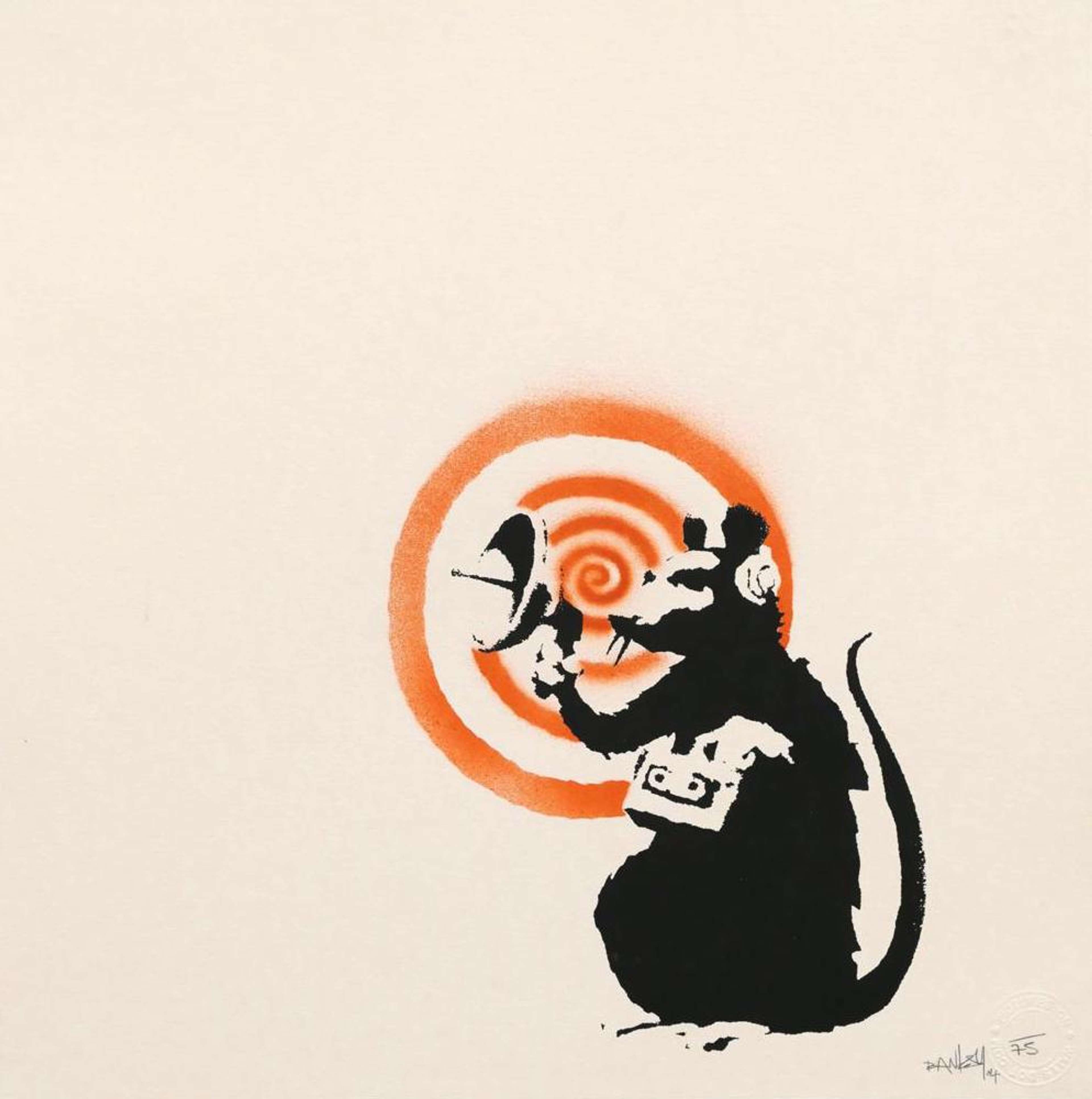

Radar Rat © Banksy 2004

Radar Rat © Banksy 2004Market Reports

The NFT - or non-fungible token – has taken the art market by storm. Showcasing all manner of images from ‘Bored Apes’ and ‘Covid Aliens’ through to the likes of Damien Hirst and Banksy, the NFT art has succeeded in establishing itself as a fast-growing and increasingly attractive investment in the contemporary art market.

What is an NFT?

Despite novel appearances, the NFT has been around for a while now: initially referred to as ‘monetised graphics’, it was first created in May 2014 by US-based software developers and tech entrepreneurs, Kevin McCoy and Anil Dash.

For the uninitiated — an NFT is a unique, digital-only asset that acts much like a certificate of authenticity or deed.

Recorded on a so-called ‘blockchain’ — a digitally distributed, decentralised, and immutable record of transactions that links an asset to its original creator — an NFT can, in principle, be anything. Over the past year, the most popular NFTs have been image-based.

Whether an image file, video, piece of music, or even a tweet, an NFT can be traded between collectors online or at auction.

(Still confused? See our NFT Glossary).

NFTs and the Art World

NFT sales have succeeded in raising billions of dollars in revenue for art investors and collectors. In June 2021, a so-called ‘Covid Alien’ NFT from the ‘CryptoPunk’ series sold for over $11.7 million at a ‘Natively Digital’ sale, hosted by Sotheby’s auction house in London. This was the most expensive NFT sale to-date.

A particularly lucrative addition to the fast-growing world of NFTs is the work of British Street Art legend, Banksy.

The latest artist to have his work appear in this increasingly accessible corner of the art investment sphere, Banksy has followed the lead of YBA and enfant terrible of contemporary art, Damien Hirst. In August of 2021, Hirst announced the creation of ‘The Currency’ – a hybrid painting and NFT-based initiative involving 10,000 unique dot-covered paintings – which now has an estimated market value of $500 million.

Banksy NFTs

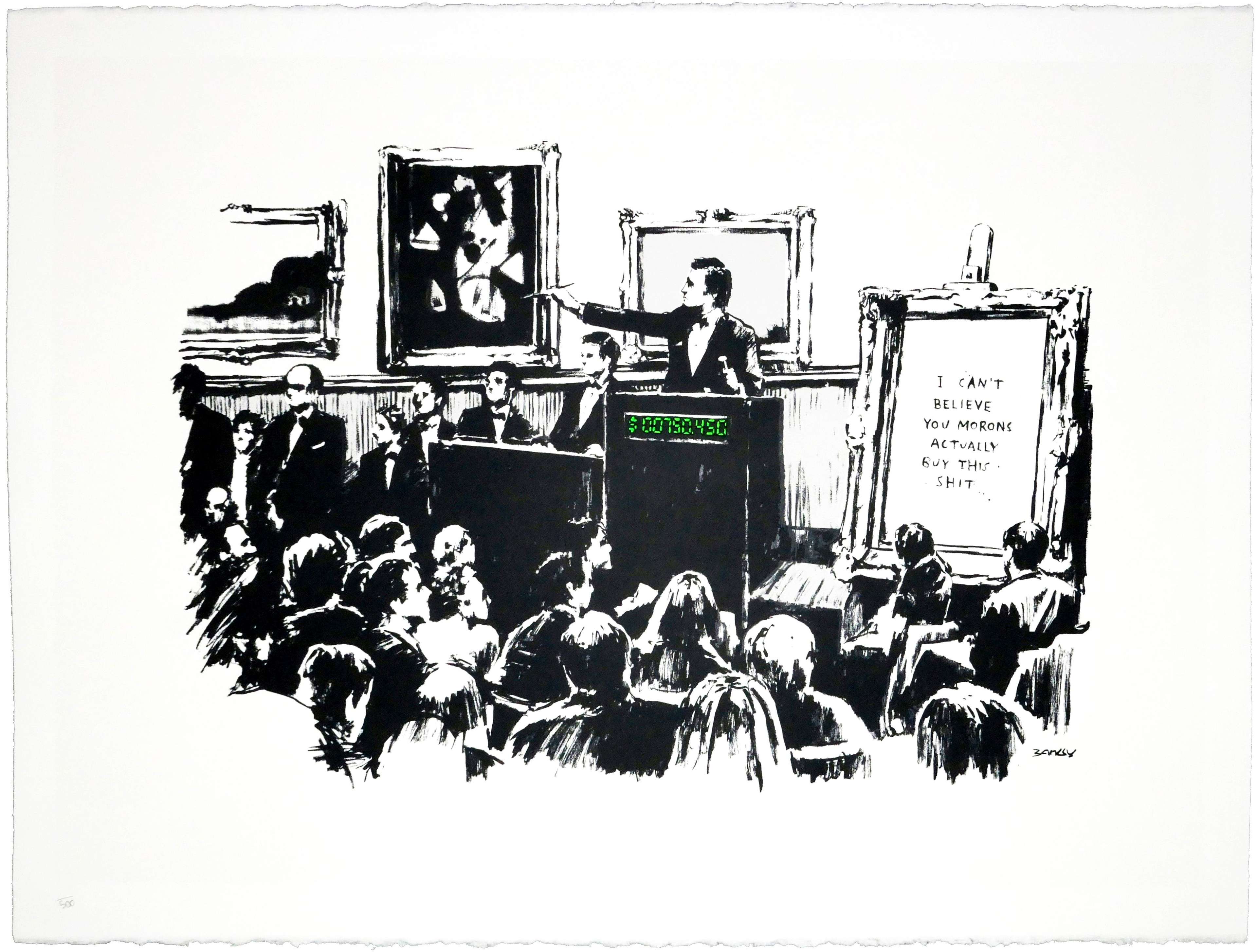

The first Banksy work to appear as an NFT was a 2006 edition of Morons (White). Bought by blockchain company Injective Protocol in March 2021 for $95,000, the original artwork was burned and replaced by a digital facsimile in NFT form.

Much like the infamous Love Is In The Bin art stunt of October 2018, which saw Banksy shred a Girl With Balloon print just as the hammer went down to mark its sale, Injective Protocol’s NFT-based intervention added value and inflated prices. Later in the same year, the Morons (White) NFT realised $380,000 via NFT marketplace OpenSea – a 300% increase on the price of the original, physical print.

In December 2021, the iconic Banksy piece, Love Is In The Air, was bought for $12.9 million. The buyer of the piece was the newly founded NFT company, Particle. Led by ex-head of contemporary art at Christie’s, Loïc Gouzer, Particle subsequently fractionalised ownership of the Banksy work, turning it into 10,000 unique NFTs each priced at around $1,500 USD.

In August 2021, a link to NFT marketplace OpenSea appeared on a sub-link on Banksy’s official website. Redirecting to a ‘CryptoPunk’ NFT featuring three smoking chimneys, some thought the work genuine. Despite a lack of comment from Pest Control, Banksy’s only official authenticator, the NFT was purchased for the equivalent of $336,000 USD. Like many others, the buyer speculated that the work may have been a critique of the NFT market and its sizable carbon footprint. The reality? Banksy’s website had been hacked and this was a scam.

Although far from genuine, a tongue-in-cheek NFT sale from Banksy is exactly what we might have expected - after all, the artist is no stranger to mocking the world of contemporary art. For example, many have speculated that the artist’s 2010 film Exit Through The Gift Shop was a publicity stunt designed to make viewers question the fact that art has become a major commodity in recent years.

Are NFTs here to stay?

The future of the NFT has been cast in considerable doubt by collectors and experts alike. According to one of the pioneers of cryptocurrency investment and founder of Coinbase, Fred Ehrsam, the rise of the NFT resembles the painfully short-lived dotcom boom of the 1990s and early 2000s.

In this period, the excessive speculation of internet-related companies caused the Nasdaq Composite stock market index to rise by 400% in a very short time. Reaching its peak in 2002, this ‘dot-com bubble’ burst; with the index falling by 78%, a dramatic crash ensued. This was responsible for the disappearance of countless internet-related companies, many of which became worthless. According to Ehrsam, the NFT boom will be similarly fleeting: ‘I go so far as to say that 90% of NFTs produced, they probably will have little to no value in three to five years’, he commented in 2021.

Alongside their high energy cost, enormous carbon footprint and frequent use in art-based fraud schemes, NFT’s have been identified as particularly damaging to artists. Noting their less-than-desirable impacts, co-creator of the NFT, Anil Dash, has argued that ‘the idea behind NFTs was, and is, profound. Technology should be enabling artists to exercise control over their work, to more easily sell it, to more strongly protect against others appropriating it without permission.’ However, Dash argues that increasingly ‘people are creating NFTs of artists’ works without asking permission or even letting the artists know.’ This is particularly damaging to emerging artists, many of whom have had to shut down their online platforms to protect their work from fraudsters.

Our take? The traditional market is here to stay.