Five Key Art Market Predictions in 2026

Femme Dans L'Atelier © Pablo Picasso 1956

Femme Dans L'Atelier © Pablo Picasso 1956Market Reports

As 2026 begins, the art market isn’t resetting – it’s reorganising. The post-pandemic surge has passed, but it hasn’t been replaced by retreat. What I’ve observed instead is a market building confidence more deliberately, deploying capital with greater intent, and placing more weight on structure than spectacle.

What’s changed most is where confidence is coming from. Ultra-high-value masterpieces are increasingly scarce and unevenly supplied. In response, confidence is forming across a wider range of segments and mediums – around material that is recognisable, structurally clear, and capable of functioning as a benchmark within its own category. Trophy status hasn’t disappeared; it’s being reassigned.

These dynamics are most legible in the prints and editions market. Its pace, repeatability, and overlap with other editioned luxury collectibles give it a long-standing authority in how confidence forms and demand reveals itself. My 2026 market predictions attempt to reflect this reading of the market – what I’ve absorbed from how collectors are behaving now, and why I expect these shifts to shape the year ahead.

Prints Will Anchor a Headline Auction Sale – Not Support It

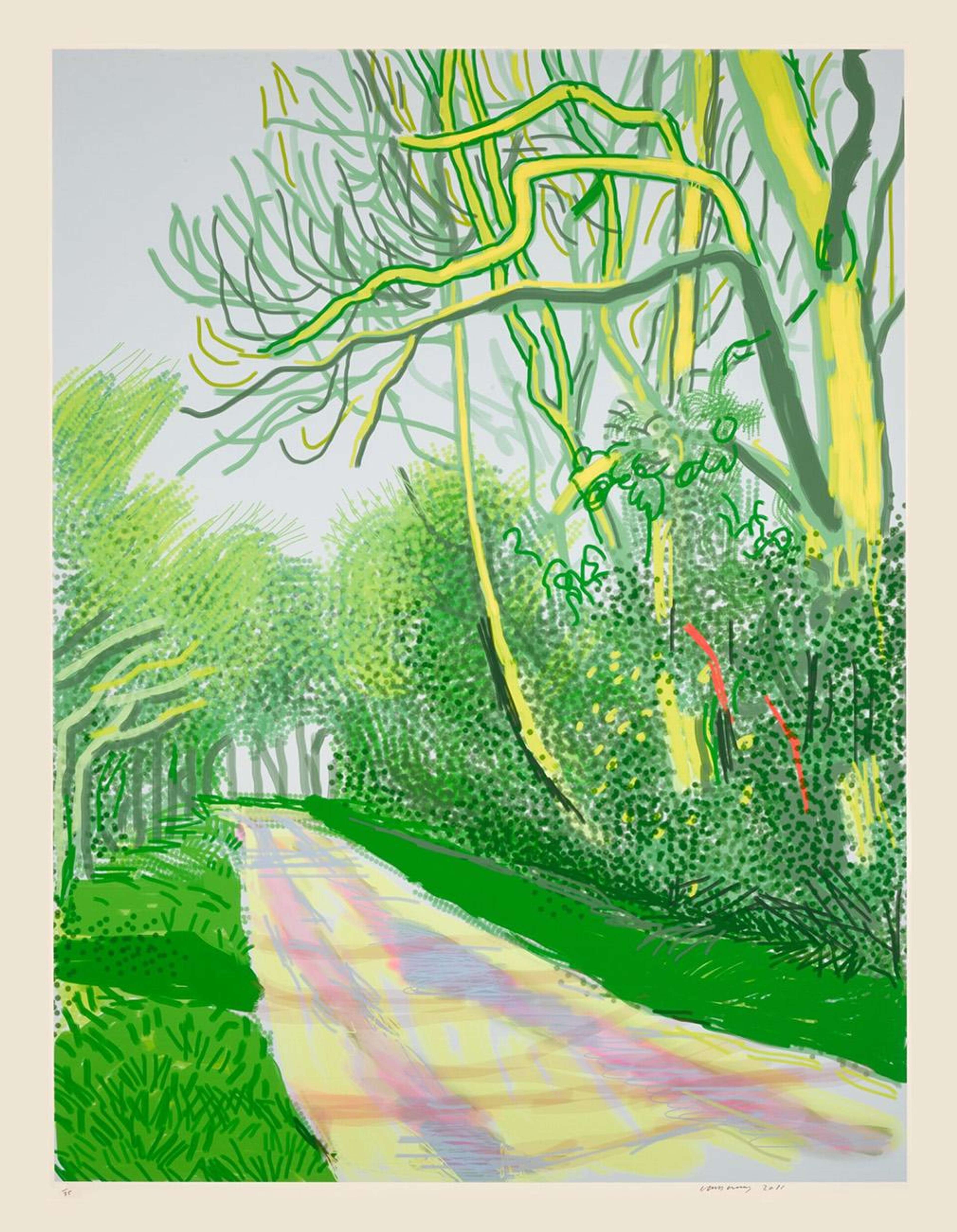

Last year, I predicted that we would see a dedicated single-artist print sale emerge as a meaningful moment in the auction calendar. I’m comfortable awarding that prediction to myself. Sotheby’s September sale of Roy Lichtenstein prints delivered exactly that, and I’d go further and count two additional signals (1) the strategic decision to open the October London evening auctions with David Hockney’s Arrival of Spring prints at Sotheby’s, and (2) Christie’s dedicated an online sale to a complete set of Andy Warhol’s Ads collection offered as individual prints.

What matters here isn’t just that these sales happened, but how they were positioned. In each case, prints weren’t treated as supplementary material. They were used deliberately – to set tone, to stabilise confidence, and to front-load momentum. London, in particular, functioned as a proving ground, allowing auction houses to test placement and appetite ahead of the higher-stakes New York season. The results justified the strategy.

Given that success, I’m carrying this prediction into 2026. I expect at least one major auction house to open a headline sale with a dedicated blue chip print selection or single-owner print collection – not as a novelty, but as a calculated confidence anchor. The constraint, as ever, will be supply. This approach relies on securing a coherent, best-in-class grouping, whether from an estate or a strategically minded consignor. But unlike traditional trophy collections driven by necessity, print collections are increasingly released with intent. And that makes them ideally suited to this kind of structural role in the market.

Freshness and Edition Structure Will Drive the Standout Print Result of the Year

One of the clearest patterns I’ve observed is not a slowdown in engagement, but a sharpening of attention. Collectors are active, but increasingly responsive to how material enters the market. Freshness has become a meaningful signal – not of novelty, but of intent – particularly when it reveals parts of the editions market that haven’t yet been fully seen or understood.

Within the print market, depth runs far ahead of visibility. There are edition proofs that have never circulated publicly, variants that remain tightly held, and collections that only fully assert their importance when presented as a coherent whole. When these works surface individually, they can blend into the broader market. When they appear with structure and clarity, they command focus.

In 2026, I expect this to crystallise in one of two ways: either a complete print set by a blue-chip artist that has never been offered as such, or the release of a previously unseen edition proof that resets the top price paid for that collection. As ever, the risk will sit in the fundamentals – condition and provenance will be decisive – but when those are right, freshness and internal structure are likely to drive the year’s most compelling print result, and reshape how conviction forms in the editions market.

A Charity-Led Sale Will Produce One of 2026’s Most Defining Results

To my knowledge, there has been only one recent charity-led sale that truly captured the market’s attention in 2025 – and I would actively advocate for more. Bonhams’ Bob Ross charity auction stood out not because Ross functions as a traditional blue chip artist, but because he operates as a widely recognised television personality and cultural brand – with proceeds benefiting Public Broadcasting Service at a moment when public funding for cultural institutions was under pressure.

What made the result notable was the alignment. The sale tapped into a demographic mindset that values visibility, cultural relevance, and purpose alongside ownership. Charity didn’t soften demand; it sharpened it, giving bidders a clear narrative rationale to engage decisively. In that context, the prices achieved felt less like anomalies and more like the logical outcome of a well-calibrated proposition.

In 2026, I expect this logic to migrate further up the market. My prediction is that a charity-led sale or philanthropic collection tied to blue chip artwork will produce one of the year’s most defining results. Not because charity overrides market fundamentals, but because it aligns with how today’s collectors want to justify participation – and when that alignment is paired with established artistic value, it has the potential to amplify demand rather than dilute it.

A Major Auction House Will Publicly Integrate a Live Pricing Signal into Its Digital Platform

This is my boldest prediction for 2026 – and I’m fully aware I’ll either be right or wrong on it.

Over the past year, one of the clearest structural shifts I’ve observed is not happening inside auction houses at all, but around them. Collectors increasingly arrive informed by digital tools that already surface live market context – pricing ranges, depth of comparable sales, and current demand signals. These tools already exist, they are being used, and they are shaping expectations long before a catalogue is published or a lot crosses the block.

In 2026, I expect at least one major auction house to respond publicly to that reality. Not by abandoning estimates or revealing full valuation logic, but by introducing a controlled, digital pricing signal into its platform – most likely within online-only sales, private sales portals, or post-sale analytics. This could take the form of dynamic comparables, live market bands, or contextual pricing indicators that sit alongside traditional estimates rather than replacing them.

This would mark a meaningful shift. Auction houses will not suddenly become transparent pricing engines, and they won’t adopt third-party tools wholesale. But they will begin to acknowledge – visibly – that pricing confidence is now formed across a broader digital ecosystem. If this happens, it will signal that the centre of pricing authority has begun to stretch beyond the auction room.

Banksy Will Re-Enter the Institutional Stage With a Major Exhibition in 2026

I could end this set with broader, more expected predictions – about fair convergence in the Middle East, further consolidation among platforms, AI’s expanding role in valuation, or the continued rise of the middle market. All of these trends I do believe in, but they are already underway.

Instead, I’m going to be more specific.

In 2026, I expect Banksy to stage a major exhibition – either as a continuation of Cut & Run or as a new, museum-scale institutional project. In 2023, Cut & Run was deliberately positioned as unfinished, mobile, and shaped by public participation. A poll invited audiences to vote on where it should travel next, but since then, nothing has been formally announced.

Banksy has always used exhibitions strategically, not routinely – often at moments when visibility, narrative control, or market context requires recalibration. His market has been through a period of correction and reassessment, where confidence has become more selective and dependent on context rather than momentum alone.

A major exhibition in 2026 would not function as a retrospective or spectacle. It would act as a narrative reset – reasserting authorship, cultural relevance, and institutional framing at a moment when the market is paying close attention to credibility signals beyond price. If such an exhibition materialises next year, it will be one of the most consequential non-transactional moments for the contemporary market.