses Determine Art Valuations.

How Do Auction Fees Work?

The seller’s commission at major auction houses, such as Christie’s or Sotheby’s, is 15%. On top of that, you’ll be asked to pay shipping, LDL (loss, damage and liability insurance), as well as a hefty marketing and cataloguing fee. These are negotiable fees when it comes to consignment. In the case of masterworks, an auction house might offer to waive the cost of selling for works of great value. They rarely offer the same waiver, however, for their Prints and Multiples auctions.

The buyer’s commission is 25% on anything you bid up to and including £450,000. You’ll then pay VAT on that commission, and in most cases, you’ll be required to produce identification details prior to bidding.

The Costs & Disadvantages of Selling at Auction

Auction fees can significantly impact both buyers and sellers.

- Seller’s commission is typically 15% of the hammer price, plus additional costs like marketing, LDL (Loss, Damage, and Liability insurance), and cataloguing fees.

- Buyer’s premium adds 25% or more to the hammer price, making auction purchases considerably more expensive than they appear at first glance.

- Performance commission fees - charged when a work sells above its high estimate - can add another 1-2% for the seller.

- Artist Resale Rights (ARR) applies to secondary market sales of living artists and those who have passed within the last 70 years, adding up to 4% in additional costs.

For a more detailed breakdown of auction fees, refer to our article A Guide to Art Auction Fees.

A Close-Up Look At Auction Commission In the Current Market

Sotheby's New Fee Structure & Back Again

In early 2024, Sotheby’s made headlines with a bold fee structure overhaul - one that some art market insiders jokingly suggested had been sketched out on a cocktail napkin. The changes introduced a flat 20% Buyer’s Premium for purchases with a hammer price up to $6 million and 10% for amounts above that threshold, while standardising the Seller’s Commission to 10% up to $500,000 across all categories. The goal? To increase transparency and drive sales. But did it work?

Looking back at Sotheby’s last major fee structure change in 1984, the evolution of the art market over the past four decades becomes clear. That year, Jean-Michel Basquiat’s Untitled sold for just $19,000; three decades later, it achieved a record $110 million at Sotheby’s. In 1984, the auction house set a then-world record with the $10 million sale of Turner’s Seascape: Folkestone, a figure now eclipsed by the $450.3 million spent on Leonardo da Vinci’s Salvator Mundi in 2017. Even sports memorabilia saw a seismic shift - 1984 was the year Michael Jordan wore the sneakers that, 33 years later, sold at Sotheby’s for $1.5 million. These milestones underscore the market’s explosive growth, raising the question: did Sotheby’s fee adjustments align with today’s realities?

The answer became clear by the end of 2024. The standardised Seller’s Commission - intended to simplify and level the playing field - had the unintended consequence of making it harder for Sotheby’s to attract high-value consignments. Traditionally, top-tier sellers could negotiate lower fees or even have commissions waived entirely. By removing this flexibility, Sotheby’s alienated high-stakes consignors, who increasingly turned to rival auction houses or private sales with more favourable terms.

The decline in major consignments put pressure on the house, especially as global art sales had already dropped by 23% in 2024. By December 2024, Sotheby’s once again made waves - this time by reversing course. The auction house reinstated a tiered Buyer’s Premium and returned to negotiable Seller’s Commissions, acknowledging that the previous structure had discouraged high-value sales. While buyers had welcomed the lower premiums, the policy ultimately undermined Sotheby’s ability to secure top-tier artworks. Facing a slowdown in high-value transactions, the firm had little choice but to pivot back to a more flexible model.

Returning to the 40-year perspective, this abrupt back-and-forth is less a sign of innovation and more an indicator of turbulence at the auction house. Whether this uncertainty will ripple into 2025 remains to be seen, but one thing is clear: in a shifting market, even giants like Sotheby’s are struggling to find the right balance.

The Benefits of Selling Prints Privately through the MyArtBroker Model

What Does It Cost To Sell Privately, Via MyArtBroker?

Because our business model at MyArtBroker is leaner, we can offer 0% seller’s fee, guaranteed, with no hidden extras. You agree on the price you'd like to return and we either promise to sell it and return that or not, in which case we won't take on the consignment.

Having amassed an extraordinary community of buyers and sellers in the print market over 20 years, it’s not difficult for us to find the right buyer for a work, and supported by digital innovation unlike our competitors, we offer 0% to our sellers, simply because we can.

We make our margin on the buyer's side, but because our competitors charge buyers up to 30% on top of the final bid, we can operate more economically and offer them a better deal too.

How it works at MyArtBroker

- You make contact, and we assign you a dedicated specialist in that field. It's worth noting that all our specialists come, almost exclusively, from auction houses, so you can expect the same expertise.

- You agree on a price, we condition check the work, check provenance, and then offer your work immediately privately to our collectors.

- Once a buyer is found and the funds are cleared, we pay, and help ship the work from our conservators, no storage facility needed. That’s it.

- We do not hold you to a date to offer your work, nor do we charge for marketing it to our 30,000-strong collector network.

How Does MyArtBroker Offer This Service At 0% And Auction Houses Can’t?

There is no magic, we benefit from remaining niche and serving a more concentrated market place. Having operated in the editions market since 2010, we’ve been listening to our buyers and sellers and adapted the platform and network in a way that’s important to make it work for all. Our optimised model means we have very few of the same overheads attached to running a traditional auction house, allowing us to invest heavily in digital innovation, print market specialism, and marketing works to our network.

When it comes to selling your artwork, to get the best price, it all comes down to accessing a niche market with a specific network of collectors. If you have a print to sell, you are far better off going to a specialist in the print market than you are going to an auction house, whose collectors are interested in much broader categories of artworks.

For buyers, we offer you the time to carefully consider each purchase without the pressures of a live auction, and we can bring a greater selection of artworks to market in a simple, secure way. Our brokers are specialists in their fields and we act as a conduit between you and sellers. We also pride ourselves on balanced market advice to first-time buyers and sellers.

For an in-depth look at the various selling avenues in the print market, refer to our market report, How to Sell Prints in the Current Market.

Should You Sell Your Print Online?

If you're considering selling your prints online, we strongly recommend consulting with experts before navigating the market alone. Art remains a tangible and deeply personal investment, and while online platforms are valuable tools, they cannot fully replace the expertise required to cater to both emerging collectors and seasoned buyers with substantial inventories.

When you buy or sell with MyArtBroker, our experienced specialists guide you through every step of the process - from sourcing the right artwork or buyer to authentication, price negotiation, and post-sale logistics. With direct access to a network of top-tier art market professionals, we handle the complexities for you, ensuring a seamless transaction from start to finish. For those looking to explore professionals individually, you can browse our available network of industry professionals via The Directory.

How To Sell Art Safely Online?

Use a secure platform, read the testimonials and speak to experts. Although there is growing trust in the online art trade, platforms such as eBay, Artsy and others, still stumble when it comes to the issue of artist authenticity and value. Many of the markets we work in are sadly riddled with fakes. Buying through a fine art professional should offer absolute assurance and our specialist can help guide you in the right direction, for free as this is advice all collectors should have as a right.

We offer the opportunity to post listings for wanted artworks within a global community of buyers and sellers on the trading floor – ideal for collectors searching for particular works that are more difficult to come by.

With 75% of new online buyers stating that they were driven by value potential more than any other motivator, it’s easy to see why both buyers and sellers are moving away from the traditional auction house, and towards online private sales.