Market Reports

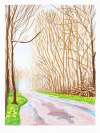

In October 2025, Sotheby’s staged its first-ever live auction dedicated exclusively to David Hockney’s The Arrival of Spring in 2011 achieving a white-glove result of £6.2 million. All but one work sold above estimate at the hammer, with 11 prints returning to auction showing gains of over 19-times the previous sales.

This landmark sale marks a major moment for the series – setting fresh public benchmarks and reaffirming institutional and collector confidence in Hockney’s recent digital works. It follows a private sale earlier in the year and cements The Arrival of Spring as one of his most sought-after print collections.

→ Explore our dedicated Arrival of Spring Market Report.

Is Now A Good Time To Sell A David Hockney Print?

Even in a selective market, Hockney’s print sales continue to perform with resilience. In the first half of 2025, total print sales reached £3.1 million across 133 lots – already outpacing 2024 by volume.

The clearest signal of ongoing strength came from Phillips’ annual dedicated Hockney sale in May, which totalled £667,500 across 38 lots. Although this was down 51% year-on-year, the auction still finished 56% above the low estimate, with four Moving Focus prints selling above estimate and three setting new records. Demand from Asia also continued to rise, reflecting Hockney’s expanding global base.

Other 2025 highlights include Arrival of Spring, 4th May 2011 achieving £504,000 at Christie’s and 31st May No.1 selling for six figures at Sotheby’s. Beyond the print market, Hockney also dominated Art Basel, where Mid November Tunnel (2006) sold for $13–17 million (USD) through Annely Juda Fine Art – the fair’s highest‑reported result.

For sellers, volumes may be smaller, but rare editions and underrepresented series continue to outperform.

Which Hockney Prints Are Performing Best in 2025?

Moving Focus Prints Lead the Market

The Moving Focus portfolio remains a cornerstone of Hockney’s print market. An Image of Celia (State I) sold for £189,376, Hotel Acatlán: Second Day for £181,983, and An Image of Gregory for £105,526. At Phillips’ May sale, three prints from the series set new records, confirming it as one of Hockney’s most consistently investable collections.

Arrival of Spring Prints Reposition at the Top Tier

The October 2025 Sotheby’s sale firmly repositioned The Arrival of Spring series into the upper tier of Hockney’s market. The white‑glove auction achieved £6.2 million in total sales, with every print hammering above estimate and multiple works exceeding £300,000–£500,000 at the hammer.

This marked a step change for the series, which now sits alongside Moving Focus and The Weather Series as one of the artist’s highest‑value categories. Once considered a mid‑tier segment, Arrival of Spring is now a benchmark for high‑value editioned works – demonstrating how scarcity, visual immediacy, and digital provenance can drive collector confidence.

Top results include 25th March 2011 (£192,264, Christie’s), 17th May 2011 (£173,209), and 14th May 2011 (£167,903), though Sotheby’s October sale redefined the value ceiling for the series – solidifying it as a leading asset in Hockney’s print market.

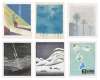

The Weather Series Holds Its Ground

The Weather Series remains a steady, high‑performing category for sellers. Rain remains the top‑valued print, while Snow continues to rise, setting consecutive records and now averaging around £80,000. The series’ pricing has remained close to its 2022 peak, reflecting enduring institutional and collector confidence.

→ Explore The Weather Series Market Report.

Pool Prints Continue to Define Liquidity

Hockney’s Swimming Pools prints remain his most liquid works, prized for their recognisability and consistent turnover. Pool Made with Paper and Blue Ink for Book reached £69,300 in 2025, while the rarer Lithographic Water Made of Lines, Crayon and Blue Wash achieved £121,500 at Doyle New York. These results confirm the category’s resilience and continued appeal to a global collector base.

→ Read our Swimming Pools Market Report.

iPad Drawings and Floral Lithographs Gain Ground

Mid‑tier buyers have increasingly turned to Hockney’s iPad drawings and floral lithographs, which offer strong visual appeal at accessible price points. 24th February 2021, Red, Yellow and Purple Flowers on a Blue Tablecloth achieved £40,350 in Asia, while Untitled, 852 (Dandelions) realised £61,865 at Christie’s. Traditional lithographs such as Pretty Tulips and Still Life With Book continue to perform reliably in the £30,000–£50,000 range.

Hockney Print Values in 2025: What Sellers Should Know

Hockney’s print market now spans a wide range of value tiers, with shifting boundaries following this year’s landmark sales:

- Entry Level (Up to £50,000): iPad drawings, interiors, still lifes, and small etchings – high liquidity and broad buyer demand.

- Mid Tier (£50,000–£200,000): Moving Focus, Weather Series, and Pool prints – core market activity with steady returns.

- High Tier (£200,000+): Arrival of Spring prints (post‑Sotheby’s), rare proofs, and low‑edition works. These now represent Hockney’s top‑performing category, with potential for record‑breaking results.

- Complete Sets: The pinnacle of collector demand. Home‑Made Prints reached £686,000 in 2021 and remain highly sought after.

Edition size, provenance, and condition remain the strongest price drivers. Following Sotheby’s record sale, Arrival of Spring prints have become high‑value assets commanding sustained attention from private buyers and institutions alike. Check your print’s current range with our Instant Valuation Tool.

How Do I Prove My Hockney Print Is Authentic?

The Hockney Foundation

The Hockney Foundation holds over 8,000 works and provides invaluable research, though it does not issue certificates. A catalogue raisonné is due in 2026.

Gallery Provenance, Signatures, & Numbering

Gallery provenance also adds significant weight. Hockney has long been represented by L.A. Louver (California), Annely Juda Fine Art (London), and Galerie Lelong (Paris). Although L.A. Louver recently announced plans to close its Venice, California gallery, works originally acquired through them will continue to carry strong provenance and historical significance.

Signatures and numbering are usually in pencil, bottom right (signature) and bottom left (edition).

Hockney's Print Publishers

Print publishers provide additional assurance, often with identifiable blind stamps. Key collaborations include: Editions Alecto (A Rake's Progress, 1963) and Petersburg Press (Six Fairy Tales from the Brothers Grimm, 1969). Gemini G.E.L., a longstanding partner since 1973, produced numerous lithographs and etchings and the unique Paper Pools series (1978–80), was created with Tyler Graphics and master printer Kenneth Tyler.

More recently, Hockney has also self-published signed iPad prints, which include his own blind stamp alongside a signature, date, and edition number. While publishers themselves don’t guarantee authenticity, recognised blind stamps or well-documented studio provenance can significantly enhance buyer confidence.

What If My Hockney Print Needs Restoring?

Condition is one of the most influential factors in determining resale value. Hockney’s prints are often delicate due to their experimental production methods – some, like his fax‑machine prints, were never expected to age into the high‑value category they occupy today.

Typical issues include discolouration, undulation, surface marks, and minor foxing. Well‑preserved works consistently achieve higher returns. As Hockney specialist Helena Poole notes, “Condition should always be considered in context of the artist’s process – what may appear as imperfection can, in fact, be inherent to Hockney’s technique.”

If you’re unsure whether to restore a print, consult a specialist first. Visit The Directory on MyArtBroker for trusted conservators, or read Is That Print Worth Still Worth Buying? to hear real stories from conservators who’ve worked on blue chip prints.

How to Sell a Hockney Print with MyArtBroker

At MyArtBroker, we specialise in the sale of blue chip prints through private sales, providing sellers with data‑driven valuations, transparency, and control.

Our specialists offer complimentary valuations grounded in real‑time Trading Floor data. You can view current demand for Hockney prints – what’s wanted, listed, or recently sold – and access historical pricing via MyPortfolio, our free collection management tool.

How a Private Sale Works

Unlike traditional auctions, we charge 0% seller fees. All costs – insurance, marketing, and logistics – are absorbed by us. Revenue is derived solely from a small buyer commission, agreed at offer. This model ensures maximum returns for sellers and seamless execution for works typically valued above £10,000.

Advisory and Recommendations

For works that fall outside our active network – due to value, rarity, or medium – we collaborate with vetted partners to ensure optimal placement. This service is free and tailored to every work.

With over 30,000 active collectors using our platform, we connect your Hockney print with serious buyers globally. Our private sale infrastructure, authentication oversight, and transparent pricing give sellers the confidence of institutional standards with the agility of a digital platform.

Manage and Track Your Hockney Collection

MyArtBroker’s MyPortfolio tool allows you to manage your collection in real time. Backed by our proprietary algorithm, SingularityX, it analyses over 50,000 auction results and private sales to deliver up‑to‑date valuations that reflect edition, condition, and market activity.

This data‑led approach empowers sellers to act strategically – tracking shifts in demand, identifying optimal sale moments, and avoiding seasonal bottlenecks. Explore Hockney prints on the Trading Floor or read the Hockney Investment Guide.