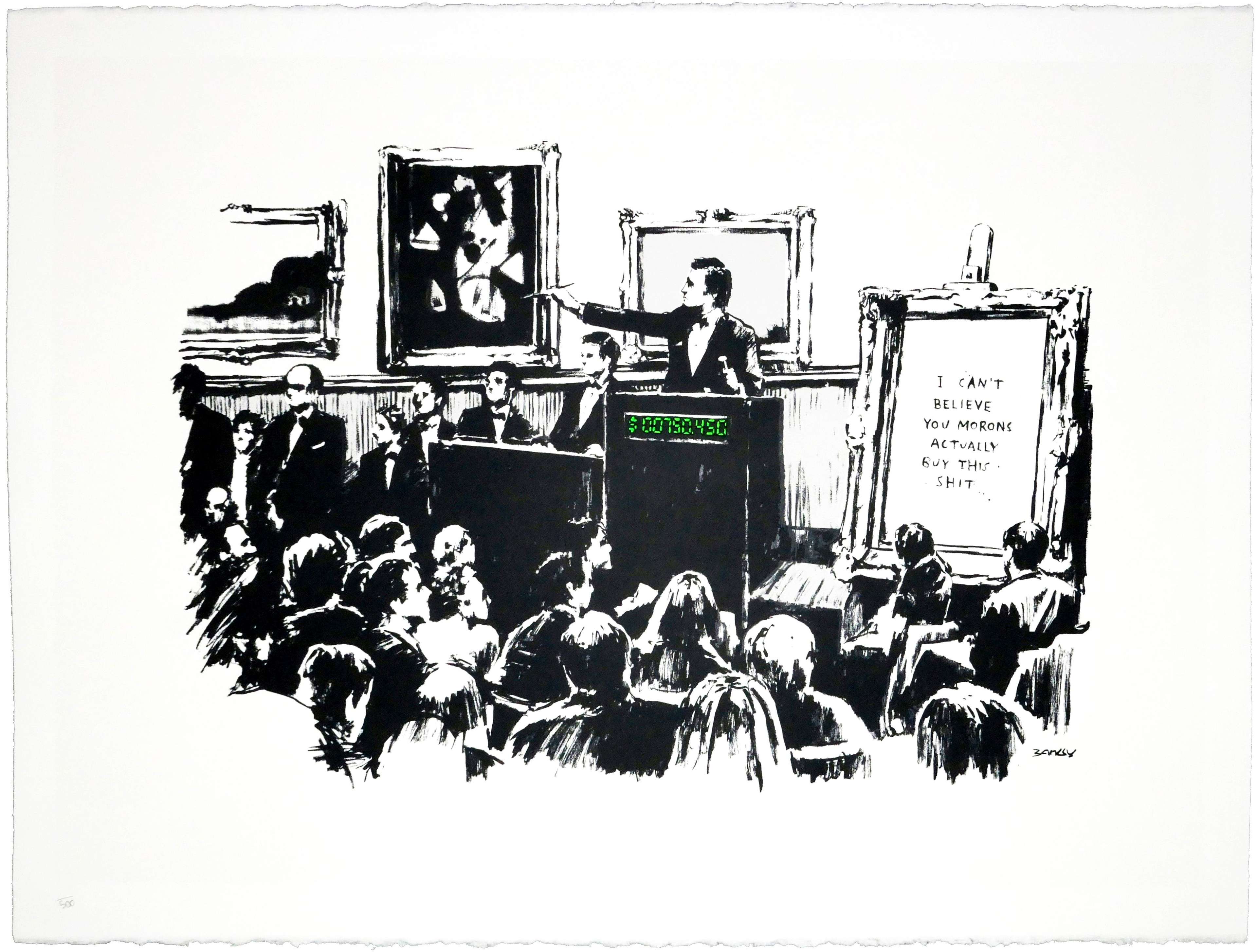

Old Masters are Out, Luxury Collectibles & Editions are In

Sale Ends V2 © Banksy 2017

Sale Ends V2 © Banksy 2017Market Reports

Like any market which is driven by ‘wants’ rather than ‘needs’, trend cycles are a crucial cornerstone of the art market and bear great influence on value. Masters & Classics Week at Sotheby’s and Christie’s in New York revealed cracks in the Old Master market, which have begun to deepen - making way for the burgeoning luxury collectibles market. Amidst accomplished oil paintings, artefacts and antiquities, the highest achieving lot across the houses was a set of six Michael B Jordan sneakers from the 1990s - a stark indication of where true appetite currently lies in the market. However, this shift in appetite is based on far more than trends, as the Old Master segment of the market remains as antiquated, elusive and exclusive as the art market itself.

In a recent article for The Art Newspaper, Scott Reyburn mused on the challenges currently faced by the Old Master market. In his words, these issues are ‘well known and much repeated’ - with the slump attributed to dwindling supply, condition and attribution issues, works being considered unreliable investments, and the fact that they simply aren’t ‘cool’ anymore. However, when the highest estimated lot of Masters Week is a set of 1990s sneakers - rather than the $35 million Diego Velázquez portrait which was pulled from Sotheby’s - the tide is very much turning.

This changing tide is symptomatic of a myriad of things outside of trend cycles: changing collector demographics, the increasingly online nature of the art market, and a greater emphasis on access and transparency than ever before. As we enter 2024, we are witnessing a really pivotal time in the market - not only for art but for ‘collectibles’ and so-called ‘alternative investment assets’ at large - ushering an age in which contemporary luxury is championed above tradition. Trend cycles will always come and go in a market that is defined by ‘taste’ - you only need to look at the journey of Impressionism in the market to know that. What was in vogue yesterday might be undesirable tomorrow; what was once relatively worthless might eventually be considered a ‘sleeper’ and shoot to market success. The concerns arising around the Old Master market reveal far more than what’s currently in vogue: they hold a mirror up to what’s fundamentally wrong with the art market as we know it.

Image © Sothbey's / A Set of 6 Michael Jordan ‘Championship Clinching’ Game Worn Air Jordan Sneakers | 1991, 1992, 1993, 1996, 1997, 1998

Image © Sothbey's / A Set of 6 Michael Jordan ‘Championship Clinching’ Game Worn Air Jordan Sneakers | 1991, 1992, 1993, 1996, 1997, 1998Why Old Masters are ‘Out’

Reyburn was right to suggest that the subject matter contained within the majority of Old Master works is no longer appealing, which is part of the reason why ⅓ lots in this category were unsold in 2023. This segment of the market, more than most, is composed of a very small pool of collectors who bid for extremely high value works. It is a market for big institutions and elite insiders alone.

It’s not so much an issue of these works not being ‘cool’ enough to appeal to new generations of collectors, or the complaint that old white male artists simply aren’t in fashion anymore - Turner, van Dyck, Caravaggio, Reynolds, di Ribera, and Gainsborough (to name a very select few) are hardly at risk of fading into obscurity or worthlessness. Rather, the ‘stale’ subject matter of these works is a turn-off mainly because it signifies - for most - a totally inaccessible and nontransparent part of the art market. With most works in the eight-figure range, it’s hardly surprising that most of us are happy to see these works in national galleries, forever to be looked at but not touched, let alone purchased at auction.

Changing Collector Demographics

According to Art Tactic and Deloitte’s 2023 Art & Finance Report, an estimated $80 trillion of wealth is set to transfer from Baby Boomers to their Gen X and Millennial offspring in the coming years - inevitably inviting a swathe of new collectors into the art market. This doesn’t even touch on Gen Z, who are set to become some of the most avid consumers of culture - not least thanks to the whirlwind of trend cycles instilled by the likes of TikTok and Instagram.

These new generations entering the market aren’t interested in buying a Turner simply because it’s a Turner, they’re interested in the facts and data behind any collectible. In the same report, it was recorded that 95% of young collectors placed chief emphasis on art market information and research when collecting. The younger generation of collectors are showing a strong interest in ‘art investment and the financial aspects of art ownership’. Essentially, younger collectors entering the market want a greater sense of security when investing their cash - something the historically illiquid and unreliable art market is still largely unable to offer. Hence, it’s hardly surprising that this new generation are turning their attention to two more topical, reliable, and accessible options: luxury collectibles and editions.

The Burgeoning Market for Luxury Collectibles

While art was crowned the top-performing collectible asset in March 2023, the wider category of luxury collectibles is growing exponentially. According to HSBC Private Banking, the global collectibles market was worth approximately US$372 billion in 2021, and is poised to reach US$522 billion by 2028. All of the major auction houses have dedicated departments for these luxury categories, which have seen resounding success in the last few years. In 2022, Sotheby’s hit a record US$158 million in wine sales, a 20% increase year-over-year. More recently in December 2023, Christie’s sold a rare sterling silver Mini Hermès Kelly for US$214,200. Now, the estimate for the six Air Jordans being flogged at Sotheby’s The One sale sits at US$7,000,000 - US$10,000,000. Clearly, the appetite for more contemporary luxuries has never been stronger, driven by hype culture and the allure of exclusive, limited-edition collectibles.

To put it simply, these collectibles offer a more tangible and often more relatable form of investment, often backed by secondary market data. Unlike the remote and somewhat enigmatic realm of Old Masters, the market for luxury collectibles is dynamic and accessible: attracting a more diverse range of buyers, from seasoned investors to the new generation of collectors driven by a passion for culture and investability.

Prints & Editions: A Legitimate Way to ‘Invest’ in Art

As the only segment of the wider art market which is truly comparable, prints and editions have been heralded as the market to watch in 2024. Where unique originals come with prohibitive price tags, prints offer a more approachable avenue to begin investing in art. As our data shows, this accessibility certainly doesn’t compromise their potential for appreciation. On the contrary, prints by renowned blue chip artists often see steady value growth - while providing collectors with a greater degree of liquidity than anywhere else in the market.

This accessible segment of the market caters to all collectors and investors - not just a handful of HNWIs. At one end of the spectrum, for instance, collectors can enter the iconic market of Andy Warhol for under £10,000. At the other, the more experienced can look towards collecting an entire set with matching edition numbers - where estimates can exceed £3,000,000. For a fraction of the cost of an Old Master original, a diverse portfolio of editions can be built - with hero works from the oeuvres of Basquait, Haring, Lichtenstein, Bacon, Freud, Hockney, Riley, Kusama, Emin, Hirst… the list goes on. In short, you don’t have to put all your eggs in one basket, and your entire portfolio isn’t reliant on one or two golden eggs.

Transparency & Access in the Art and Luxury Markets

The crux of this issue lies at the very heart of the art market itself: a historic lack of transparency and access. In the wake of the pandemic, the global art market had no choice but to migrate online which - as with the rest of the world - became a somewhat permanent change. Yes, we have returned to the in-person theatre of the auction house for marquee evening and day sales, but a large portion of auctions are now taking place either partially or completely online. That’s not to mention the burgeoning landscape of online secondary marketplaces, like MyArtBroker, which exist solely online. In an age where we expect transactions to be more-or-less instant and data to be available in moments, the art market as it was 15 years ago is very much a thing of the past.

Old Masters will always have their place in the traditional auction house, making headlines when they appear for sale with all the theatrical pomp we expect and love. That won’t change. What is changing is the wider business of the market where most transactions are made, and where tradition is no longer necessary or even wanted. This new and exciting part of the market simply doesn’t need four walls, excessive buyer’s premiums, a handful of dealers with all the insider information, and an unsustainable circus of art fairs every year. It needs one thing and one thing only: transparency, underpinned by a more inclusive approach. This new market thrives on the principles of openness, accessibility, and data-driven insights, providing collectors with the tools and information they need to engage with art and luxury collectibles. It is in this environment that collectors of all levels can participate, armed with the knowledge and confidence that was once reserved for a select few. And that’s certainly not something to shy away from.