Auction Watch: Warhol’s Endangered Species Break Records at Phillips June 2025 Editions Sale

Market Reports

Phillips’ June Evening & Day Editions sales took place in London on the 5th and 6th, offering 208 lots. These mid-year auctions are known for both range and resilience - spanning sub-£10,000 editions to six-figure blue chip works. The sale brought in £1.9 million at the hammer, 22% above the low estimate with an 87% sell-through rate. While this total is 28% below last year’s, the drop is partly due to a leaner offering of over 100 fewer lots - suggesting tighter public consignments and a continued shift toward private sales.

In today’s climate, where buyers are more selective and competition at the top has softened, prints continue to offer a strategic edge: museum-backed imagery, transparent pricing, and a track record of strong performance. As collecting becomes increasingly data-driven, editioned works remain highly liquid and tradable across geographies and collecting tiers - making this segment more vital than ever.

Here are the results of Phillips June 2025 Editions sale:

Warhol Endangered Species Lead Market With New Records

Andy Warhol had a notably strong showing - particularly in contrast to earlier H1 2025 sales - reinforcing how context and timing can meaningfully shape outcomes. His Endangered Species series led the sale, with African Elephant achieving £215,900, a new record. The work - one of ten Roman numeral impressions made for wildlife organisations - surpassed the previous high by over 40%. Between 2015 and 2024, the average value of this work - across main editions and trial proofs (TP) - rose at a compound annual growth rate (CAGR) of approximately 13.7%. Despite low annual turnover, the series has remained consistently strong, reflecting its status as one of Warhol’s most tightly held editions in this 10-piece portfolio.

Orangutan, another key work from the series, also set a new record at £184,150 - well above its £60,000 estimate and exceeding even a 2024 TP result by 5%. With values rising from £31,000 in 2016 to £138,200 in 2024 (CAGR ~20.4%), it remains one of the most actively pursued prints in the series. For further analysis of growth trends, edition structure, and market depth, download our dedicated Endangered Species market report.

Warhol Flowers & Cows: Mid‑Tier Resilience Amid Market Selectivity

Two Flowers prints - one in electric green and the other in a peachy lilac-pink - sold for £44,459 each. While far below the £1M record set in 2022 during a single-owner Warhol sale at Sotheby's, these results are remarkably strong in context. The Flowers series has grown from £18,600 in 2015 to over £47,000 in 2025, with a CAGR of 9.7%. Sales volume has declined since its 2023 peak, but prices have held or improved - where it’s safe to assume that collectors are focusing on rare colourways and pristine examples in a more selective market phase. See our Warhol Seller’s Guide for the most current market trends and results.

Four Cow prints also sold - each estimated between £8,000–£12,000 - and all surpassed their high estimates. Though these are often viewed as decorative entry points, they remain consistently liquid. After peaking in volume in 2024 (27 sales), the average price dipped to £9,300, but has rebounded in H1 2025 to around £11,000. Cow may be volume-sensitive, but it remains one of Warhol’s most reliable performers for new and price-conscious collectors.

Elsewhere, Warhol’s Committee 2000 hit £11,439 (vs. £7,000 high estimate), and Poinsettias achieved £16,519, doubling expectations.

Banksy Market Stabilises: Thrower, Kate Moss & Post‑Boom Recovery

Banksy also performed solidly, showing signs that his print market is finding its footing post-correction. Love Is In The Air (Thrower) sold for £127,000, squarely within estimate and up from its last result in January 2025 (£120,650). While only one Thrower print has sold publicly each year since 2023, the sequential price recovery suggests renewed buyer confidence in this politically resonant image - especially for works in strong condition.

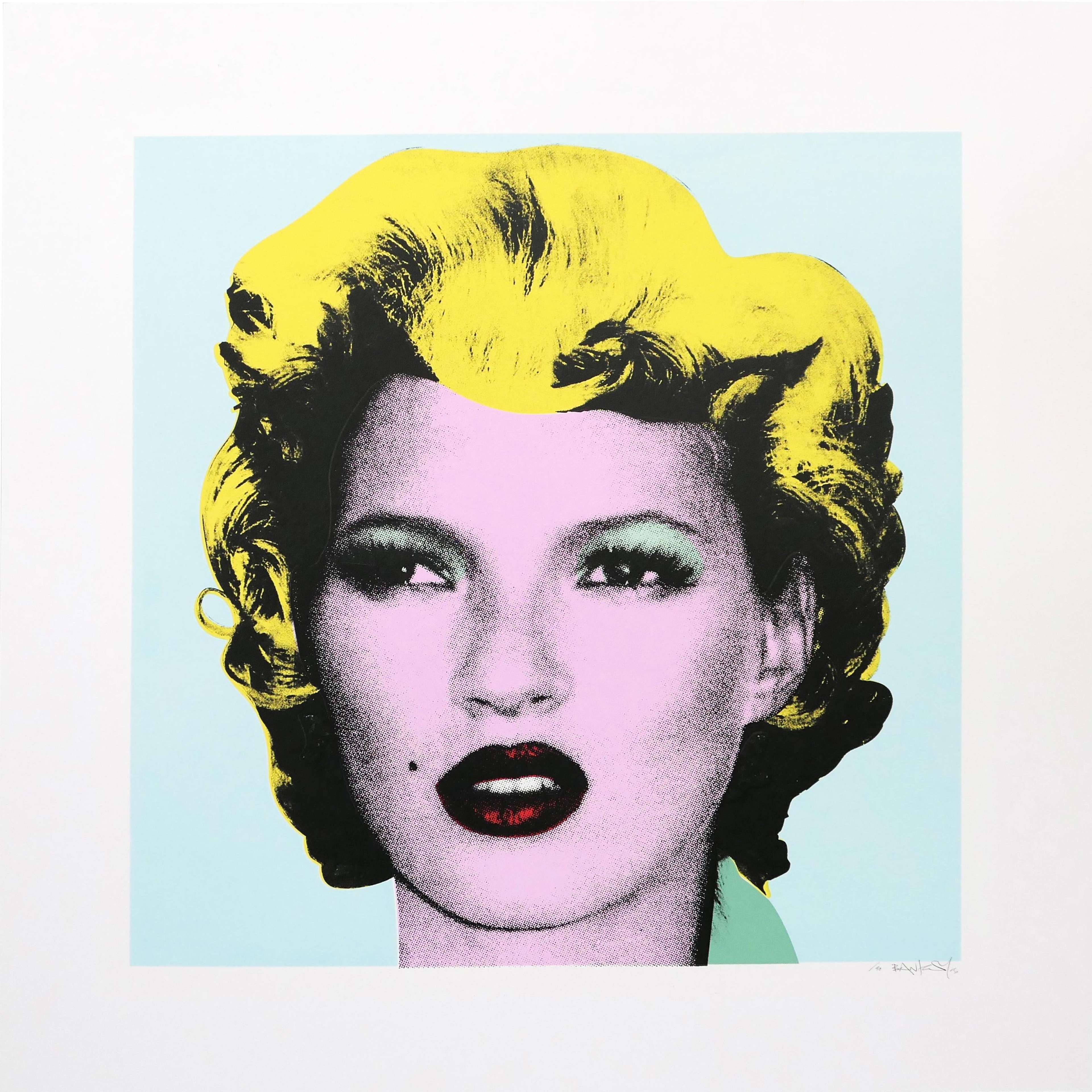

Kate Moss (Original Colourway) also delivered a solid performance, selling for £107,950. Although still below the heights of Banksy’s market peak, the result reaffirms ongoing collector demand for image-led works that fuse pop culture with street art aesthetics. Like Girl with Balloon, Kate Moss followed a steep trajectory during the speculative boom, with pricing peaking in 2020 before entering a multi-year correction.

Core Editions Girl With Balloon & Morons Remain Strong

As detailed in our Girl with Balloon market report, both signed and unsigned editions saw sharp growth during the speculative boom of 2020–2021, followed by a multi-year correction. While signed works peaked at £564,000 in 2021, unsigned editions hit their high in 2020 at £161,000, before declining steadily to an average of £65,000 in the first half of 2025.

Though well below peak levels, the current average remains substantially above pre-boom values - unsigned editions averaged between £29,000 and £46,000 between 2018 and 2019 - indicating that the market has reset but not collapsed. With 2025 only halfway through, current pricing aligns closely with 2023 and 2024, suggesting that average values are stabilising rather than continuing to fall.

At Phillips sale, an unsigned edition achieved £82,550, beating its £80,000 high estimate - a sign that collectors remain willing to compete for quality examples. While overall volume has contracted, this result reflects a maturing market for Girl With Balloon prints - one where pricing is increasingly driven by condition, timing, and placement, rather than speculation alone.

Meanwhile, Morons (Sepia) posted a strong result in 2025, with one edition achieving £29,210, comfortably above its £20,000 high estimate and marking the highest of three public sales this year. While the overall 2025 average, for the collection, sits at £19,600, the market appears to have stabilised in a pricing band of around £20,000 since 2023.

Though still well below the peak averages of £55,700 in 2021 and £50,000 in 2022, Morons prints continues to demonstrate strong long-term performance, with a ten-year CAGR of approximately 11% - reflecting sustained collector demand despite the post-boom correction.

Other notable Banksy results included:

- Flying Copper (signed) - £27,940

- Love Is In The Air (unsigned) - £25,400

- Sale Ends V.2 - £17,780

Together, these results indicate that while the speculative frenzy around Banksy has subsided, his core market is moving into a more stable and selective phase. Pricing for his most iconic images is showing signs of consistency, and well-consigned works continue to attract competitive bidding. For a deeper analysis of current trends and opportunities, see our updated Banksy Seller’s Guide.

Looking Ahead

What June’s Results Mean for Global Print Markets

As the art market continues to recalibrate, prints and multiples remain one of its most dynamic and strategically significant sectors. This recent sale reaffirmed the resilience and leadership of blue chip editions, but it’s just one part of a broader picture. June is traditionally a pivotal moment in the art calendar, and several major print sales - across Europe, the US, and Asia - are still unfolding.

These upcoming results will offer a fuller view of global market sentiment as we close the first half of 2025. Watch this space for our full June Print Market Recap, where we’ll unpack the key data, standout performers, and evolving trends shaping the editions landscape.