Image © See-ming Lee via Flickr, CC BY-NC 2.0 / Pumpkin, (stainless steel) © Yayoi Kusama 2010

Image © See-ming Lee via Flickr, CC BY-NC 2.0 / Pumpkin, (stainless steel) © Yayoi Kusama 2010Market Reports

The first half of 2025 has been volatile: inflation, wars and renewed tariff tensions have kept confidence in check, yet the Asian art market continues to evolve. New collectors in their thirties - from mainland China, Taiwan, South Korea and the Asian diaspora - are entering through fairs across Europe and Asia, signalling more durable demand than short‑term speculation.

Art Trends 2025: How We Got Here

Asia’s art market has moved through distinct phases over the past four years. The boom of 2021–2022 was fuelled by reopening after the pandemic, ultra‑low interest rates and a rapid shift online. Prices for very recent work rose quickly, auction volumes surged and fairs were defined by waiting lists and speed.

By late 2023 and through 2024 the tone changed. Inflation and higher borrowing costs, a slower Chinese economy and renewed tariff tensions made sellers more cautious and buyers more selective. Auction values fell across much of the region, and the pace at fairs moderated, but the core infrastructure - museums, galleries and year‑round programming - continued to deepen.

In 2025 the market is measured rather than exuberant. At the upper end, decisions are anchored in three basics: the quality of the artwork, the significance of the artist’s career, and sound provenance (the documented history of ownership, exhibitions and literature). Exceptional works still command strong results; otherwise, buyers take their time. Most activity sits in the middle price band (about US$50,000 to US$1 million) where established names and museum‑level contemporary artists change hands. Below US$50,000, online sales are now routine and continue to bring new collectors into the field.

Two operational shifts shape how business is done. First, digital tools have become part of the market’s plumbing: machine‑learning systems help benchmark prices, flag possible forgeries and match works to likely buyers; blockchain databases support provenance and edition control behind the scenes. Second, sustainability has moved from talking point to practice. Where timelines allow, shipments go by sea rather than air; packing is reused or replaced with recyclable materials; and consignments are consolidated. These steps are increasingly requested by lenders, insurers and fair organisers.

This context frames the trends that matter in 2025. Hong Kong remains the most reliable clearing house for high‑value works; Seoul is building a year‑round engine around its fair season; Singapore has become the pragmatic conduit for Southeast Asian trade. Japan’s steady, gallery‑led base contrasts with a more experimental China. Together, these dynamics explain why today’s market feels slower but more durable, and why the region’s growth now rests on depth, not speed.

Hubs

Hong Kong

Hong Kong’s March week is now firmly consolidated: Sotheby’s, Christie’s, Phillips and Bonhams have aligned their Hong Kong marquee sales to coincide with Art Basel Hong Kong. Despite softer Greater China totals in 2024, the city remains the region’s most reliable marketplace for high‑value consignments and a magnet for year‑round private sales. The institutional core has also strengthened: the West Kowloon Cultural District continues to raise the bar; M+ (Hong Kong’s museum of contemporary visual culture) has deepened its international partnerships, including a new collaboration framework with MoMA; and the major auction houses have upgraded their physical footprint (Christie’s new headquarters at The Henderson, Sotheby’s expanded Maison in Central, and enlarged permanent spaces for Phillips and Bonhams). Buyers at the top end are favouring blue‑chip works with proven depth, while an active cohort from Singapore, Indonesia and Thailand is increasingly visible.

Seoul

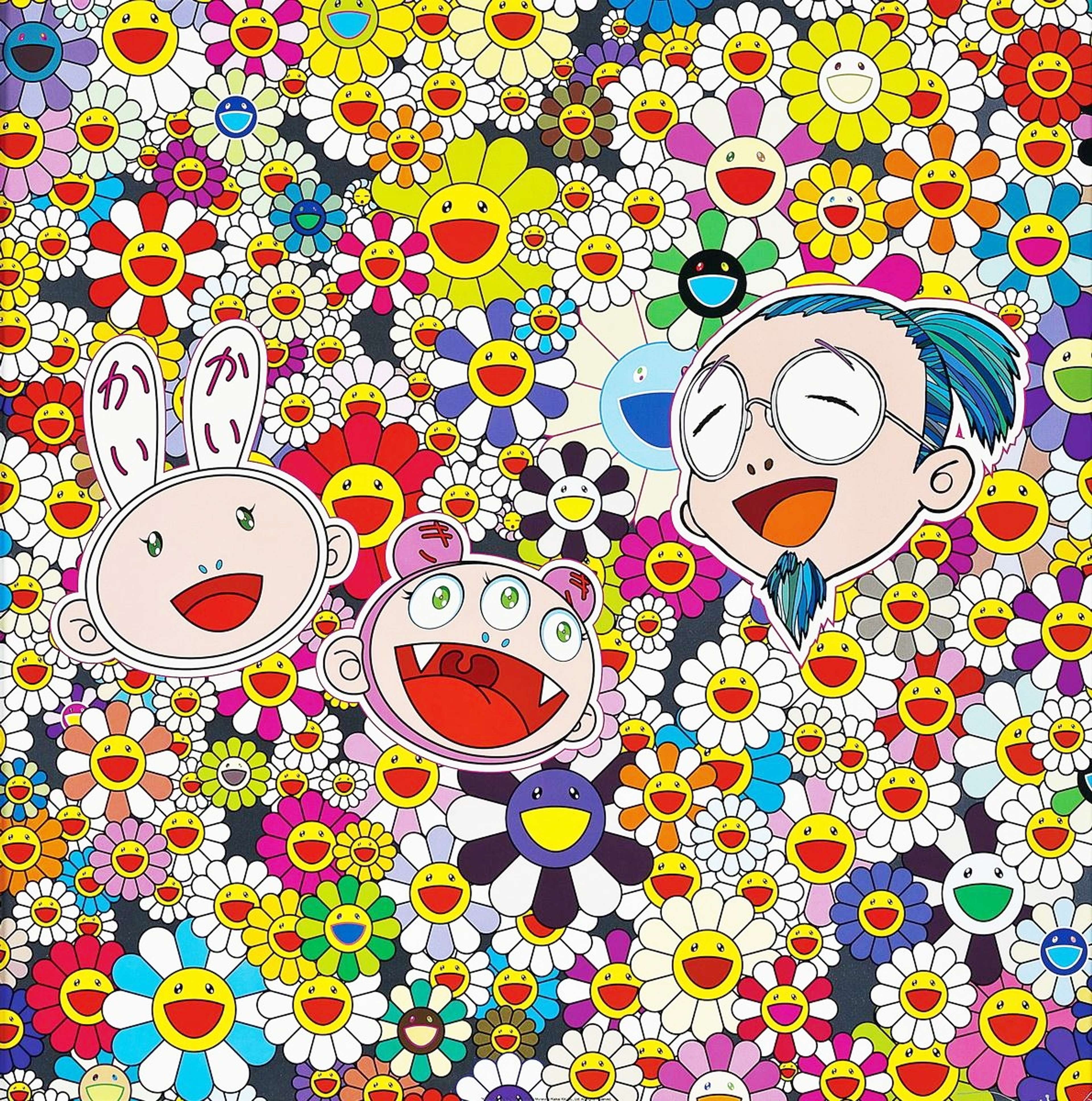

Seoul’s September season exemplifies the market’s new temperament - quieter but more decisive transactions when quality and context align. The fourth Frieze Seoul and the 24th Kiaf Seoul returned to COEX with a higher share of Asia‑based exhibitors. City‑wide programming amplified demand, from Gagosian’s Murakami pop‑up at Amorepacific to museum presentations for Louise Bourgeois and Lee Bul. Frieze’s commitment now extends year‑round via Frieze House Seoul in Yaksu‑dong, giving visiting galleries a ready-made platform and local support between fair cycles.

Singapore

Singapore’s rise is steady and pragmatic. Art SG’s third edition in January hosted just over one hundred galleries from around thirty countries, drew more than forty thousand visitors and saw seven‑figure transactions - including a Picasso placed by a London gallery - consolidating the city’s role as Southeast Asia’s trading hub.

North‑East Asia

In Japan, the market remains principally gallery‑led, supported by incremental policy reforms and a steadier macroeconomic backdrop. While auction activity has migrated towards lower price bands, underlying demand is intact. Flagship artists such as Yayoi Kusama, Yoshitomo Nara and Takashi Murakami, continue to achieve their highest prices offshore, typically in Hong Kong; domestically, sales are driven by long‑standing relationships and exhibition‑led programmes rather than rapid‑fire bidding.

In South Korea, the first half of 2025 saw the auction houses offering and selling a healthy volume of works, yet aggregate value declined to about approximately US$40.5 million, 15.3% lower year on year and well below the 2021 peak. The picture is one of heightened selectivity - fewer trophy consignments and greater scrutiny from buyers - rather than a withdrawal of participation. The fair ecosystem remains resilient: Frieze and Kiaf continue to attract a rising share of Asia‑based galleries, and the presentations performing best are those underpinned by clear curatorial arguments, scholarship and museum alignment.

In China, confidence has been tempered by another contraction in 2024 auction totals and by trade‑war rhetoric, even though artworks themselves are not subject to the new tariffs. Nevertheless, Beijing’s scene in 2025 is notably energetic, with risk‑taking museum surveys and curated gallery‑weekend formats that raise curatorial standards while keeping costs in check. A cohort of second‑generation, globally educated collectors has been directing demand towards Chinese artists through domestic galleries, with international attention increasingly following their lead. Because the commercial infrastructure remains comparatively young, the medium‑term growth runway is substantial.

Autumn 2025

East Asia’s autumn calendar is dense. Frieze Seoul and Kiaf run back‑to‑back at COEX, followed by Tokyo Gendai at Pacifico Yokohama, now aligned with the Aichi Triennale. Expect leaner, research‑led presentations, close integration with museum programmes and measured buying focused on high quality works and compelling emerging voices. The region is not immune to macro shocks, but its cultural infrastructure is broader and more resilient than even three years ago. If 2024 forced a reset, 2025 is revealing a market that is maturing: slower, but more thoughtful, more regionally connected and better equipped for sustainable growth.

Navigating the Asian Art Market in 2025

Measured rather than exuberant, Asia's art market is defined by disciplined buying at the top, a resilient mid‑market, and online sales that continue to bring in new collectors. The map is multipolar: Hong Kong remains the clearing house for high‑value consignments, Seoul is evolving into a year‑round platform, Singapore anchors Southeast Asia with a logistics‑led model, while Japan’s gallery‑led base and China’s experimental scene provide depth and room for long‑term growth.