Should You Sell Your Art Prints Before the Autumn Auctions?

Autumn Leaves © David Hockney 2008

Autumn Leaves © David Hockney 2008Market Reports

For collectors weighing up whether to sell, private sales offer a powerful antidote to the unpredictability of auction seasonality. Unlike the rigid schedules of autumn auctions, private marketplaces operate year-round, letting you sell on your terms without competing against a flood of similar works. With platforms like MyArtBroker, a private sale delivers greater control and potentially stronger net returns: you can set your price, avoid seller fees, and secure a more discreet transaction.

Art Market Seasonality and Auction Cycles

The autumn auction season is fast approaching and for collectors holding blue-chip prints, that raises a critical question: is now the right time to sell? With marquee sales scheduled for October and November, and a flood of prints set to hit the market, timing your sale could mean the difference between a strong result and a missed opportunity.

The art market has a well-established seasonal rhythm. Major auction houses typically hold their largest sales in two peak seasons each year: spring and autumn. In these high-activity periods, marquee evening sales in May and again in late October/November set the tempo for the market. By contrast, the summer months tend to be slower, with fewer auctions and many collectors and dealers on holiday. This means that blue-chip prints often debut in spring or autumn sales when buyer appetite is strongest, whereas July and August see a lull in activity.

What are the “autumn auctions”? In the art trade, “autumn auctions” refers to the major sales that take place after the summer break, typically from early October through late November. During these weeks, heavyweight auction houses like Christie’s, Sotheby’s, and Phillips host high-profile sales of Impressionist, Modern, and Contemporary art in global hubs such as New York, London, and Hong Kong. These events are significant barometers of market health – the autumn auction season is when records are often set and when the year’s art market trends become clear.

The Autumn Auction Season: Opportunity or Risk?

For owners of blue-chip prints and editions, the autumn auction season can be both an opportunity and a risk. On the upside, activity is high: many buyers return from summer eager to acquire works, and there’s excitement in the market as galleries and auction houses launch their fall programs. The advantages of selling during this season include a large pool of active bidders and the marketing momentum that auction houses build for their autumn sales. A well-timed sale in October or November might ride the wave of post-summer enthusiasm, potentially resulting in strong prices if your print attracts competitive bidding.

However, there are drawbacks to consider. Autumn is also one of the most crowded periods on the art market calendar. With so many auctions clustered together, the supply of artworks hitting the market surges. This flood of material means if many similar prints by the same artist are consigned at once, each individual work might get less buyer focus and potentially lower bids.

Another risk of the autumn rush is that everyone is trying to sell at the same time. If your goal is to stand out, consider that buyers in late-year auctions face fatigue from so many concurrent sales. A high-quality blue-chip print might attract greater focus in a less congested moment, rather than in an autumn week where works are competing for the spotlight. In essence, the autumn auctions bring great energy and high transaction volumes – but also heightened competition and unpredictability in pricing.

Consignment Timing Considerations

If you do aim for an autumn auction, timing is critical behind the scenes. Auction houses work on fixed schedules and typically require you to consign your artwork well in advance of the sale date. In practice, this means you often need to commit your print 2–3 months before the auction itself. For instance, to have a work included in a big November sale, you might need to have contacted the auction specialist and signed a consignment agreement by August or early September at the latest. This lead time allows the house to research the piece, photograph it, publish it in the catalogue, and begin marketing to prospective buyers.

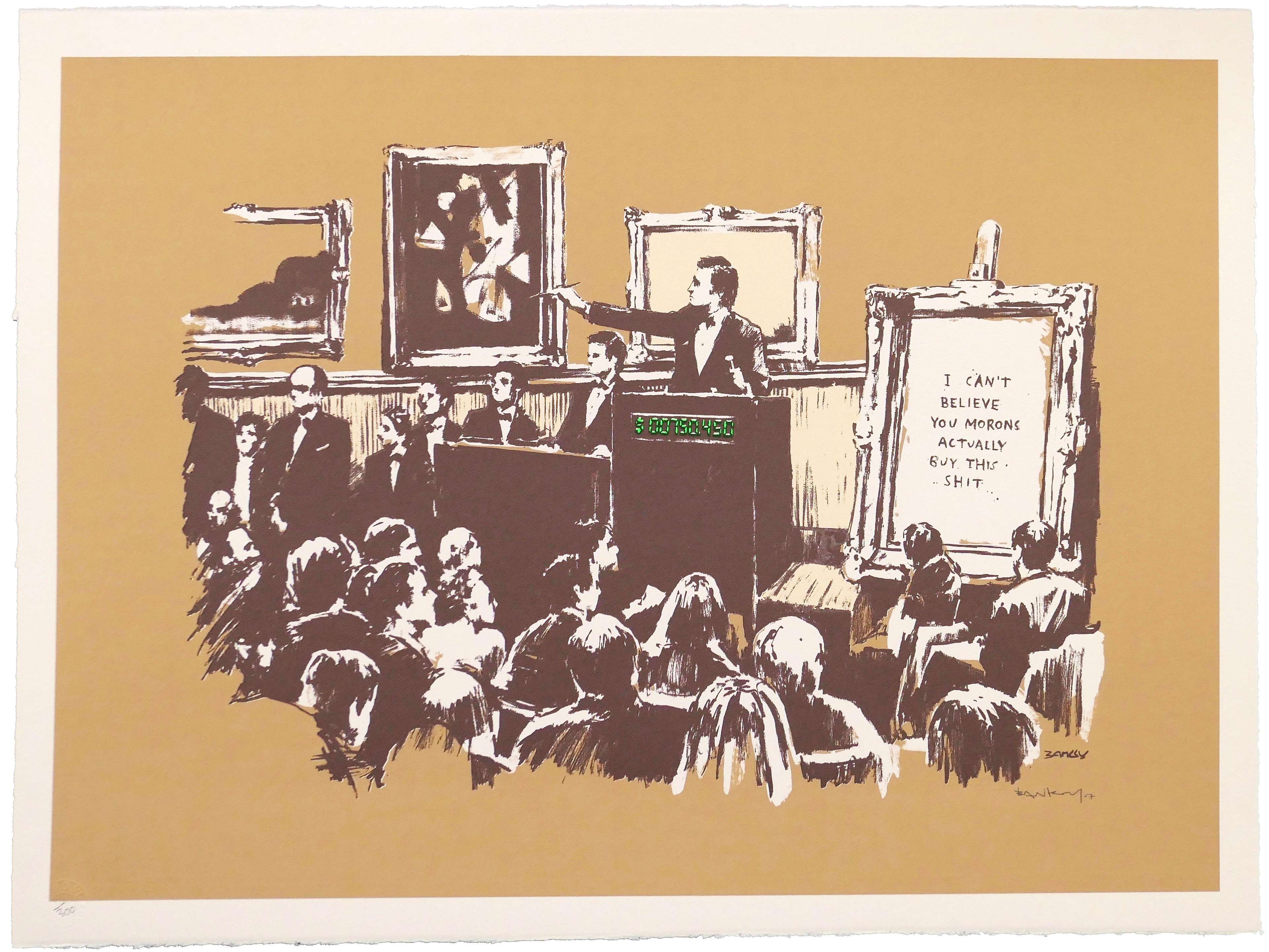

What if autumn is already approaching? If you haven’t consigned by late summer, your print is unlikely to make it into an autumn auction – it might be deferred to a later sale. In some cases, even if you do meet the deadline, the auction house might suggest holding your work for a future auction if they’ve already received several similar pieces for the same event. Top auction houses carefully curate their sales; they often avoid listing multiple identical or near-identical editions in one evening, since doing so can split bidder interest. For example, if two sellers each consigned the same popular print by Banksy or Andy Warhol for the autumn auction, the specialists might schedule one for the fall sale and push the other to a winter or spring auction to prevent undercutting competition.

Timing Your Sale: When Is the Best Time to Sell Prints?

The decision of when to sell your art print should account for both broad market conditions and the specific context of your artist’s market. Here are key factors to consider:

- Market-Wide Conditions: Assess the broader market climate before selling. In a strong, confidence-driven market, acting quickly can capture high demand and favourable pricing. If conditions are uncertain or soft, waiting may prove prudent. Seasonal trends also matter: spring and autumn bring increased buyer activity, but also higher competition from other sellers. Quieter periods may offer less demand but also less supply, potentially improving visibility for your work.

- Opportunity Cost: Consider the cost of holding onto the artwork versus selling it now. Every extra month you keep a high-value print is a month your capital is locked in that asset. If you have a use for the funds, selling sooner could be advantageous. Markets can change quickly; a print valued highly today might drop in price if tastes shift or if a broader downturn hits. On the other hand, patience can pay off if you believe the print’s value will appreciate further or if you’re waiting for an optimal selling venue. Timing also ties into liquidity: blue-chip prints are fairly liquid as art assets, but they’re not as liquid as money – so ask yourself how long you’re comfortable holding that value in print form.

- Artist’s Market Momentum: The ideal time to sell can depend on what’s happening with the artist of your print. Pay attention to your artist’s current popularity, recent auction results, and any upcoming events:

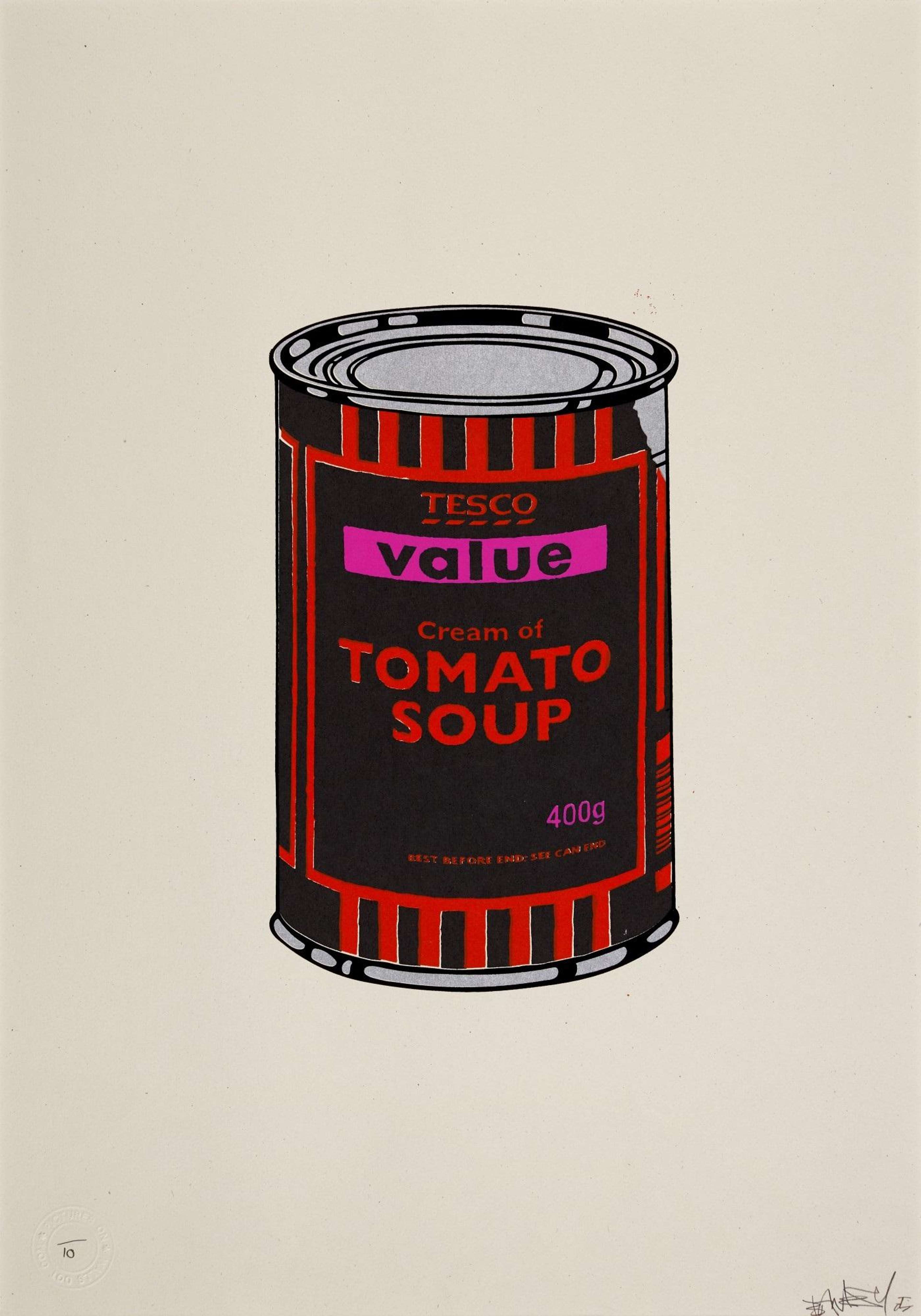

- If the artist is about to have a major retrospective exhibition, a new museum show, or has been featured prominently in the media, these can all boost demand. A famous example is Banksy: after his sensational self-shredding artwork stunt in 2018, interest in all things Banksy increased.

- If the artist recently achieved a record auction price or other headline-grabbing success, that could signal heightened demand.

- Conversely, be mindful of supply events. If you know that a large number of works by the same artist will hit the market soon – for instance, an estate sale or a high-profile auction featuring many prints by that artist – you might avoid adding your piece to that crowded field. When buyers see a flood of similar material, prices for that artist’s works may stagnate or dip due to competition.

- Research how similar prints to yours have performed lately. If identical or comparable editions have been selling above estimate consistently, it’s a positive sign. If they’ve been struggling to sell or frequently going below reserve, it might not be the best time to auction your copy.

The best time to sell a print isn’t dictated by the calendar alone – it’s a combination of market timing and the individual artwork’s situation. Stay informed with market reports to understand macro trends, and stay attuned to news about your specific artist. An educated seller will weigh both the broad market seasonality and the micro-level signals from the artist’s market before deciding to sell.

Auction vs. Private Sale

This is where private sales have a clear advantage over the rigid auction cycle. Auctions operate on fixed schedules, requiring sellers to plan months in advance. This can be risky if market conditions shift before the sale. While auctions can generate strong results for rare, one-of-a-kind works, editioned prints typically don’t attract the same intensity because buyers know other copies will reappear. Sellers also face higher fees (often around 15%), have no control over the final price, and are at risk of an unsold lot damaging the work’s market perception. Once consigned, timing and terms are out of your hands, with little flexibility if circumstances change.

In a private sale, you have much more flexibility on timing and terms. You can choose to list or offer your print whenever you think the market is ripe – there’s no need to wait for the next auction season. Private brokers or marketplaces operate year-round, so you could avoid the autumn rush entirely if it seems advantageous.

Control is another benefit. With MyArtBroker’s model, for example, sellers work with a specialist to set an agreed price for their print upfront. You know in advance what net amount you’ll receive if the sale goes through, removing the uncertainty of auctions. There are 0% seller fees on MyArtBroker’s platform, meaning you won’t lose part of your profit to commissions. In contrast, at auction you’d typically pay a seller’s fee and the buyer pays a premium – money that, in a private sale, could instead go to the seller or make the deal easier by offering a better price to the buyer. Private sales also eliminate the risk of public failure; if a deal doesn’t happen immediately, it remains discreet (the artwork isn’t “burnt” by an unsold public listing).

That said, auctions and private sales each have their place. If you own a truly standout print, you might still consider a marquee auction, hoping that competitive bidding will yield an exceptional result. Auction houses also provide global exposure and can be the right stage for works that need the drama of a live sale. But for the vast majority of prints and multiples, an “online-first” private sale tends to trump auction in terms of convenience and net return to the seller.

(For a detailed comparison of these routes, see our guide on Auction vs. Private Sale in the Art Market, which explains the pros and cons in depth.)

Data-Driven Decision Making with MyArtBroker

If you're looking to get a quick sense of what a print might be worth, MyArtBroker’s Instant Valuation tool offers a useful, data-driven benchmark. It’s designed specifically for the prints and editions market, drawing on public sales data from over 400 auction houses and private sales to give you a real-time estimate in seconds.

This kind of snapshot is especially useful if you're considering selling, insuring, or simply curious about where a work sits in the market. While it doesn’t account for condition or provenance, it does factor in key details like edition size, colourway, and market demand, offering a far more tailored result than a Google search or general auction result comparison. For collectors who want a data-backed starting point, it’s a practical first step. Powered by the same technology, MyPortfolio helps you track real-time demand and market trends when you upload works to your dashboard - giving you a clearer picture of when to sell.

(If you’re interested in leveraging these tools, you can sign up for MyPortfolio for free to track your collection’s performance. MyArtBroker also offers free art valuations – you can request an expert valuation to get a bespoke analysis of your print’s value, factoring in the latest market data.)

Making an Informed Selling Decision

There’s no one answer to whether you should sell before the autumn auctions - the best decision depends on your specific artwork, market conditions, and goals. For many seasoned collectors, avoiding the crowded end-of-year sales can reduce competition and increase control - a well-timed private sale may yield a better return without the wait or seller fees. That said, standout works may still thrive at auction, provided you're strategic about pricing and timing.