Banksy Print Market Investments © MyArtBroker 2024

Banksy Print Market Investments © MyArtBroker 2024

Florence Whittaker, Urban Art Specialist & Sales Director[email protected]

Interested in buying or selling

Banksy?

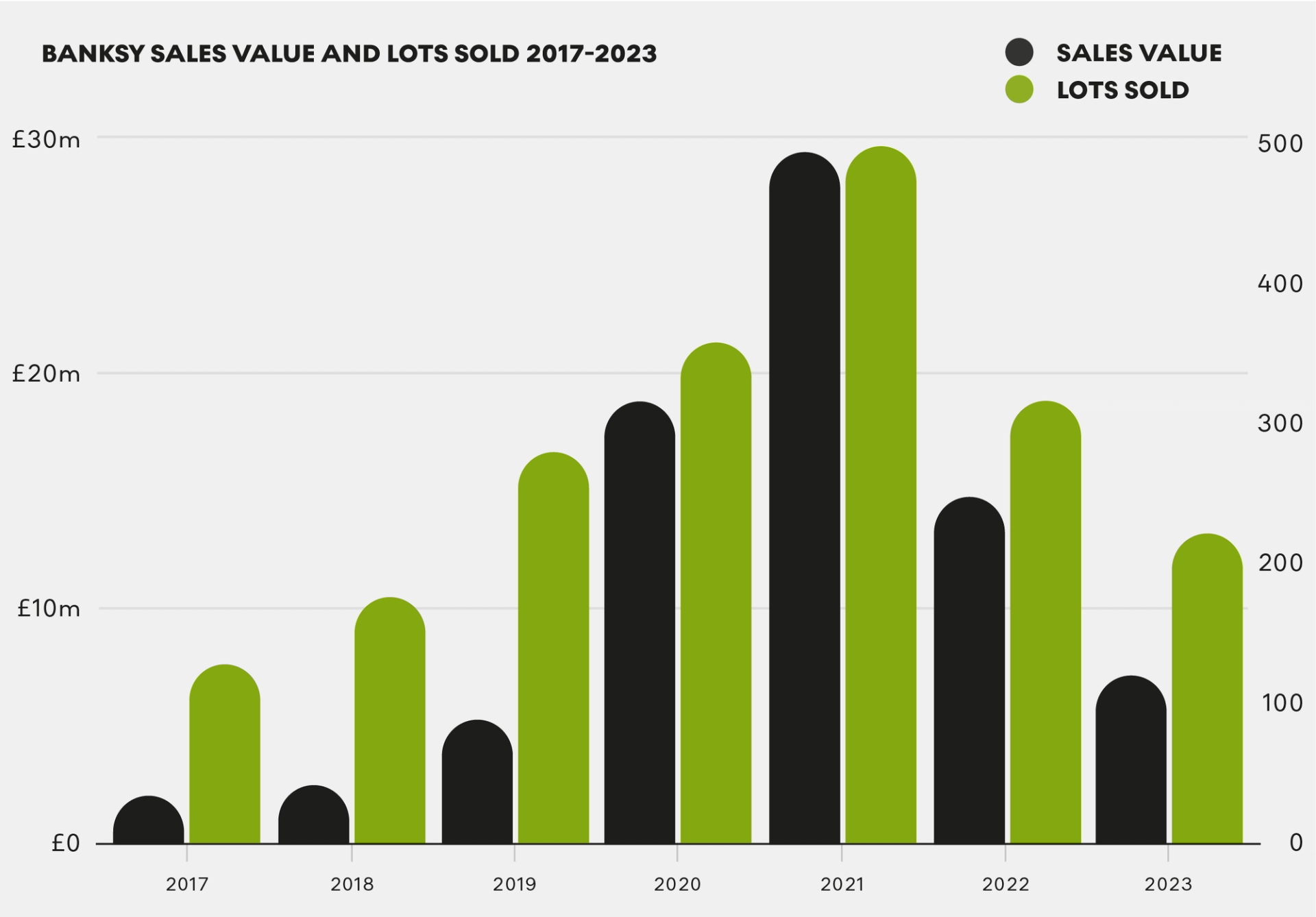

In the dynamic world of Banksy's print market, the numbers tell an intriguing story. Following the pinnacle of its performance in terms of sales value and lots sold in 2021, the market has experienced a series of consecutive declines. While this indicates a market softening, it also suggests a stable market for buyers on the surface, signalling a broader shift towards diversifying art collections with what we know to be high value prints, a shift offering appealing investment as market conditions change. A buyer's market can be followed by a seller's market, and Banksy's market is still in its early stages, with anticipation for what the coming years will bring.

In this investment report, we examine Banksy's print market performance spanning the past seven years. Leveraging auction and sales data from our dedicated database focused on prints and editions, our objective is to provide valuable insights to help you determine whether investing in Banksy prints is a wise decision for 2024.

ACCESS THE BANKSY REPORT: SEVEN YEARS IN THE PRINT MARKET

BANKSY SEVEN YEAR PRINT PERFORMANCE

Banksy Sales Value And Lots Sold 2017 - 2023 © MyArtBroker 2024

Banksy Sales Value And Lots Sold 2017 - 2023 © MyArtBroker 2024Is Buying A Banksy Print a Good Investment?

Banksy's meteoric ascent commenced in the mid-2000s, evolving from the streets to provocative and controversial exhibitions in both the United Kingdom and the United States. The early sales of prints at these exhibitions served as harbingers of the rapid rise of Banksy's print market and several pivotal moments played a crucial role in fuelling the Banksy surge from 2017 to 2021.

In 2018, Girl With Balloon was unexpectedly shredded at Sotheby's, ultimately achieving a sale price of over £1 million. The following year, Stormzy made headlines by donning a custom-signed vest at Glastonbury, while Gross Domestic Product opened its doors in Croydon. Simultaneously, Devolved Parliament (2009) set a new auction record, sparking heightened interest in affordable prints. These developments led to a 105% surge in sales value within Banksy's print market, reaching £9.8 million (hammer), accompanied by a 60% increase in lots sold, totalling 278 in 2019.

Amidst the challenges posed by the COVID-19 pandemic in 2020, Banksy's influence continued to expand. The appearance of Game Changer near Southampton General Hospital resulted in an astonishing 253% surge in Banksy's print market, reaching £18.7 million (hammer).

The pinnacle of Banksy's success unfolded in 2021, characterised by noteworthy events such as the charitable sale of Game Changer (2020) for £16.7 million and Love Is In The Bin (2018) achieving £18.5 million at auction. These milestones propelled Banksy's print market to unprecedented heights, with a total sales value of £29 million (hammer) and 492 lots sold in 2021.

Despite Banksy's subversive tactics and anti-establishment messages, these iconic moments undeniably represent significant trends within Banksy's art market, igniting interest and expanding the collector base. Those who acquired prints for as little as £400 during the early 2000s exhibitions have witnessed substantial returns on their investments. Our Banksy specialist, Florence Whittaker, succinctly encapsulates the Banksy 'trend' phenomenon, “We can see the trickle effect between the auction of that original work, the shredding in 2018 and the resale in 2021. You can see that kind of trend match against the original pricing.”

Listen to MyArtBroker's Live Panel Discussion Unleashing The Power of Prints and Editions: Art Market Insights and Investment Strategies

Banksy 2023 Print Market Performance

Banksy Print Market Values 2023 © MyArtBroker 2024

Banksy Print Market Values 2023 © MyArtBroker 2024What Happened In Banksy's Print Market Performance In 2023?

Following Banksy's peak performance in the print market in 2021, there was a noticeable softening, with a decline in both the number of lots sold and the total sales value during 2022 and 2023. The sales value experienced a 50% year-on-year (YoY) decrease, resulting in a total of £7.1 million (hammer) for Banksy's print market in 2023, encompassing 220 lots sold. These figures translated to an average selling price (ASP) of £32,413, indicating a 31% decline compared to 2022. Many are curious about the reasons behind this trend, but the truth is that it's not because Banksy's prints have become less relevant; rather, the market became oversaturated, reaching heights that were perhaps unsustainable.

These statistics offer valuable insights into the fundamental dynamics of Banksy's print market, particularly when considering the potential benefits of acquiring a Banksy print. This assessment becomes increasingly important in the current market landscape, which is characterised by favourable conditions for buyers and potential opportunities for acquisition, rather than selling.

Banksy Average Selling Price

Banksy Average Selling Price 2017 - 2023 © MyArtBroker 2024

Banksy Average Selling Price 2017 - 2023 © MyArtBroker 2024Average Selling Price Of Banksy Prints

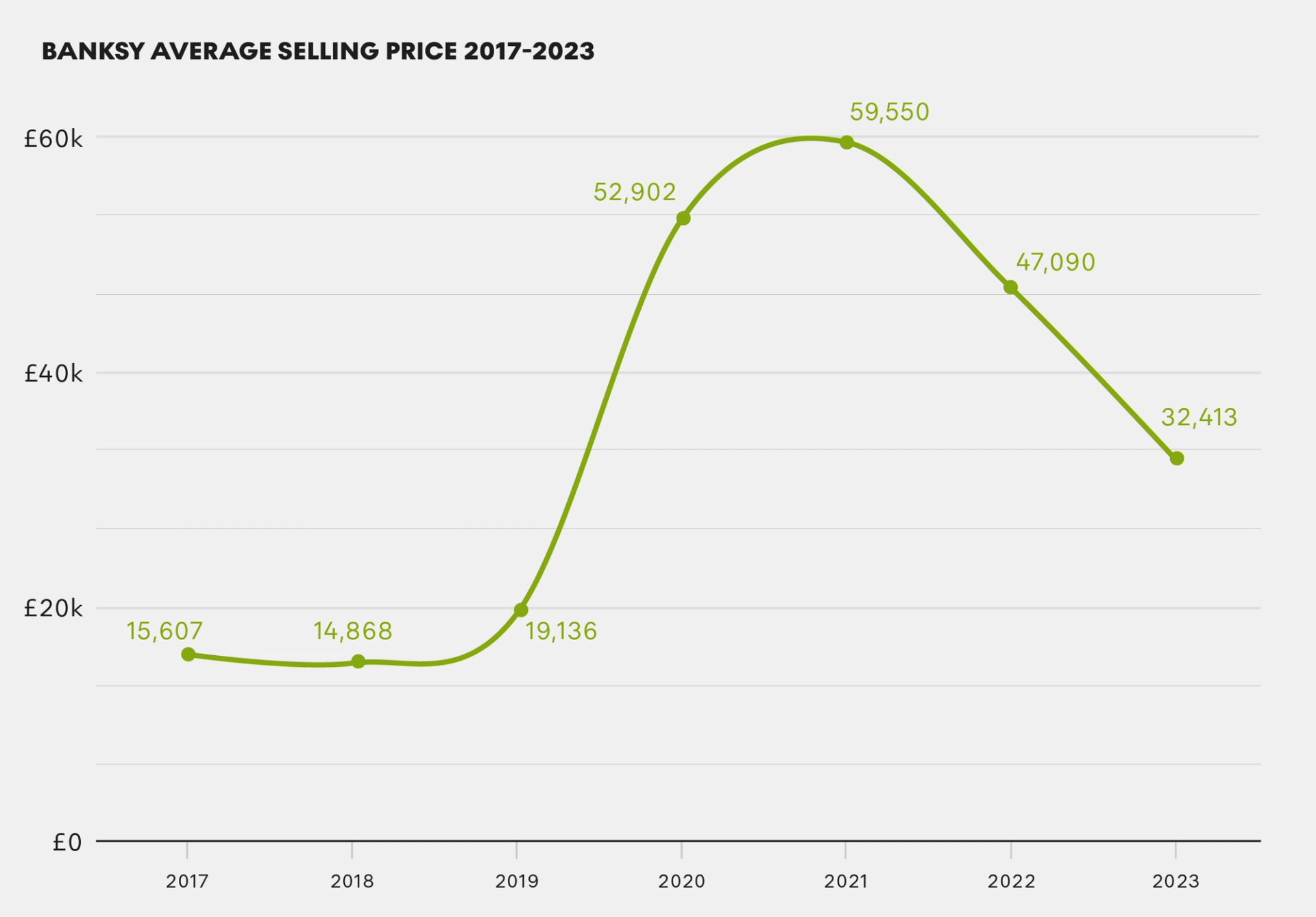

The ASP in Banksy's print market has experienced a decline since its peak in 2021, with it standing at £32,000 in 2023. This ASP remains 45% lower than the peak seen in 2021, yet it is 70% higher than the 2019 level at the beginning of Banksy's print market surge.

In the current market softening, there exists a favourable opportunity for Banksy enthusiasts and collectors to expand their collections, especially compared to the peak in 2021 when individual print ASPs exceeded £50,000.

Interestingly, Banksy's ASP over the past seven years follows a similar pattern as his print market performance in terms of sales value and lots sold. These market performance metrics tend to move in sync where changes in one metric coincide with shifts in the others. This balance demonstrates that alterations in supply and demand have a ripple effect throughout the entire market, creating a unique and interdependent system. While it may not provide specific insights, it does indicate that if there is a shift in one aspect of Banksy's print market, a similar shift can be expected in another area.

BANKSY MOST POPULAR PRINT SERIES

Banksy Trending Print Series: Sales Value x Lots Sold In 2023 © MyArtBroker 2024

Banksy Trending Print Series: Sales Value x Lots Sold In 2023 © MyArtBroker 2024Top Performing Print Works In Banksy’s 2023 Market

Banksy's portfolio encompasses numerous print series, each exhibiting varying performances in terms of 'lots sold' and 'sales value.' However, a select few manage to strike a balance between these factors. These series have achieved widespread circulation in the market while maintaining their value and appeal among collectors, even in the face of global economic factor and a market softening.

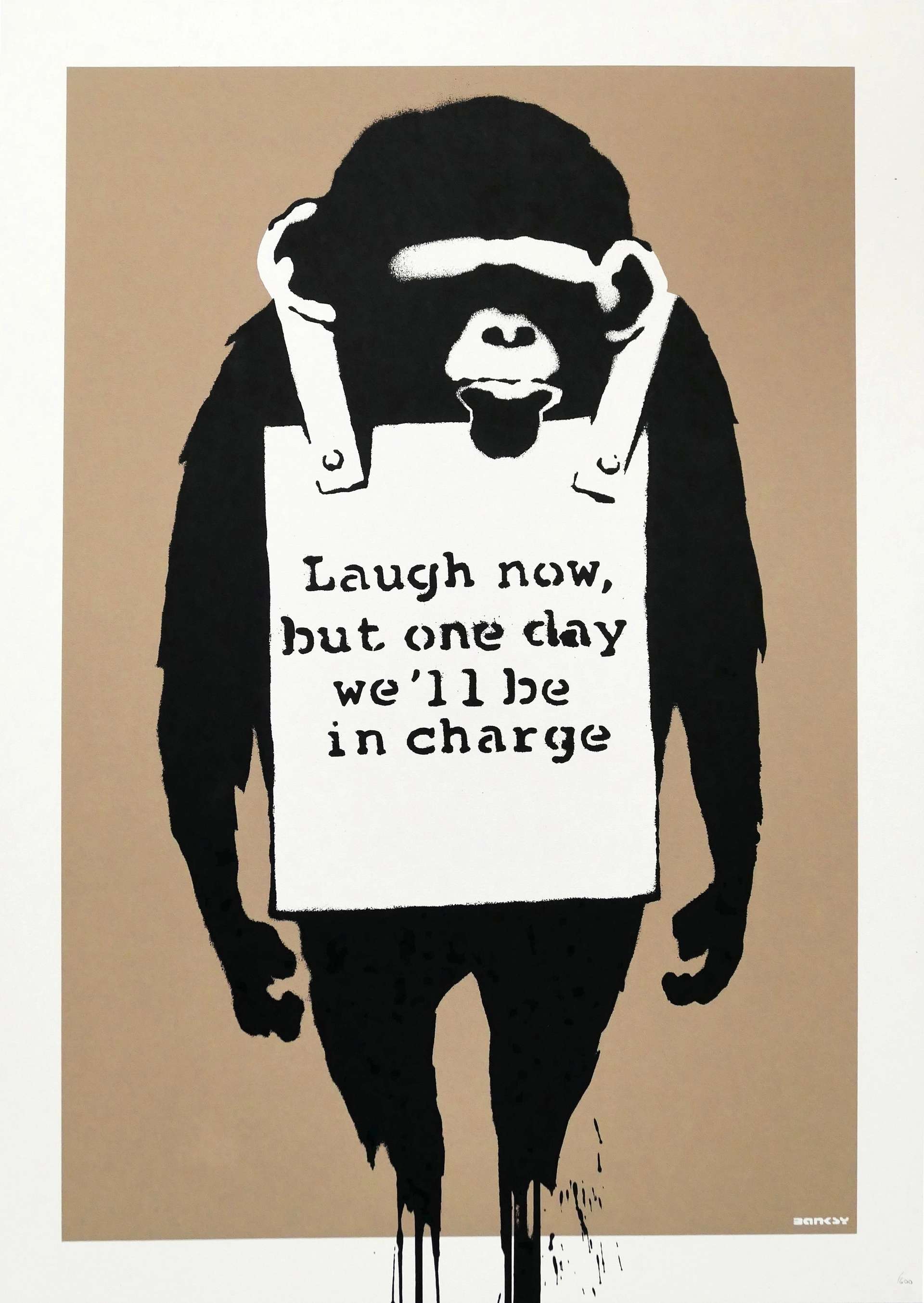

This exclusive category includes iconic series such as Girl With Balloon, Thrower, and Laugh Now, inspired by some of Banksy's most renowned street murals. These hero works consistently demonstrate strong performance in the market and maintain their value over time.

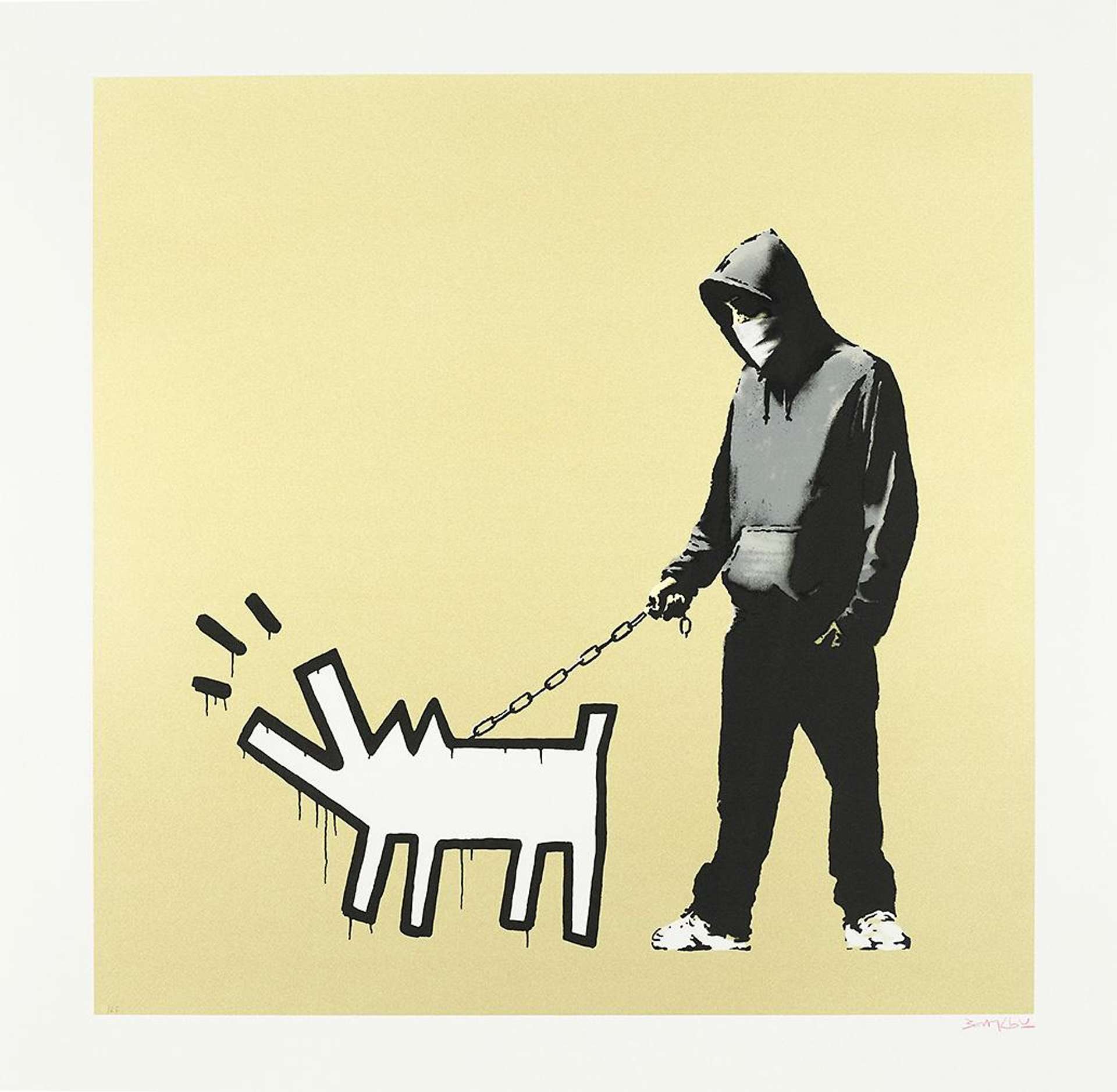

Print series including Choose Your Weapon (CYW), Nola, and Banksquiat also rank in terms of sales value. Although they may not claim the highest volume of prints sold, the elevated position of these artworks in terms of sales value highlights their rarity and exclusivity. When these pieces do enter the market, their sales value mirrors the strong demand among collectors.

Listen to MyArtBroker's, Banksy Value & Market Stories In 2023

Other sought-after Banksy print series establish their presence through 'lots sold,' extending accessibility at more affordable price points. Examples of works in Banksy's print series with wider market availability include Bomb Love, Jack & Jill, Flying Copper and Happy Choppers.

When considering a Banksy print purchase, in conversation with Charlotte Stewart, Florence astutely underscores the importance of making informed investment decisions by assessing prints that exhibit strong performance in terms of both sales value and market circulation. This coupled with buying something you love can pave the way for future resale opportunities.

Banksy Prints Signed and Unsigned

Banksy Prints Signed/Unsigned Sales Value and Lots Sold 2017 - 2023 © MyArtBroker 2024

Banksy Prints Signed/Unsigned Sales Value and Lots Sold 2017 - 2023 © MyArtBroker 2024Banksy Signed and Unsigned Print Value

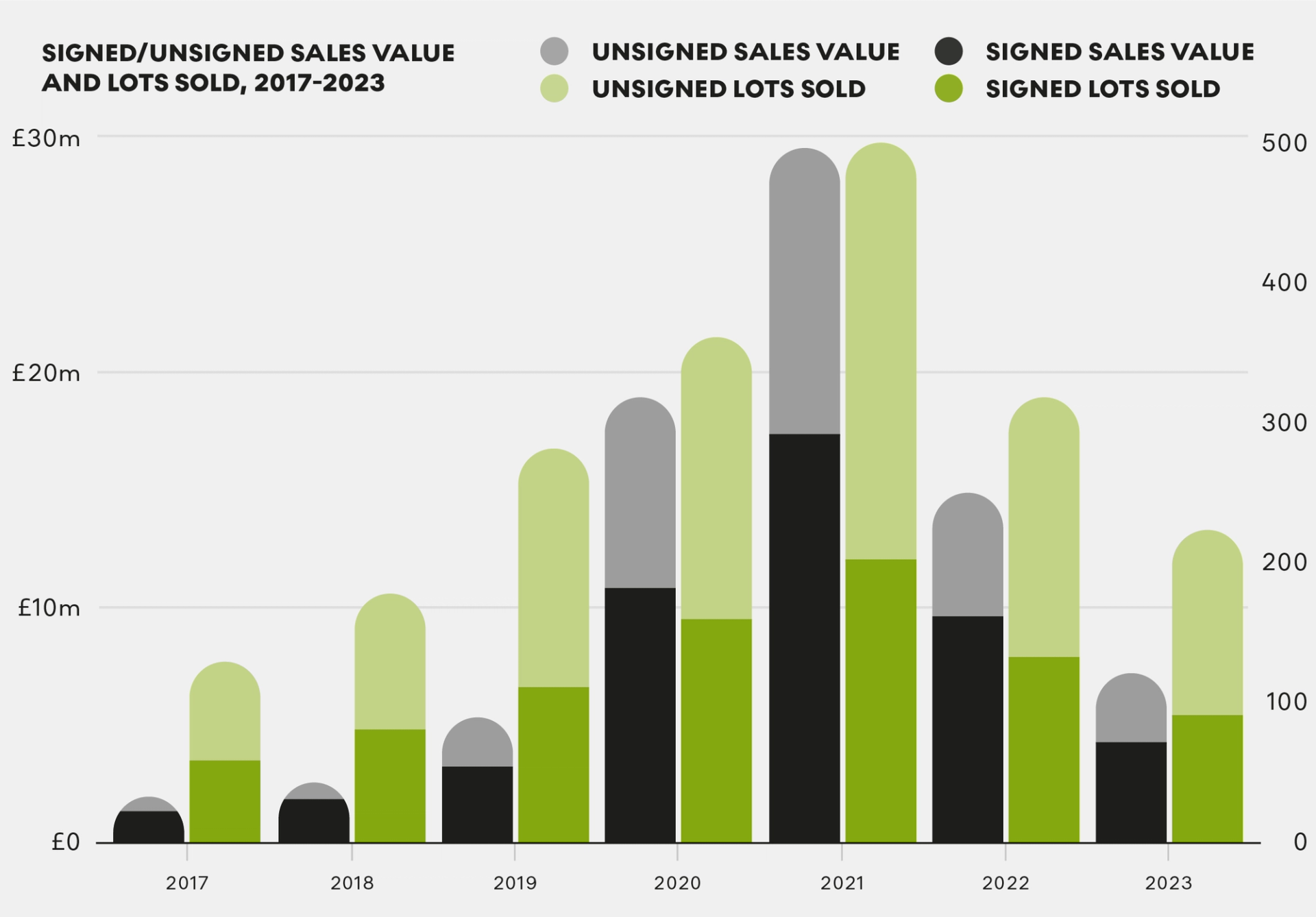

Over the past seven years, unsigned Banksy prints have consistently exceeded signed prints in terms of lots sold, while maintaining competitive sales values. During Banksy's peak years in 2020 and 2021, the sales value of unsigned prints accounted for 40% of his print market. This percentage decreased to 35% in 2022 but rebounded to 40% in 2023. Despite fluctuations, the sales value of unsigned Banksy prints remains significant, partly due to a consistent higher availability within the market.

Banksy Average Selling Price Signed/Unsigned 2017 - 2023 © MyArtBroker 2024

Banksy Average Selling Price Signed/Unsigned 2017 - 2023 © MyArtBroker 2024When examining the ASP of Banksy's signed and unsigned prints over the seven-year period, it becomes evident that prices have significantly decreased for both categories. The value of unsigned prints became inflated, just as signed prints did during Banksy's peak market years. This inflation was most noticeable in 2021, where 300 unsigned lots were sold, yet the ASP remained comparable to the previous year when only 200 unsigned lots were sold.

More recently, there has been a decline in the ASP of both signed and unsigned Banksy prints. The ASP for unsigned prints decreased by -22% from 2022 to 2023, which, although a decline, is less severe than the previous year's change of -30% from 2021 to 2022. This suggests a slowdown in the rate of decline for unsigned prints, while the decline in ASP for signed prints remains more pronounced.

When considering the purchase of a Banksy print, whether signed or unsigned, it's important to recognise that signed prints are typically regarded as the hero pieces and present less volatility for resale.

Ensuring fair market value (FMV) and maintaining transparency is crucial. Seeking guidance from experts such as Florence Whittaker from MyArtBroker and utilising cutting-edge Art Tech tools like MyArtBroker's bespoke value indicator accessible through MyPortfolio can be invaluable. Despite the current downturn in auction figures for Banksy's print market, online sales still present promising opportunities for both buyers and sellers.

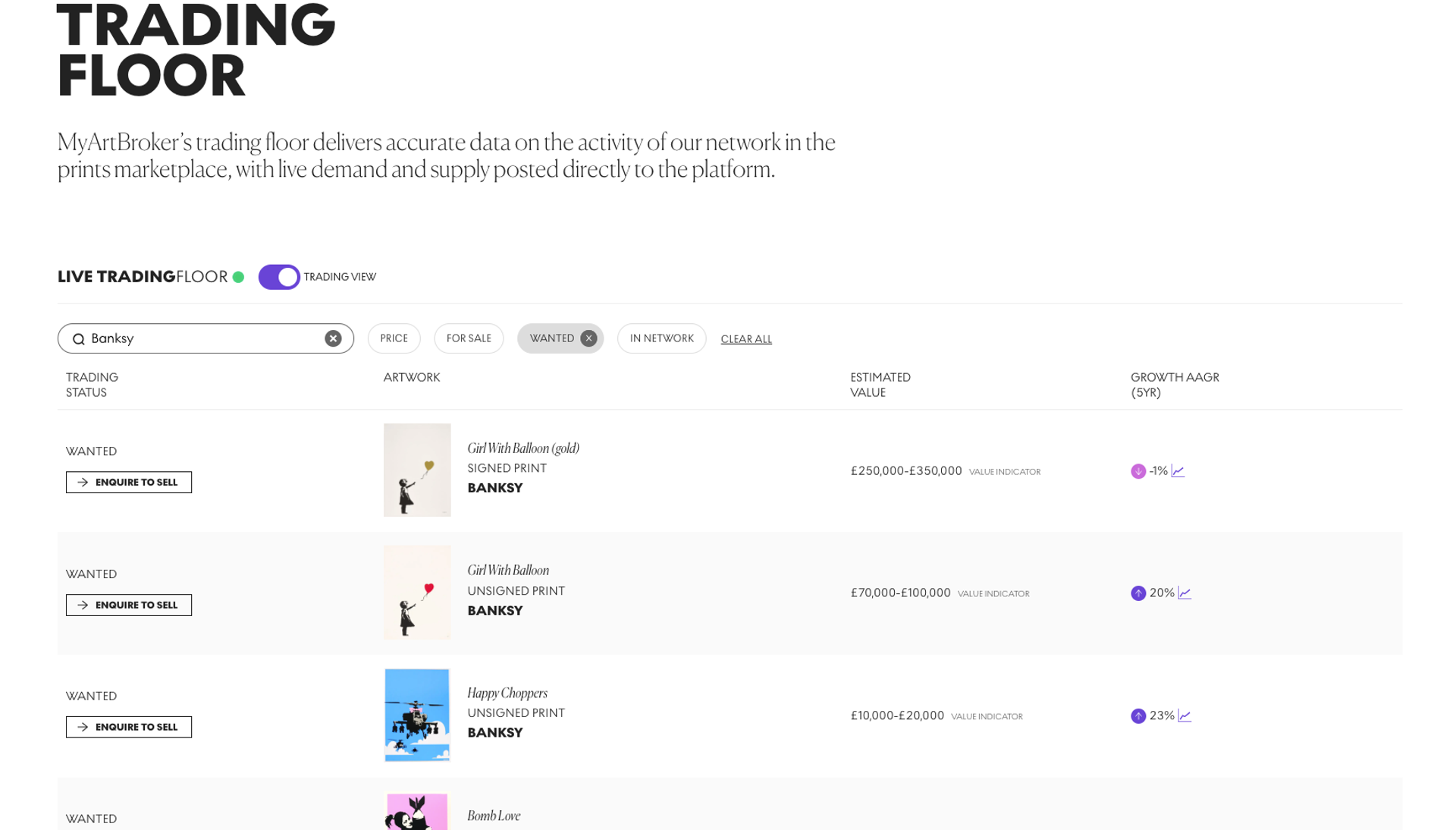

Buying With MyArtBroker's Live Trading Floor

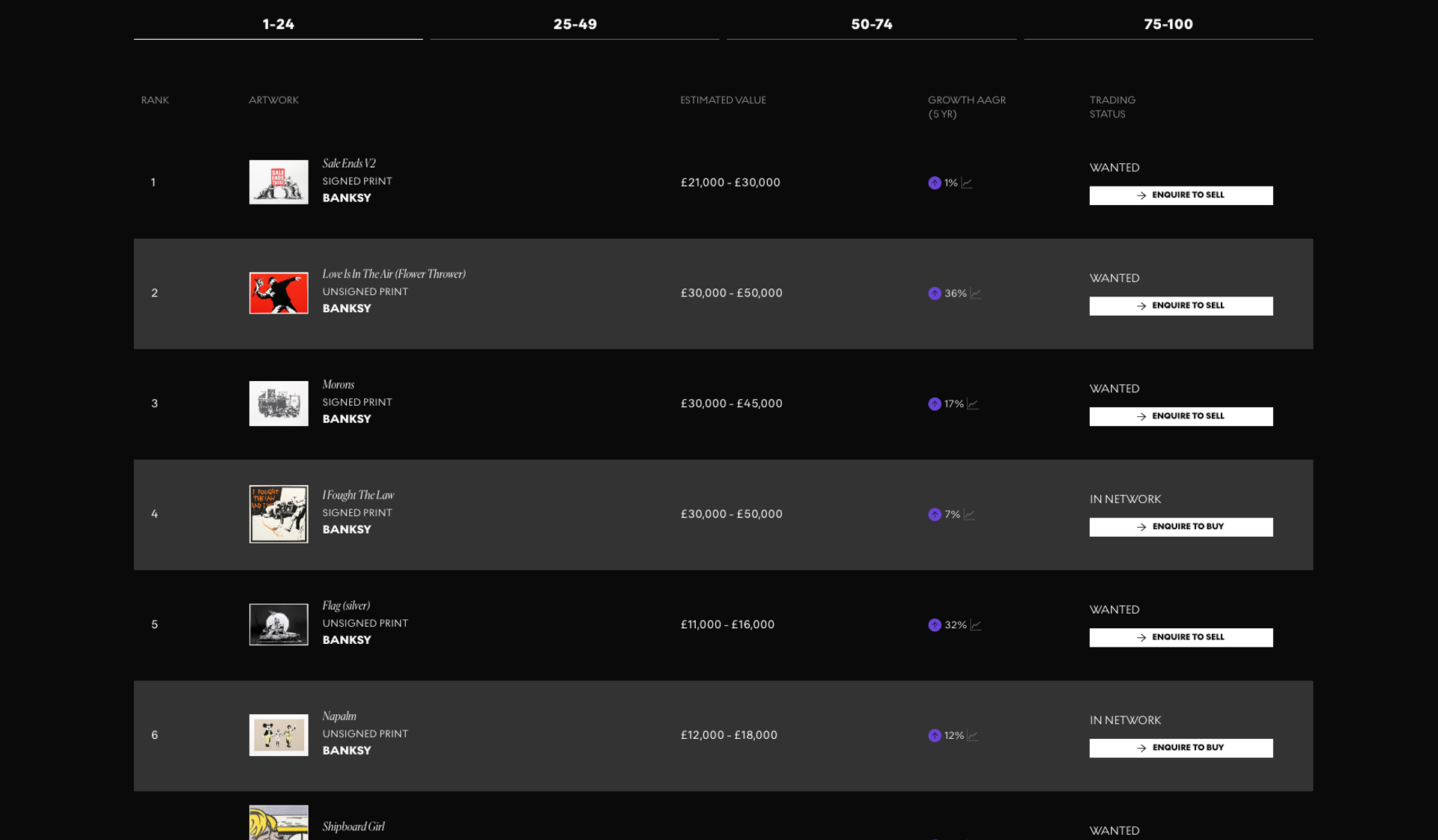

Live Trading Floor, Wanted By Banksy © MyArtBroker 2024

Live Trading Floor, Wanted By Banksy © MyArtBroker 2024The Most In-Demand Banksy Prints Within Our Network

Banksy's prints consistently generate high demand on our live trading floor. Buying or selling a Banksy print online can offer advantages over traditional auction houses for two main reasons. Firstly, it allows us to ensure FMV by avoiding the inflated or deflated values often seen in public markets. Secondly, Pest Control certificates of authentication represent the pinnacle of authenticity for Banksy prints, which alleviates the need, as seen with other blue chip works, to view in person to verify authenticity.

Hero works such as CYW, Girl With Balloon, and Love Is in The Air typically experience heightened demand on our trading floor. Rare colourways of these works, including hand-finished versions and Artist Proofs (APs), are seldom made available publicly. Florence emphasises the significance of these pieces in a podcast, “These are the iconic pieces with very limited edition numbers. These are the works we haven't really seen a significant dip in because there aren't that many, and people aren't selling them publicly very often.”

Browse Banksy prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR BANKSY PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

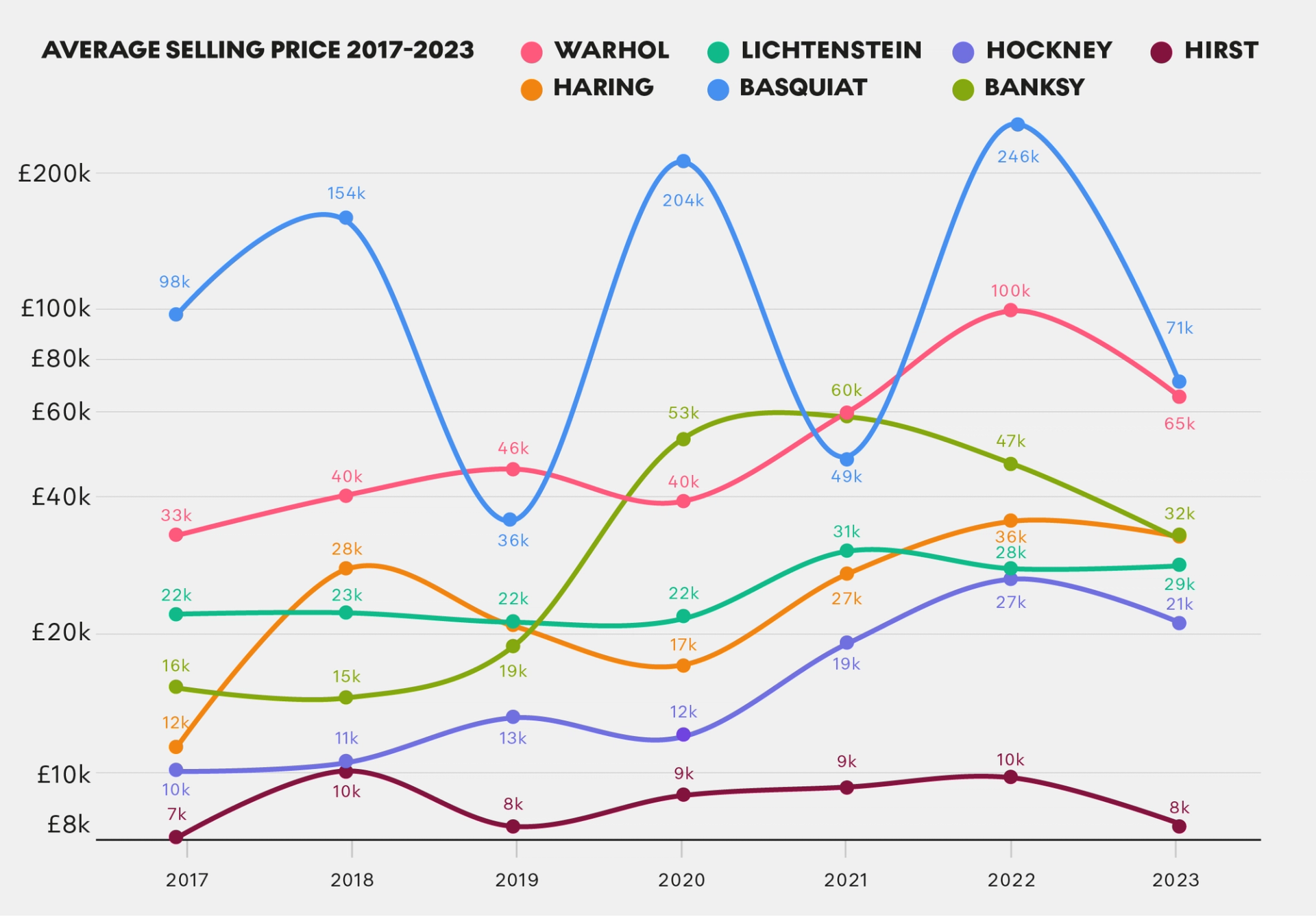

Comparative Blue Chip Market Performance 2017 - 2023

Blue Chip Artists Print Market © MyArtBroker 2024

Blue Chip Artists Print Market © MyArtBroker 2024Seven Blue Chip Artists Markets To Know

The chart above illustrates Banksy's ASP in the print market over seven years, alongside six other well-established blue chip artists known for their strong performance in prints and editions.

In 2020 and 2021, Banksy's ASP exceeded that of Andy Warhol, reaching £53,000 and £60,000. In the following years, although Banksy's ASP declined, it continues to outperform other blue chip artists such as Keith Haring and Roy Lichtenstein, both of whom had successful print market performances in 2023.

While the ASP of an artists market is largely influenced by the supply and demand for artworks in a given year, it's noteworthy that the ASP of Banksy's print market has shown consistency and limited fluctuations. This stability and limited variation indicate a degree of investment stability and the potential for a market correction, as it suggests a level of resilience and predictability in the market.

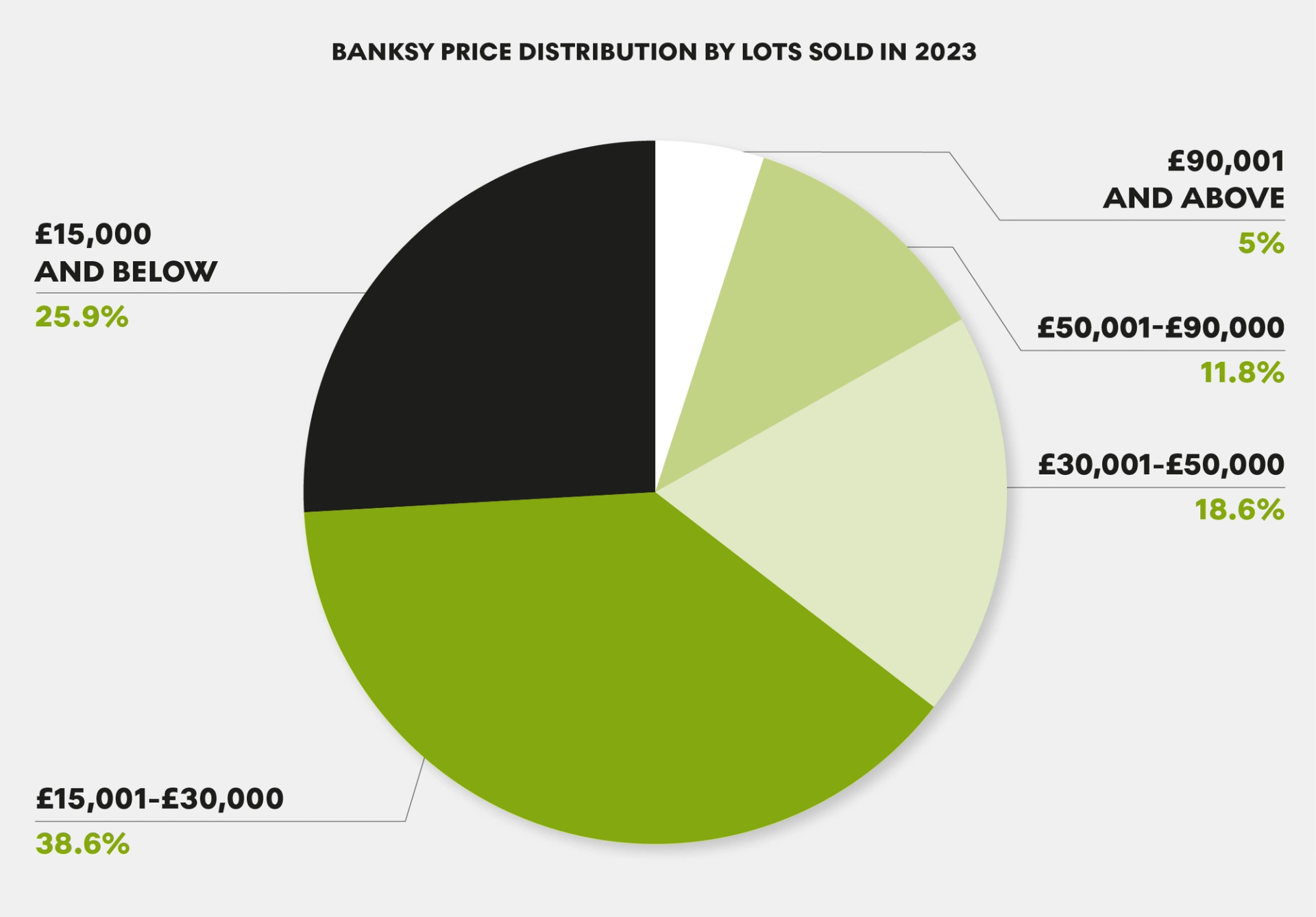

Banksy Print Market Price Distribution 2023

Banksy Price Distribution By Lots Sold © MyArtBroker 2024

Banksy Price Distribution By Lots Sold © MyArtBroker 2024 Where to Start When Looking to Buy A Banksy Print

The price distribution of Banksy's print market based on lots sold in 2023 shows that at the uppermost tier of this price range, 5% of Banksy prints were sold for over £90,000. These prints represent the pinnacle of Banksy's print market, characterised by their exclusivity and the ability to consistently command premium prices. Prints from iconic series sit within this small category, including Girl With Balloon, Thrower, CYW, and Nola. One explanation for the consistent high sales value of these prints is attributed to scarcity in the market, but also the imagery in each which offers unapologetic criticism of political and cultural issues that initially gained recognition when they were stencilled on the streets before being produced as limited edition prints.

Listen to MyArtBroker's, Banksy's Anti-War activism - Murals & Prints

Banksy prints ranging from above £50,000 to £90,000, include a variety of signed and unsigned versions belonging to series including Pulp Fiction, Laugh Now, and Barcode. These prints have consistently retained their market value, as evident from their prominent placement in our MAB100 print index.

Banksy's prints priced below £50,000 include works like Happy Choppers, Jack & Jill, and Donuts. However, the largest portion of Banksy's print market, comprising 38%, currently falls below £30,000. Buyers can discover a blend of signed and unsigned prints that offer commentary on pop culture and political perspectives, featuring artworks like Morons, Bomb Love and Flying Copper.

Banksy Print Works Below £20,000

Banksy prints priced below £20,000 constituted a significant portion, comprising 25% of his market in 2023. These more accessible prints, primarily unsigned, feature iconic pieces like Grannies, Weston Super Mare, and Have A Nice Day. Grannies stands as a pinnacle of punk works, initially released as part of Banksy's Barely Legal exhibition in Los Angeles, where only 100 signed copies were made available. However, unsigned copies still possess value and authenticity, offering more budget-friendly alternatives. These prints not only provide an entry point for newcomers to the art market but also present an opportunity for seasoned collectors looking to diversify their portfolios.

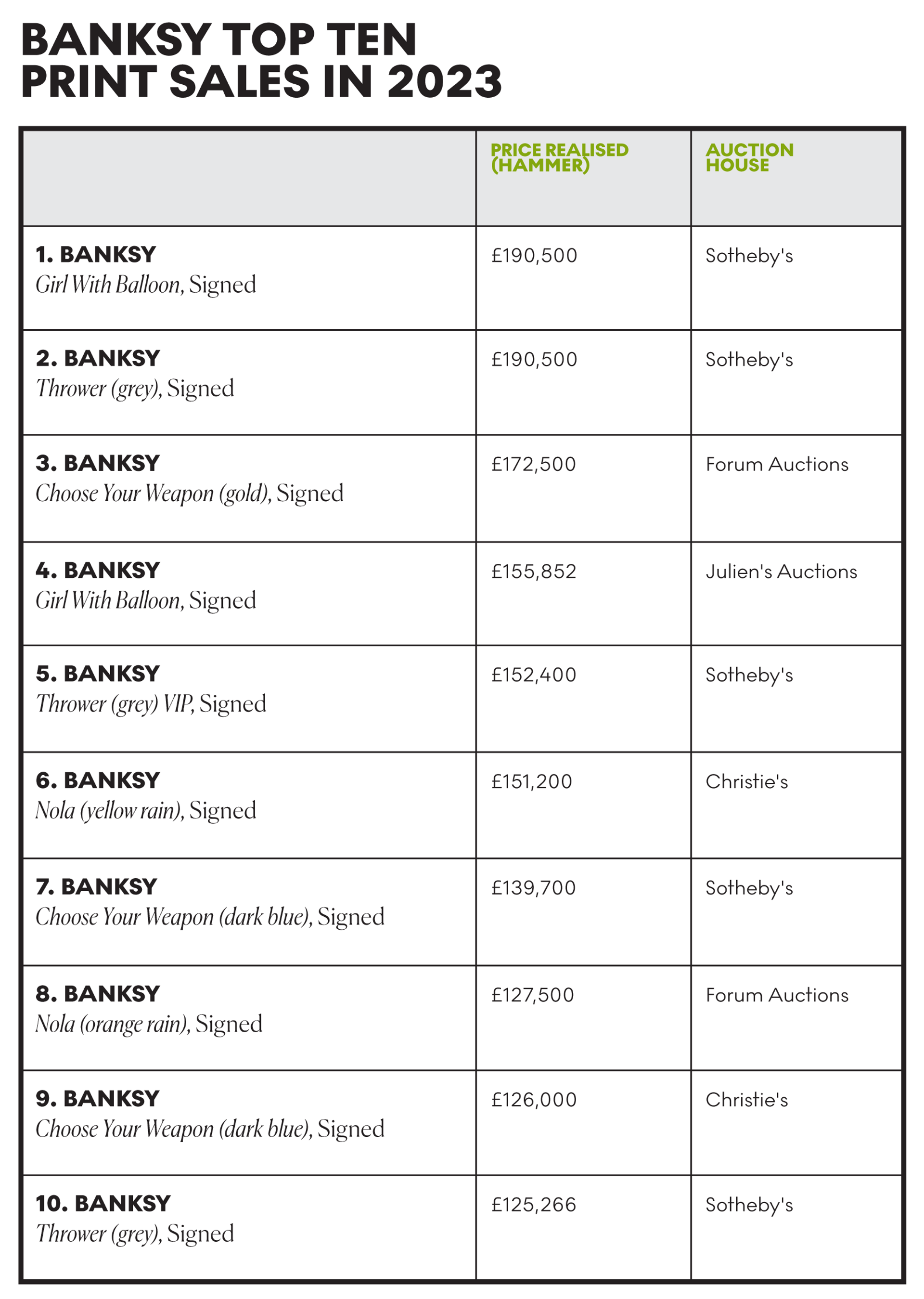

Banksy Top Ten Print Sales In 2023 © MyArtBroker 2024

Banksy Top Ten Print Sales In 2023 © MyArtBroker 2024 The Most In-Demand Banksy Prints from Investors

In Banksy's print market its commonly seen that the prints in highest demand often have their roots in a cascade effect that typically starts with the auction of the original work. The most prominent example of this was the infamous shredding of Girl with Balloon at Sotheby's in 2018 and its subsequent resale in 2021. In 2023, Girl with Balloon prints performed as Banksy's top-selling works in signed and unsigned versions.

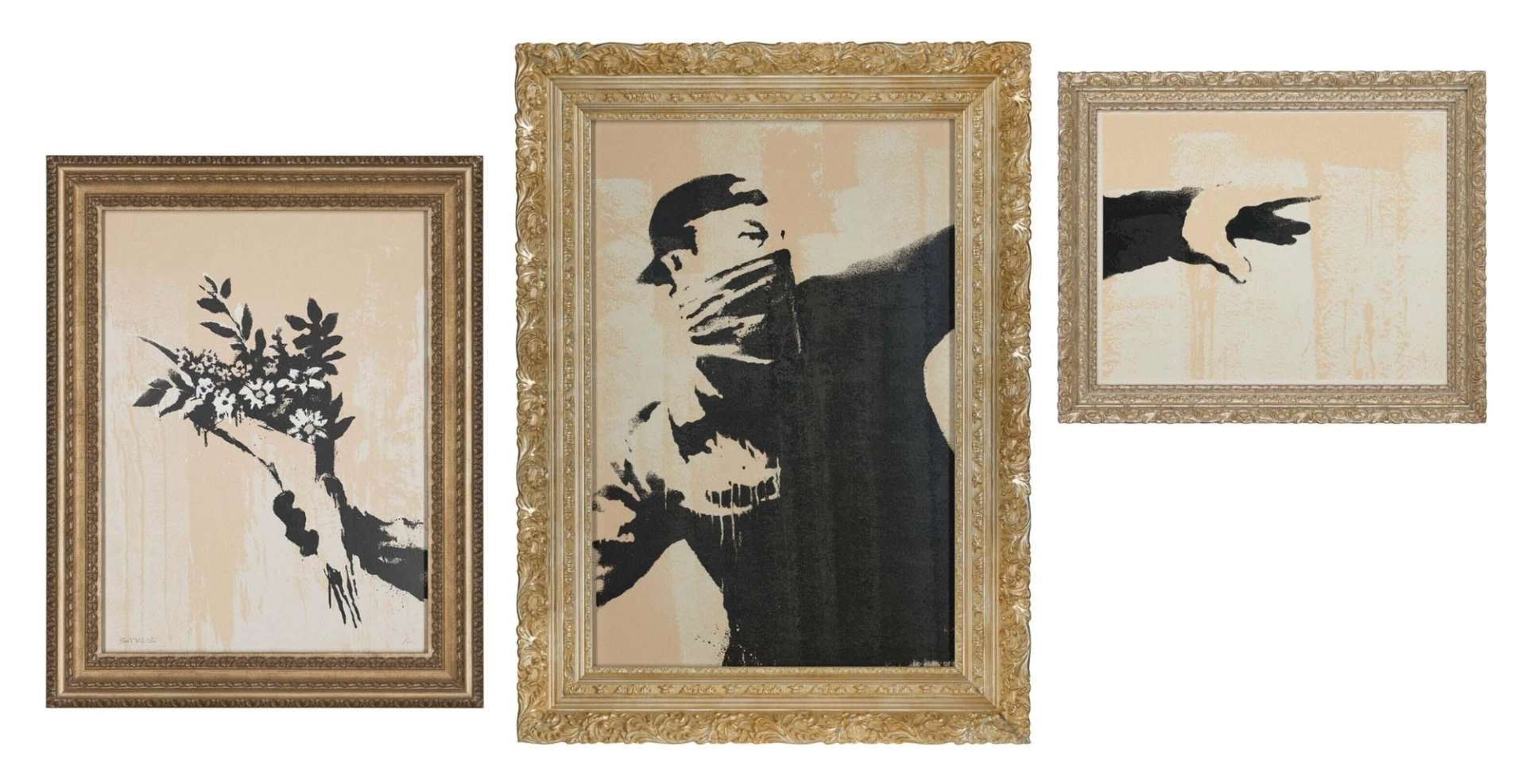

Other prints that perform favourably in the market are those that carry political undertones. For example, Thrower originally appeared on the wall in Jerusalem shortly after the construction of the West Bank Wall. This limited edition series is one of Banksy's most well-known and its anti-war message has made it a popular choice for investors.

In addition to well-known pieces, lesser-known hand-finished prints also carry their unique appeal. Florence discusses the relevance of Banksy's Dumbo in a podcast and how this print has never appeared on the public market and was only available to exclusive private collectors. Part of a small edition series of 25, this print features hand-finished watercolour elements, making it exceptionally rare and unique. A unique hand-finished print also belongs to Banksy's CYW series where the dogs eyes are spray painted in red against a white background. These unique prints hold higher value in the market and provide valuable insights into market trends for regular editions.

LOOKING TO SELL YOUR BANKSY PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

Banksy MAB 100 © MyArtBroker 2024

Banksy MAB 100 © MyArtBroker 2024Liquidity Of Banksy’s Artwork

In the art market, 'liquid' typically refers to artworks that can be easily and quickly bought or sold without significantly impacting their market value. The highest level of liquidity often results from strong demand and a wide base of collectors. Banksy's market success and wide pool of buyer's was built of his distinctive voice that speaks through the political imagery of his prints and underlying themes of freedom and hope which speak to universal appeal.

Although, political messaging, while impactful, can have drawbacks by narrowing the pool of potential buyers and affecting liquidity. For example, Banksy's provocative pieces like Napalm, which reinterprets Nick Ut's The Terrors of War photograph, or Banksy's Placard Rats, symbolic to society's vermin. Although important and rare works to the market, these may present a more limited pool of buyers. However, the art market remains dynamic, and the scarcity of these prints contributes to their exclusivity, ultimately expanding Banksy's market presence.

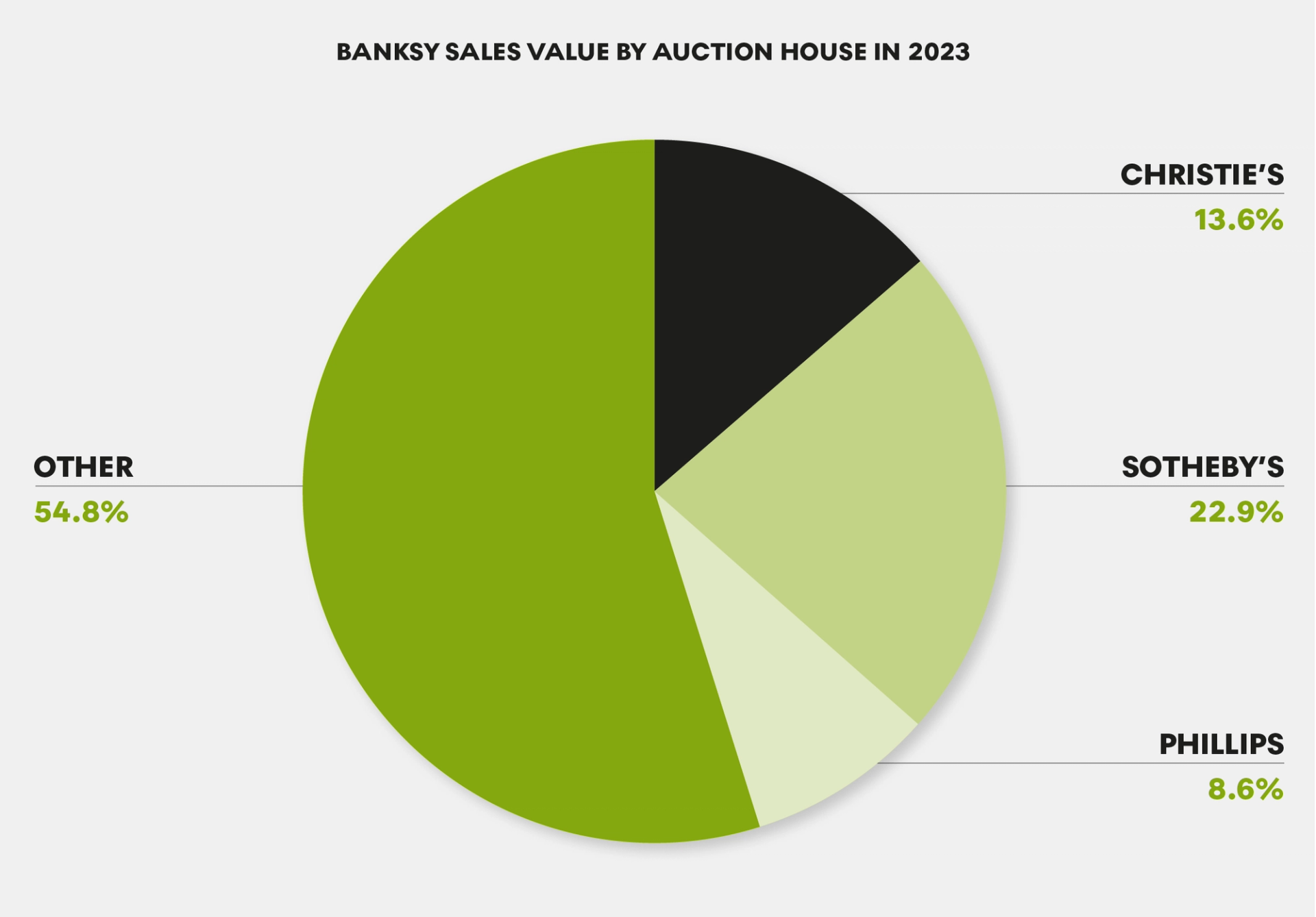

Banksy Sales Value By Auction House In 2023 © MyArtBroker 2024

Banksy Sales Value By Auction House In 2023 © MyArtBroker 2024Recent Market Performance and Current Opportunities

A key consideration when assessing investment opportunities is the market's breadth whereas a wider market has the potential to attract more buyers when it's time to sell. The Major auction houses–Christie's, Sotheby's and Phillips–accounted for less than half of Banksy's print sales value in 2023 demonstrating the extent of market opportunities for buying and selling Banksy prints.

What Makes a Banksy Print Desirable?

Since Banksy prints were initially released for mere hundreds of dollars and now command thousands, the condition of these print works can vary. When considering investments in the Banksy print market, the condition is a crucial factor. Given the prevalence of replicas and counterfeit works in Banksy's market, obtaining a certificate of authenticity from Pest Control is the only way to successfully sell a Banksy print on the market.

The appeal of Banksy print works lies in their unique blend of cultural relevance and exclusivity. Banksy's artistic journey began on the streets with stencilled imagery presented as a commentary on cultural shifts and social injustices. These thought-provoking visuals make his works both poignant and relevant. Banksy's adeptness at leveraging artworks to shed light on contentious issues elevates the artist to the ranks of modern art masters, seamlessly melding urban and street art into art history.

BANKSY'S MOST INVESTABLE PRINTS

SIGNED BANKSY PRINTS

Thrower (Grey) - Signed

In 2019, Banksy released the Thrower (Grey) (2019) triptych, featuring his iconic, bandana wearing street bandit, poised to throw a bomb, transformed by Banksy into throwing a bouquet of flowers instead. This print is an evolution of his renowned street art piece, Love Is In The Air (Flower Thrower) (2003), originally created in response to the West Bank Wall construction, a highly controversial and contested structure, separating parts of Israel and the West Bank. Its relevance recently heightened, this work sold for £190,500 (with fees) in April, making it Banksy's top-selling print for 2023. We'll continue to monitor its value and potential appearances in 2024.

Girl With Balloon

Girl With Balloon is not only an image quintessential to Banksy's oeuvre, but one which has an enduring reputation for drama. In 2018, Banksy staged one of his most unforgettable public spectacles with this work, shredding it immediately after the hammer finalised its sale for £1,042,000 at Sotheby's. This shocking stunt has only served to make this work even more desirable, making it one of the artist's most sought-after prints. Such is the popularity of the work that the signed edition of Girl With Balloon has grown in value by approx. 380% since 2017.

Choose Your Weapon (gold)

Choose Your Weapon (CYW) (2010), an iconic and exceptionally rare print, was initially released in 15 distinct colourways, with 14 editions limited to just 25 prints each. Among these, unique colourways including lemon, dark blue, turquoise, and fluoro green are particularly sought after, often fetching the highest prices. The Gold, White, and Silver colourways represent VIP editions, exclusively released to collectors and never made available to the public for direct purchase. Initial secondary market sales of these editions barely exceeded £10,000 (including fees). Currently, these prints consistently sell for well over £100,000, with the highest recorded purchase exceeding £300,000. CYW (Gold) sold for £172,500 (with fees) in February, positioning third in Banksy's top-selling works.

Thrower Grey (VIP)

Thrower (Grey) VIP (2019) secured the fifth position among Banksy's top-selling prints in 2023, fetching £152,400 (with fees) in March. This artwork portrays the same figure in a backward baseball cap and a bandana, tossing a bouquet of flowers. The signed VIP edition, limited to 300, is split into three gold-framed panels. Remarkably rare in the market, this sale marked only its fourth appearance. The hammer price for this work has fluctuated, reaching up to £160,000. We will be closely observing its resurgence in 2024.

Nola (yellow rain)

Utilising his platform to convey crucial political messages, the Nola prints commemorate the 2005 Hurricane Katrina in the United States. They feature a young girl holding an umbrella, symbolising the inadequate response of New Orleans’ authorities to shelter vulnerable people during the hurricane aftermath. Originally a graffiti stencil in 2008 in New Orleans, Louisiana, the work was later turned into a screenprint, available in various colourways and edition numbers. Nola (yellow rain) (2008) is a signed edition of 31, a rare colour variant in the market. This piece was sold for £151,200 (with fees) in March, marking its first appearance since 2021 and securing the sixth position in Banksy's top-selling signed prints for 2023.

UNSIGNED BANKSY PRINTS

Girl With Balloon (unsigned)

In 2023, Banksy's unsigned edition of Girl With Balloon demonstrated remarkable performances in 2023, achieving eleven successful sales. The highest recorded sale reached £155,852 with fees at Julien's Auctions in the United States. In recent years, unsigned Banksy prints consistently delivered competitive performances. The image of a young girl reaching for a red heart-shaped balloon holds significant importance in Banksy's body of work, symbolising universal aspirations for peace and freedom making it an incredibly lucrative print.

Laugh Now (unsigned)

Similar to the rat and the young girl reaching for the balloon, the chimpanzee holds a significant place in Banksy's iconic imagery. In Laugh Now, we encounter a despondent-looking chimp trudging forward, burdened by a sandwich board displaying the titular words, ‘Laugh Now, but one day we'll be in charge’. Banksy further explores this theme in the Keep It Real series. As with many of Banksy's pieces featuring animals, Laugh Now symbolises the marginalised individuals in society who may eventually assert themselves. This depiction of sardonic rebellion has consistently garnered attention since 2017 and continued to do so in 2023. In 2023, six unsigned works entered the public market, with the highest fetching £75,600 at Phillips in January.

Love is In The Air (Flower Thrower) (unsigned)

One of the most notable characteristics of Banksy's print market is the unparalleled uniqueness and iconic nature of each image he produces. The masked figure wearing a backward cap in Love is In The Air (Flower Thrower) embodies contemporary culture, resembling a graffiti artist-perhaps Banksy?. This figure symbolically hurls a bouquet of flowers as if it were a grenade. Originally appearing on the West Bank Wall in Jerusalem, separating Palestine from Israel, this work has gained immense popularity. Amidst escalating conflict in the region, its relevance and poignancy have only intensified, contributing to its status as one of Banksy's most sought-after prints in 2023. An unsigned version of this print fetched £58,695, including fees, in Switzerland.

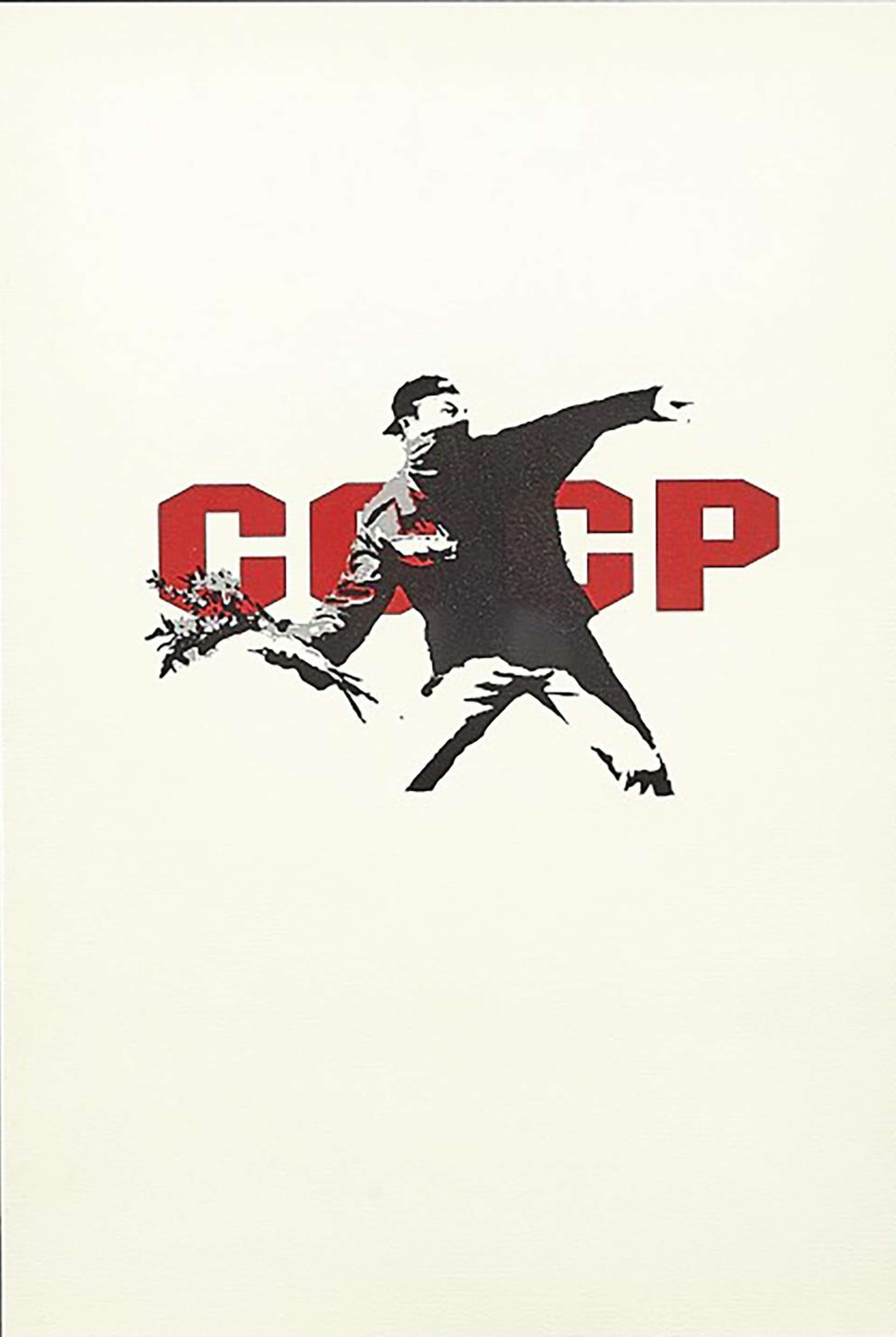

CCCP

In 2023, Banksy's CCCP (unsigned) print made a rare appearance on the public market, marking its first since 2020 and only the second overall. What sets this print apart is its absence of signature and edition number, leaving its actual size unknown. Featuring the stencilled flower thrower over red spray-painted block letters CCCP, this early Banksy print fetched £53,340, including fees, at Phillips in 2023.

Pulp Fiction (unsigned)

Described by Florence Whittaker as offering a unique perspective on the intersection of film and art, Banksy's Pulp Fiction appeals to both Tarantino aficionados and Banksy devotees. The unsigned version of this print made five auction appearances in 2023, with the high sale price of £38,100 with fees.

Listen to MyArtBroker's Banksy: Pulp Fiction - MyArtBroker Invests