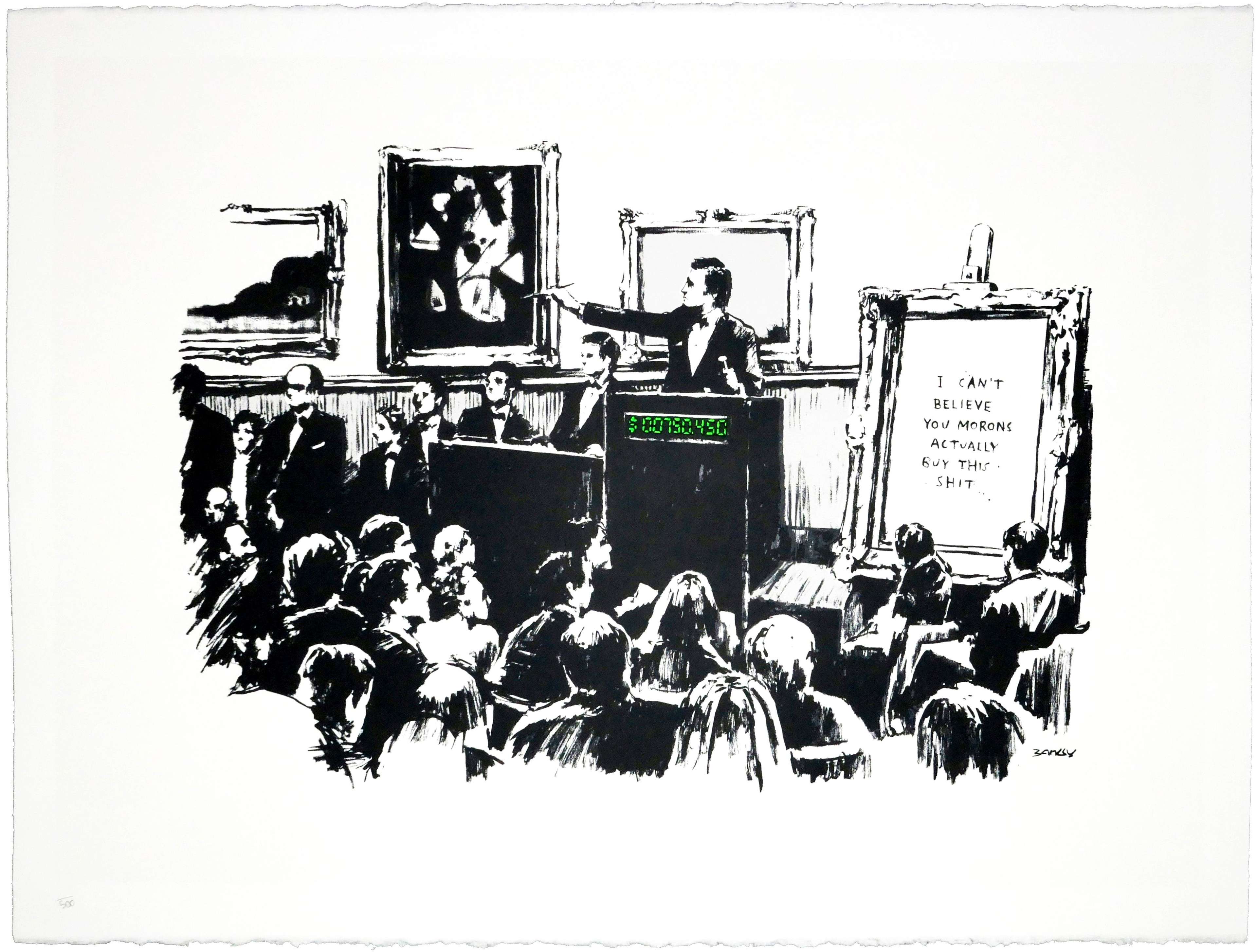

Morons © Banksy 2007

Morons © Banksy 2007Live TradingFloor

Since their appearance on the market, NFTs have disrupted ideas of what art can be, how art can be bought and sold, and the value of art itself. Here are five ways NFTs have revolutionised the art world as we know it.

NFTs can unlock gated communities

In the tech world, NFTs have already become an established passport to exclusive members-only clubs and experiences. The most famous is Bored Ape Yacht Club (BAYC), the most sought-after NFT collection on the market with celebrity collectors like Elon Musk, Paris Hilton, Eminem and Jimmy Fallon. But BAYC offers more than just sullen primate cartoon characters for your Twitter profile picture, they also hold in-person get-togethers and parties around the world, where NFT owners could rub shoulders with musicians and comedians like The Strokes, Chris Rock and Aziz Ansari.

Meanwhile, Flyfish Club in New York will become the world’s first NFT restaurant when it opens in 2023. Membership to the private dining club can only be purchased as NFTs on the blockchain, but will give access to the restaurant and a host of online and social events.

The art world’s offerings are comparatively basic but are catching on. Pace Gallery launched Pace Verso in November 2021, their platform for NFT drops by their blue-chip artists, including Jeff Koons and Urs Fischer. Sotheby’s Metaverse, likewise, is the auction house’s permanent saleroom for crypto-art. But at the moment, both are spaces for traditional artists and collectors to dip their toes into NFT waters for the first time. Neither offer membership programmes nor perks for collectors after purchase.

At least, not yet.

Image © Instagram @boredapeyachtclub

Image © Instagram @boredapeyachtclubOne NFT can lead to more — free — NFTs

In addition to exclusive membership events, BAYC owners regularly enjoy new NFT drops — which they have turned into significant profit.

In March 2022, BYAC released free tokens of ApeCoin, their new cryptocurrency, to their community. One receiver was 29-year-old Rahim Mahtab, a photographer, digital artist and NFT collector, who bought his Bored Ape NFT in 2021 for around US$1,700. After the ApeCoin drop, he sold some of his free tokens for US$90,000 — a return of over 5000% and not even on the initial investment.

“I am still in shock,” Mahtab told Fortune. “It is a very huge amount of money to be airdropped for holding and believing in a community and project. Never in my wildest dreams could I have imagined this.”

Meanwhile, the NFT collection Moonbirds encourages owners to hold (or ‘nest’) their pixelated owl avatars in return for benefits, like membership upgrades, invitations to events and future NFT drops. This feature was brought in to foster a sense of community and give owners more return than just the resale value of their Moonbirds.

NFTs can earn more money for buyers and artists

To get a return on investment for traditional art, buyers need to sell their painting or print and hope that its market value is higher than when they bought it. Not so with NFTs. Numerous owners have generated a passive income while still retaining their NFTs.

One way is to rent out your NFT without giving up ownership. Members of the upcoming NFT restaurant Flyfish Club can potentially rent out their tokens to others; those with real estate in the metaverse can rent out these digital spaces to advertisers; and NFT artists can loan their works to NFT exhibitions for a fee, suggests strategists PSFK.

Artists and creators can write a royalty code of any value into their NFT art’s smart contract, meaning that they receive a resale fee every time their work changes ownership in the future. This system is fairer and more convenient for artists than in the traditional art world: although artists are legally entitled to an Artist’s Resale Right (ARR), the rates are low (4% up to €50,000) and there are many exemptions. Many artists also need to manually chase up their royalties or employ a team to do so on their behalf. With NFT smart contracts, the resale fee will be paid automatically.

NFTs have disrupted artist copyright and licensing

Another method of monetising NFTs is through image licensing. Bored Ape, Moonbirds and CryptoPunks all offer full commercial rights to their buyers, meaning owners have unlimited freedom to create merchandise of their NFT. In contrast, traditional artists retain the copyright of their works for up to 70 years after their death.

Restaurateur Andy Nguyen reportedly spent US$267,000 in March 2022 on three Bored and Mutant Apes NFTs, and has used their images as the branding for his new pop-up burger restaurant, Bored & Hungry, as well as on merchandise, clothing and social media posts.

“We're excited to showcase what you can do with your NFT's,” Nguyen wrote on Instagram, adding, “Even if you don't care about any of that, you can come have some really good food.”

Love Is In The Bin © Banksy 2021

Love Is In The Bin © Banksy 2021NFT owners can make new NFTs

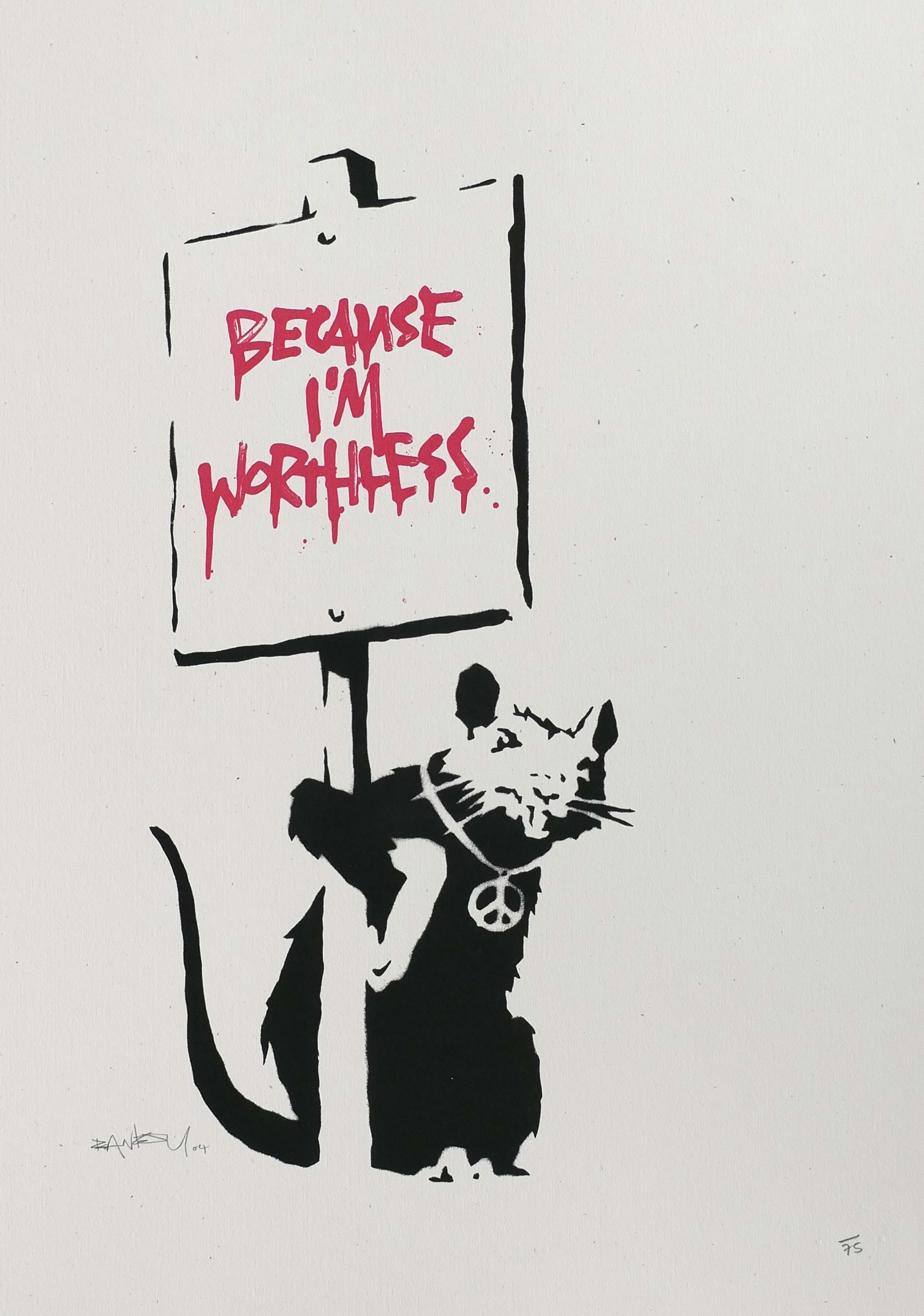

If owners of traditional paintings and prints tamper with their artworks, the art will almost always decrease in value (Banksy’s infamous shredded painting Love is in the Bin being an exception, because it was altered by the artist). But NFT owners are often rewarded for changing their NFTs.

In August 2021, BAYC released a special ‘Mutant Serum’ to their community. This add-on gave owners the chance to create a new, mutant variant of their Bored Ape NFTs, which they could hold as status symbols or sell on.

One of the most expensive NFTs in the collection — Mutant Ape #4849, a horned devil primate with glowing red eyes — was minted and sold within hours on 29 August 2021 for 350 ETH, or about £820,400 at the time.

Perhaps not as high a return as Banksy's Love is in the Bin, which increased its value from £1.04 million to £18.6 million in three years, but still an excellent profit on a freebie.