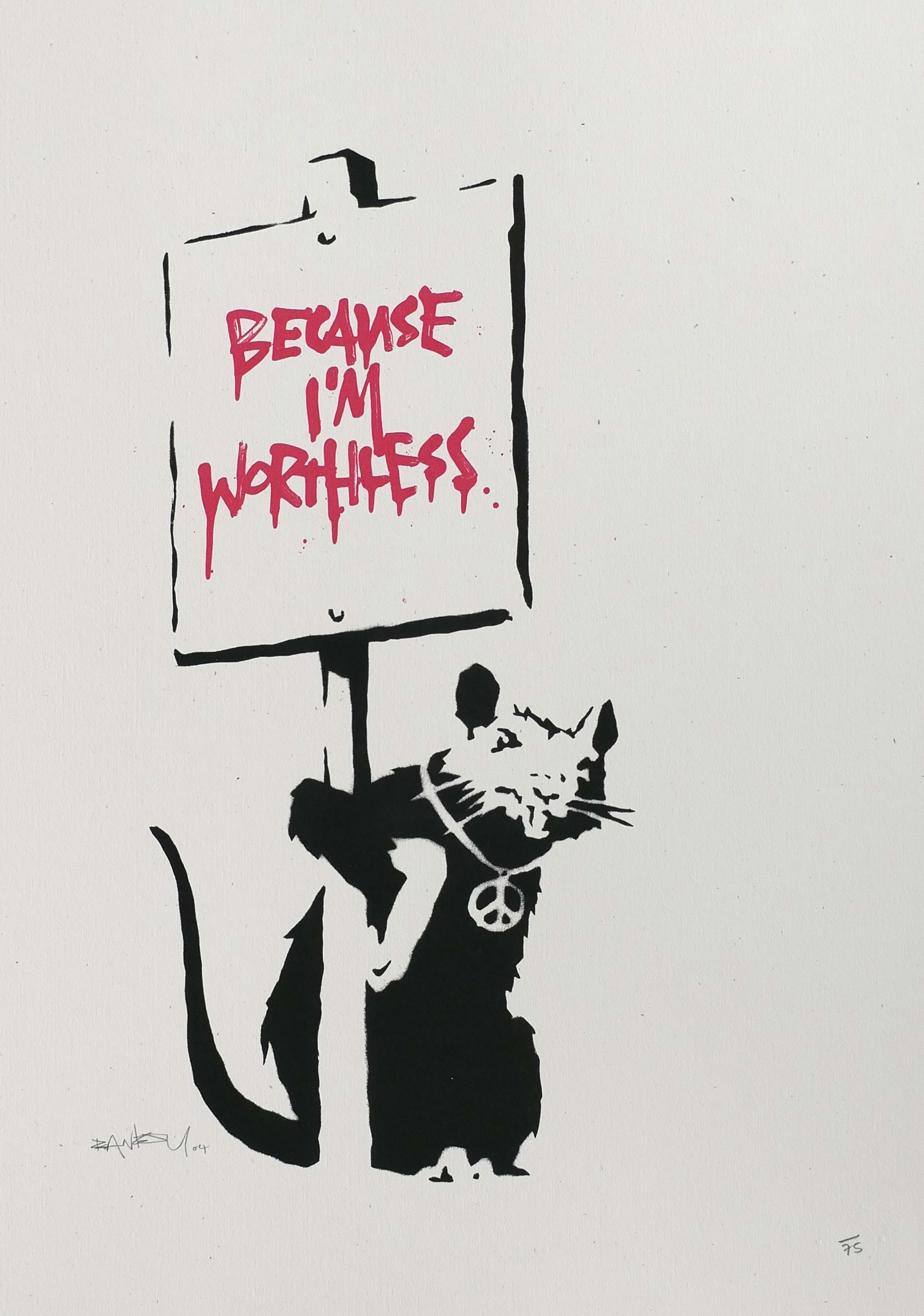

Because I'm Worthless © Banksy 2004

Because I'm Worthless © Banksy 2004Market Reports

How can a virtual Banksy artwork sell for 300% more than a physical Banksy print? Why is a purely digital artwork worth $69.3 million? Here is MyArtBroker’s guide to Nonfungible Tokens (NFTs) that have shaken up the artworld and prints market.

What is an NFT?

Non-fungible Tokens, or NFTs, are digital-only visual assets that are made unique and traceable by blockchain technology. NFTs can be an image file, video, music, trading card, or even a tweet, and they can be traded and sold between users (for a fuller definition, see our NFT Glossary).

According to the New York Times, NFTs have been around since the mid-2010s. But they only became mainstream in 2017 with the online video game CryptoKitties, which allowed users to collect, “breed” and buy virtual cartoon cats with cryptocurrency. In 2020, the market for NFTs has skyrocketed. In the last year however, NFTs have been dragged into the recent cryptocurrency crash.

NFT and the art market

The NFT industry grew by 299% in 2020, states a report from the time. The U.S. National Basketball Association (NBA) made a total of $198million in February 2021 selling NFT video clips of highlighted games. The most expensive single transaction was $208,000, paid for a video of a LeBron James slam dunk.

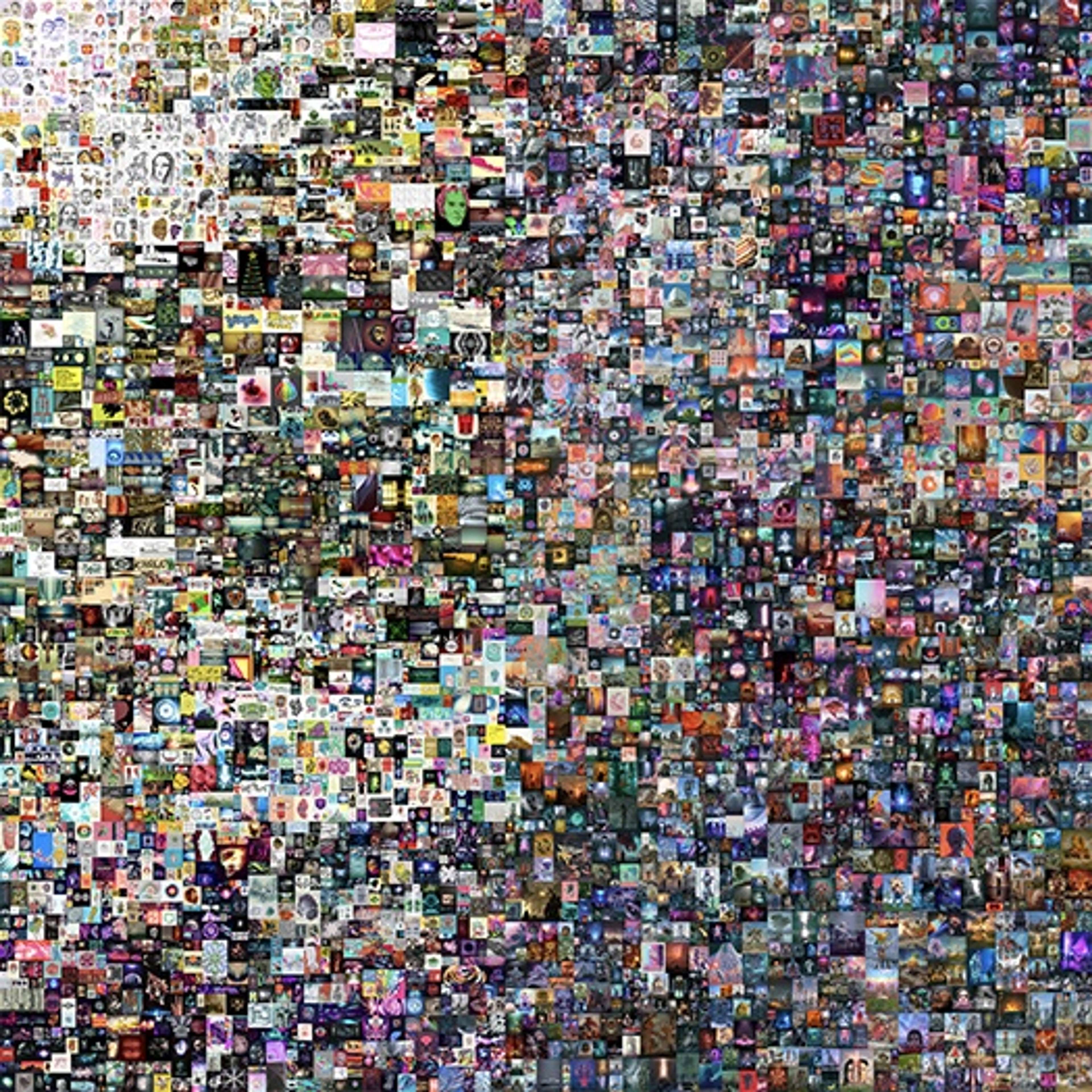

NFTs initially shook the art world when Christie’s sold its first NFT, Everydays: The First 5000 Days by digital artist Beeple (real name Mike Winkelmann), for $69.3million. Beeple became the third most expensive living artist alive, after Jeff Koons and David Hockney.

As of August 2022, NFT sales have reached a 12-month low according to a recent report. In June, NFTs totalled just over $1 billion (£830 million), according to research from crypto firm Chainalysis, their lowest performance since June 2021 when sales totalled $648 million. The peak of NFT sales was in January 2022, when they totalled $12.6 billion.

Image © Christie's / Everydays: The First 5000 Days © Beeple 2021

Image © Christie's / Everydays: The First 5000 Days © Beeple 2021How can a digital artwork, which can be easily copied – or a video of a basketball game, which is available to watch on YouTube – be worth any amount of money?

What makes NFTs so valuable is their unique blockchain code. Even if Beeple’s Everydays: The First 5000 Days is available for free online (and it is), the version sold at Christie’s will always remain the original, and no other NFT will have the same provenance recorded in its blockchain. In this way, an NFT’s blockchain is like a special artist’s signature or personal dedication on a print, making it unique no matter how many editions there are.

As Jesse Schwarz – the buyer of the $208,000 LeBron James slum dunk NFT video – said in a video interview with the BBC: “Everyone knows there is one Mona Lisa. Anyone can go make a fake Mona Lisa [but] there’s only one. And all that attention, people using the Mona Lisa, whether it’s a meme or a postcard…just increases the value of THE Mona Lisa.”

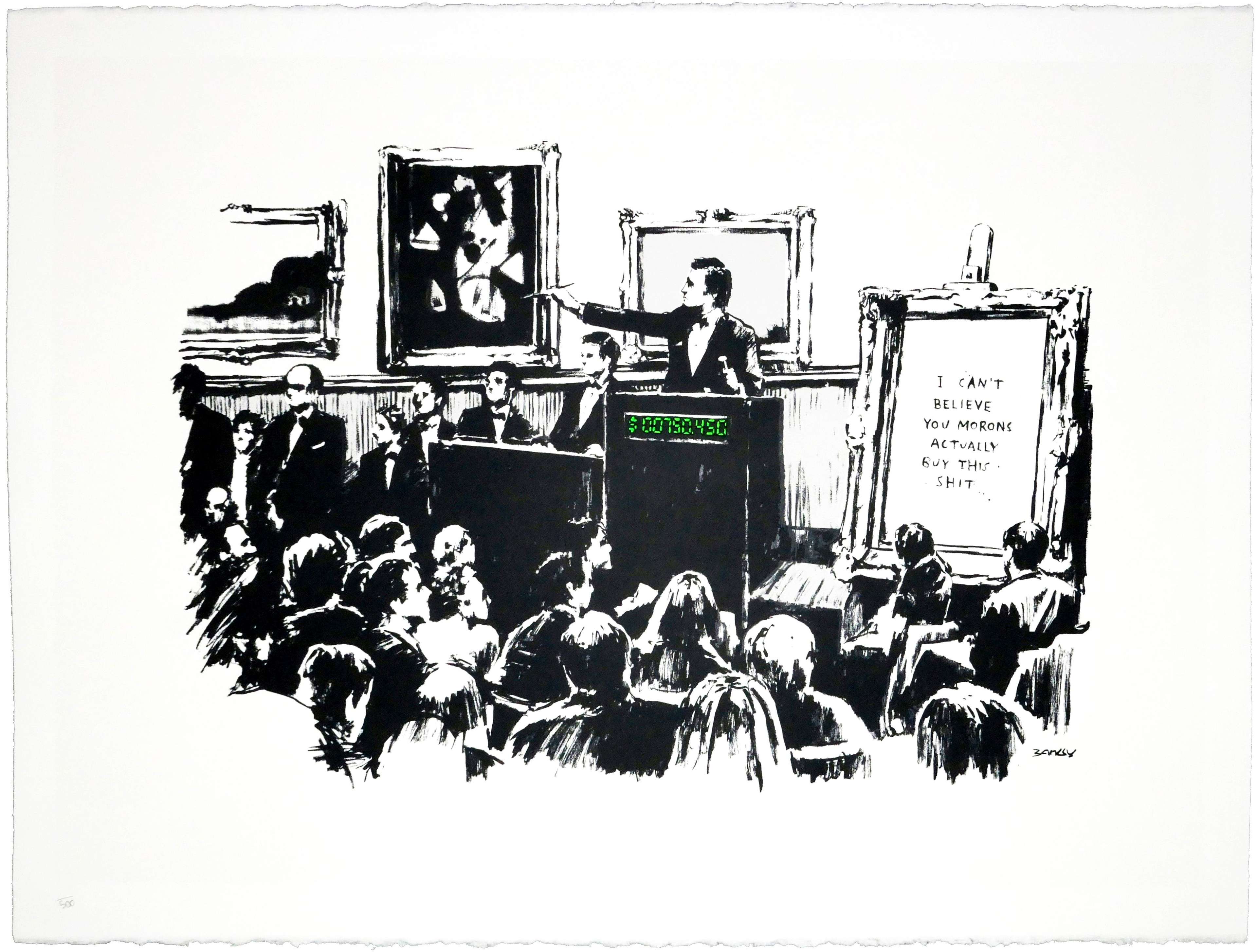

How NFT ‘destroyed’ a Banksy

In early March, blockchain firm Injective Protocol bought a 2006 edition of Banksy’s Morons (White) for $95,000 – then burnt the work to ashes. The company immediately created a digital representation of the print using blockchain technology and turned it into an NFT.

“We view this burning event as an expression of art itself… The physical piece will forever be memorialised in this NFT,” said Mirza Uddin, an Injective Protocol executive, adding, “We specifically chose a Banksy piece since he has previously shredded one of his own artworks at an auction.”

While this sounds like the time a collector shredded their Girl With Balloon print at home – cutting the artwork’s value from £40,000 to roughly £1 – Injective Protocol’s stunt has paid off. The Morons NFT has sold for $380,000, a 300% increase from its price as a physical print.

Is NFT the future of art collecting?

The global pandemic caused investors to seek new markets and, at a glance, NFTs offered a secure alternative to traditional fine art investments. Each work is unique, and an NFT does not need upkeep or conservation, like a print. Its provenance is also transparent thanks to blockchain technology.

NFTs can also be more empowering for artists, as they can bypass the traditional gallery system and make sales with users directly. Each new sale of an artist’s NFT can automatically provide a resale fee, if this is written into the NFT’s smart contract (see NFT Glossary). The democratic nature of NFTs may be attractive to young buyers looking to align their spending with their ethical values.

But trends do not always translate to return on investment, and the recent crash of the cryptocurrency market is telling of this. After all, there was the cryptocurrency bubble in 2017-18 and, before that, the dot-com crash in the late 1990s. The skyrocketing price of cryptoart in 2020 and 2021 could have also been artificial. The buyer of the $69.3million Beeple NFT – who is only known by his pseudonym, Metakovan – is also the founder of Metapurse, a fund that collects NFTs. The underbidder of the sale was Justin Sun, founder of the blockchain network BitTorrent. An increase in the popularity of NFTs is beneficial to their companies.

It is also questionable how long Christie’s will offer NFTs. The auction house recently announced their new sustainability initiative to become net-zero by 2030. The sale of NFTs, however, uses significant amounts of electricity – the average NFT has a carbon footprint “equivalent to more than a month’s worth of electricity for a person living in the EU”, reported The Verge. Only time will tell if cryptoart investment can flourish without the endorsement of blue-chip auction houses.

“Art theft has never been this aggressive and rampant.”

NFTs are not always fraud-free, despite their blockchain technology. Anyone can, theoretically, register themselves as the original creator of an artwork. In 2018, British coder Terence Eden registered himself as the maker of the Mona Lisa on Verisart, a company offering blockchain certification for art and collectables. It was laughed off as a stunt – but maybe it shouldn’t have been. Now, “art theft has never been this aggressive and rampant ever before,” says artist Chris Moschler. Over 30 Twitter accounts have tried to ‘mint’ NFTs of Moschler’s art tweets and profit from his work.

In exceptional circumstances, an artist can even change their NFT after its sale. The cryptoartist Neitherconfirm in 2021 changed the images associated with his NFTs, from portraits to antique carpets, in a stunt to ‘pull the rug’ on an NFT’s value. “It is pretty easy to change the jpg, even if it does not belong to me or it is on auction. I am the artist, my decision, right?” tweeted Neitherconfirm, adding in another tweet, “What is the meaning of creating an unforgeable token on a highly secured network if someone can alter, relink or destroy your possession?”

Ultimately, the NFT market is still new and it may be too early to analyse its benefits and returns. “If you want to buy an asset as an investment, ideally you should do it because you have done your homework and you believe that over the longer term that investment will rise,” Susannah Streeter, senior analyst at Hargreaves Lansdown, said to the BBC. “At the moment some people are buying these types of assets for short-term speculative gain… but then the craze is likely to move onto the next big thing and the asset could end up being worth nothing.”

NFT Glossary

Blockchain – A digital system that records the history and sale transactions of an asset. Blockchain permanently links the asset to its original creator, so buyers and sellers can see the provenance and authenticity.

Cryptoart – Art that exists as tokens on the blockchain.

Cryptocurrency – A digital-only currency where every transaction is recorded on a decentralised system. The best-known cryptocurrencies are Bitcoin and Ethereum, but there are thousands of different cryptocurrencies in circulation.

Ethereum – A popular blockchain platform and the world’s second-largest cryptocurrency after Bitcoin. Most NFTs are bought and sold with Ethereum, according to the tech news website The Verge.

Fungibility – An asset’s ability to be exchanged with a similar asset for the same value. A £10 note is fungible because it automatically has the same value as another one £10 note, or two £5 notes. Conversely, a painting is non-fungible, because one painting does not automatically have the same value as another painting.

Minting – The act of creating a new NFT on the blockchain.

Non-fungible token (NFT) – A unique digital token which is secured by blockchain technology, most commonly Ethereum. The token can be linked to any visual asset, including an artwork, a video, music, text, sports card, bits of code or a tweet.

Smart contracts – A self-executing contract written as lines of code and stored on the blockchain. Smart contracts automatically take effect when conditions are met. E.g. A smart contract could state that an NFT’s creator gets a percentage royalty every time the work is resold; a payment will then be automatically sent to the creator after each resale.

Token – A unique string of code, secured by blockchain, which can be transferred and traded between users.