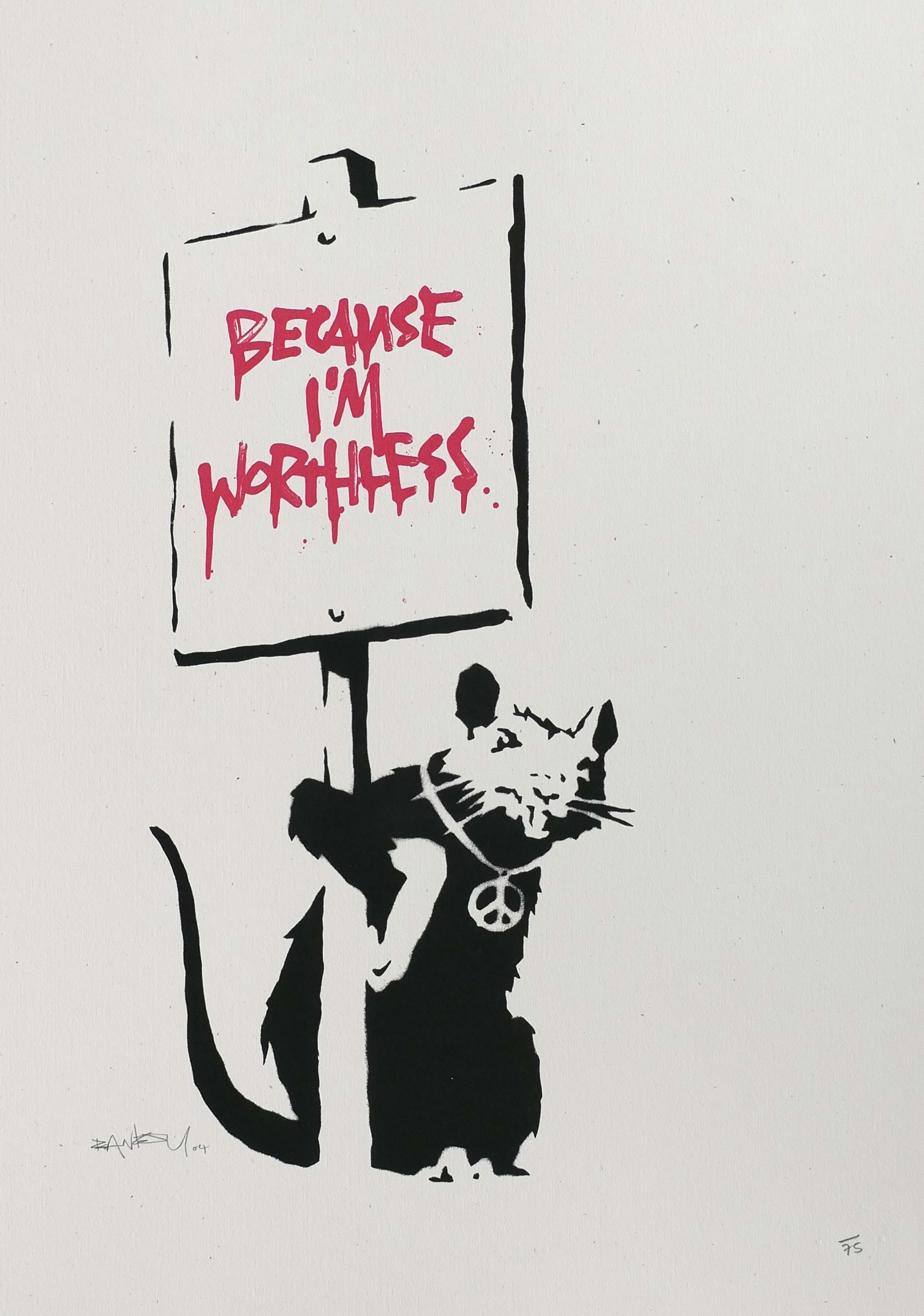

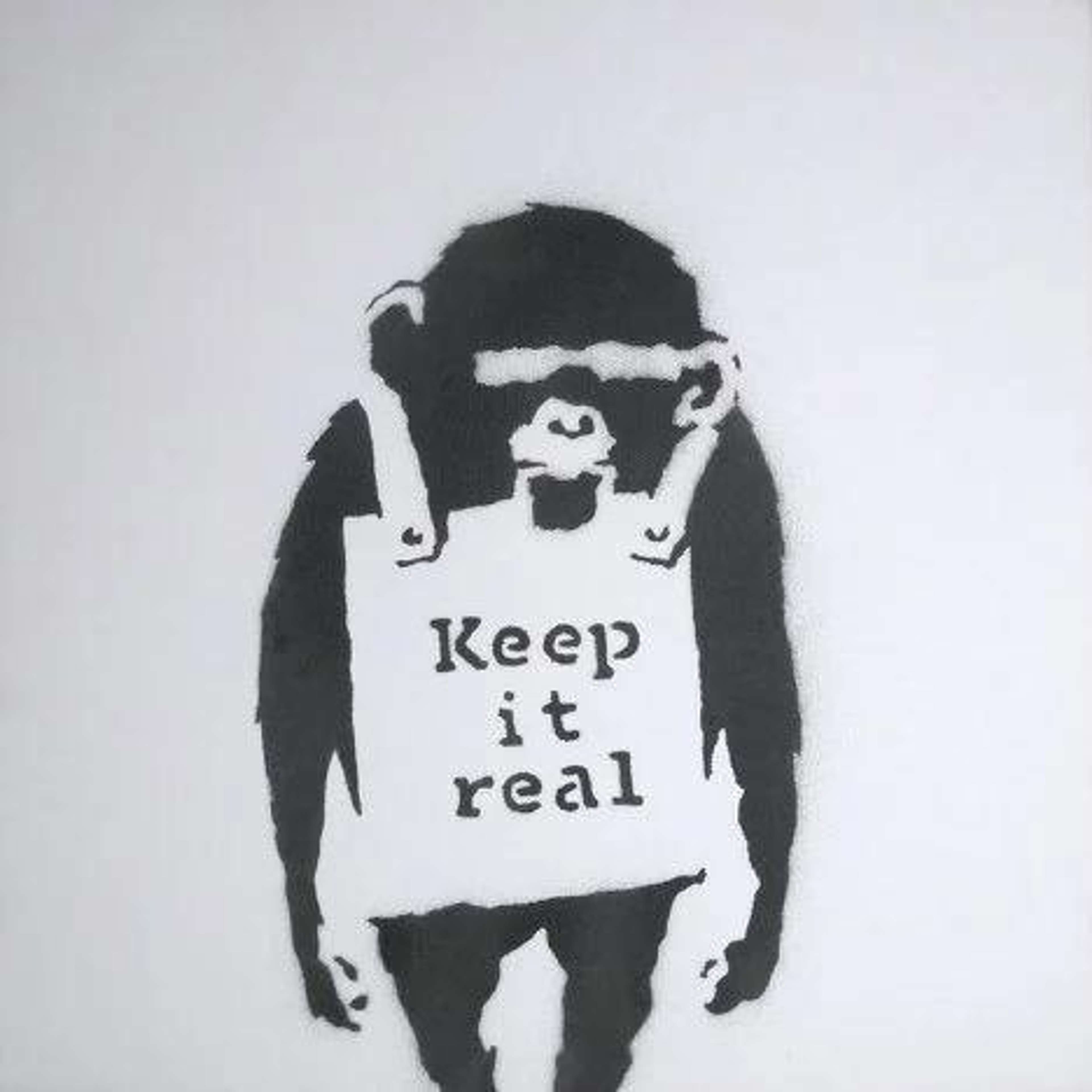

Keep It Real © Banksy 2002

Keep It Real © Banksy 2002Market Reports

It's hard to escape the buzz surrounding non-fungible tokens (NFTs). With the high-profile sales of 2021 and a growing number of platforms, it's no wonder people are getting curious. Before making any decisions, it's important to understand both the potential benefits and risks of investing in NFTs.

Benefits of NFT investing:

NFTs have become popular because of the many benefits they offer to both creators and investors. Some of the most notable benefits include:

Fractionalised ownership of assets

It's much easier to own a fraction of an NFT than it is to own a fraction of a physical asset. For example, it's difficult to divide a bottle of wine into fractions and sell it. However, with an NFT, you can easily divide it into 100 pieces and sell each piece for a fraction of the price.

This makes NFTs more accessible to a wider range of people and allows you to own a piece of something that may otherwise be out of your price range.

Foster a strong community

NFTs are perfect for building hype around a certain asset, project, or brand. For example, if an artist is launching a new album of music, they could sell NFTs of the album cover. As a buyer of this NFT, you would receive the album before anyone else, album royalties, access to merch, and other future benefits.

This creates huge buzz and excitement around the release and builds a strong community of fans who are invested in the project.

True ownersip of in-game assets

With NFTs, you have true ownership of in-game assets. This is unlike traditional video games, where the game developers can take away your items or currency at any time.

For example, if you purchase a sword in a traditional video game, the game developers could take away that sword from you if they wanted to. However, if you purchase an NFT sword, you could trade it, transfer it to another game, or sell it for fiat currency.

Acquiring these in-game NFTs not only makes gaming more fun, but it adds to the value of your portfolio. These are assets that can significantly appreciate in value over time.

Easy to authenticate

NFTs are stored on a blockchain, which is a decentralized ledger that records all transactions. The data is immutable, meaning it cannot be changed or tampered with. This makes NFTs much easier to authenticate than physical assets.

For example, let's say you're buying a piece of art from an online seller. It can be difficult to tell if the online seller is selling you an original or a copy. However, with an NFT, you can easily check the blockchain to see the complete history of the asset.

Smart contracts promote efficiency

Smart contracts are digital contracts that execute automatically based on a predetermined set of criteria. They can be used to automate a variety of processes, including the buying and selling of NFTs.

Diversification

NFTs offer a unique way to diversify your investment portfolio. For example, you can invest in NFTs that represent physical assets, like property or art, or you can invest in NFTs that represent digital assets, like crypto-collectables or in-game items.

The key is to find an asset class that fits your risk tolerance and investment goals. From there, you can use NFTs to diversify your portfolio and reduce your overall risk.

Risks of NFT investing:

NFTs are a relatively new asset class and they come with a unique set of risks. Some of the most notable risks of investing in NFTs include:

High price volatility

NFTs are still in the early stages of development, which means they're subject to high price volatility. For example, the prices of Bitcoin and Ethereum – two of the most popular cryptocurrencies – have been known to fluctuate rapidly.

This volatility can make it difficult to predict the future value of an NFT. As a result, you could end up losing money if you invest in an NFT that doesn't hold its value.

In addition, while the market has been on an upward trajectory for the last five years, it's still relatively small compared to other asset classes. Not only does this mean that a small number of people can have a large impact on the price of an NFT, but you may have trouble finding a buyer if you need to sell your NFT in a hurry.

NFTs do not generate income

Unlike other investable assets, like stocks or bonds, NFTs do not generate income. This means that you're purely relying on the appreciation of the asset to make a profit.

As it's difficult to predict how an NFT will perform in the future, you could end up holding an NFT for years without seeing a positive return on your investment.

Security concerns

While blockchain technology is secure and decentralized, not all networks are created equal. Some blockchains are more vulnerable to hacks than others.

Plus, many of these NFTs are not stored on-chain, which means the NFT is stored on a centralized server and linked to the blockchain. As such, off-chain NFTs are easier to hack and steal than on-chain NFTs.

Phishing is also a major concern, as scammers can create fake websites and wallets that look identical to the real thing. This makes it easy for them to steal your private keys — and your NFTs.

Discord has become the new destination for NFT traders to talk about the latest trends, find new projects to invest in, and more. But this also makes it a prime target for scammers.

One such case is when Twitch co-founder, Justin Kan, had his NFT Discord server compromised. Specifically, one of his bots was hacked, which sent out a fake link announcement. This resulted in over US$150,000 worth of SOL being sent to a scammer's wallet.

There's not much the people could have done in this case, but it shows just how careful you need to be when dealing with cryptocurrency and other decentralized assets.

NFTs can harm the environment

The cryptocurrency industry is receiving a lot of bad press for its environmental impact. And NFTs are no exception. This is because most NFTs run on blockchains that use a proof-of-work consensus algorithm.

This means that miners need to use computers to solve complex math problems in order to verify transactions. A vast amount of energy is needed to power these computers, which results in a large carbon footprint. In fact, data shows that Bitcoin shares the same carbon footprint as New Zealand.

As the demand for NFTs grows, so does the need for energy. Not only does this have a negative impact on the environment, but the blockchain industry is facing a huge backlash from environmentalists.

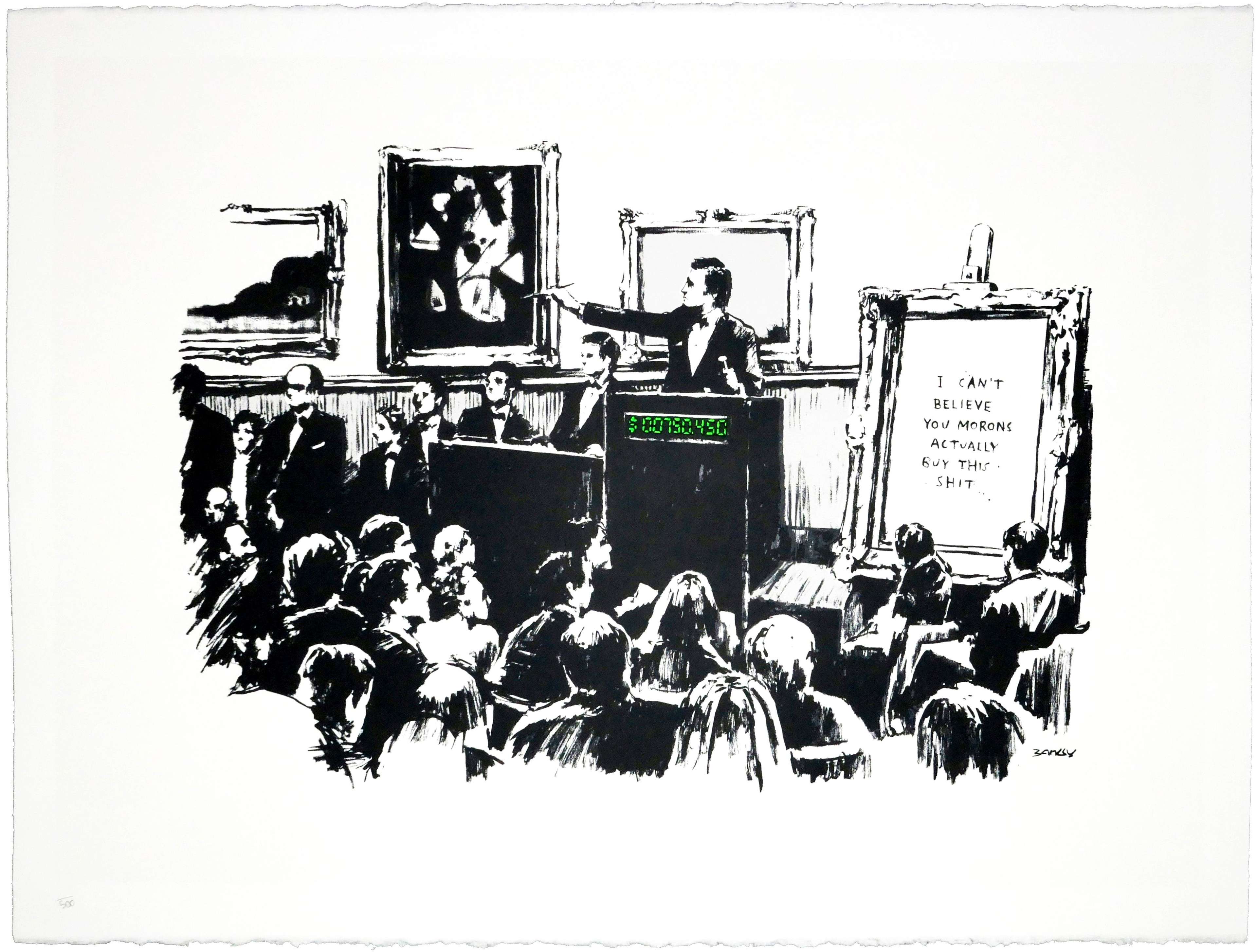

NFTs can perpetuate fraud

It's not uncommon for artists to find that someone else is selling their work as an NFT without their permission. In some cases, the artist may not even know that their work has been turned into an NFT.

This happens because anyone can create (mint) an NFT. As a result, it's relatively easy for someone to steal someone else's work and sell it as their own.

As an investor, it's important to do your due diligence and make sure the NFT you're buying is legitimate and sold with the artist's permission. You don't want to end up purchasing a fake Banksy NFT for £244,000.

So, is investing in NFTs a good idea?

Investing in something just because it's an NFT is a recipe for disaster. Just like any other asset, you need to do your research and understand the risks involved before investing.

However, if you're looking for a new and exciting way to invest, NFTs could be a good option.

Bottom Line

NFTs are a new and exciting asset class with the potential to change the way we interact with digital art, games, and other online content.

However, they're also investments that come with a unique set of risks. Before investing in NFTs, make sure you understand the risks involved and only invest what you're comfortable losing.