The Rise of Alternative Art Markets

Pop Shop VI, Plate II © Keith Haring 1989

Pop Shop VI, Plate II © Keith Haring 1989Market Reports

The art world has long been dominated by prestigious galleries, renowned auction houses, and the elite. However, in recent years, the rise of alternative art markets has presented new opportunities for investors, collectors, and enthusiasts. As niche markets and emerging art scenes help democratise the art world, they offer access to diverse and unique works, support local artists and communities, and facilitate investment opportunities. In investigating the latest trends in alternative art markets and highlights the benefits, challenges, and risks associated with investing in these emerging spaces.

Exploring Alternative Art Markets

Alternative art markets such as online platforms, independent art fairs and local art communities provide unprecedented access to art, allowing collectors and investors to explore lesser-known artists and styles. These markets popularise a wide range of collectible art, including digital art, street art, artisan crafts, and outsider art, catering to various tastes and preferences. Digital Art and NFTs, for example, have revolutionised the market, providing a platform for artists to showcase and sell their work. NFTs provide access to unique, limited-edition pieces that can be easily bought and sold through online marketplaces. This trend has opened up a whole new world of possibilities for artists and collectors alike, facilitating the growth of alternative art scenes.

Online art platforms play a crucial role in democratising the buying process, providing a less intimidating experience and making it more accessible to a wider audience. They allow prospective buyers to browse, discover and purchase art from around the world without the need for physical attendance. This has led to the growth of a more diverse and global collector base. Alternative art fairs have also become increasingly popular in recent years in response to the growing demand for more accessible, diverse, and innovative art experiences. These fairs deviate from the traditional model by focusing on emerging artists, prioritising inclusivity, affordability, and a sense of community.

Niche Art Markets: Opportunities for Collectors

Niche art markets, such as those focused on outsider art or artisan crafts, offer collectors a chance to invest in unique and underrepresented works that may not be featured in mainstream galleries or exhibitions. These often highlight the diversity and richness of local and global art communities, presenting exciting acquisition opportunities for discerning collectors and broadening aesthetic horizons, allowing for the discovery of new artistic styles, techniques and subjects.

By investing in alternative art markets, collectors can also contribute to the growth and sustainability of local art scenes. This support provides emerging artists with the resources and recognition needed to develop their careers and positively impact their communities, while offering untapped investment potential for buyers willing to do research and take risks. While investing in these markets can be challenging and unpredictable, it also presents an opportunity for significant financial returns if an artist or artwork gains prominence. As usual with collecting, the most important part is how a buyer feels about the piece and whether they connect with it or if it fills a gap in their collection – the variety of the art available in niche art markets ensures there will be something for everyone.

Emerging Art Scenes: A Look at Local Communities

The rise of emerging art scenes around the world has led to a greater focus on local art communities, showcasing the talent and creativity of artists who may not have previously had the opportunity to gain international recognition. Independent art fairs, art exhibitions, and art shows offer a platform for these artists to share their work with a broader audience, while simultaneously enriching the global art landscape. This is especially true in regards to artists who hail from countries without an established art market, who now have an opportunity to advertise and promote their work around the world.

Similarly, traditional crafts and folk art have found new audiences in the global market as people seek out unique, handmade pieces that embody the heritage and history of a region, or provide a tangible connection to the past and a glimpse into the lives of those who create them. The outsider art market, which focuses on self-taught and non-traditional artists, has gained momentum as collectors seek out unconventional works that defy established norms. This niche market offers an opportunity to discover raw, uninhibited talent and invest in artists who may be overlooked by the mainstream art world.

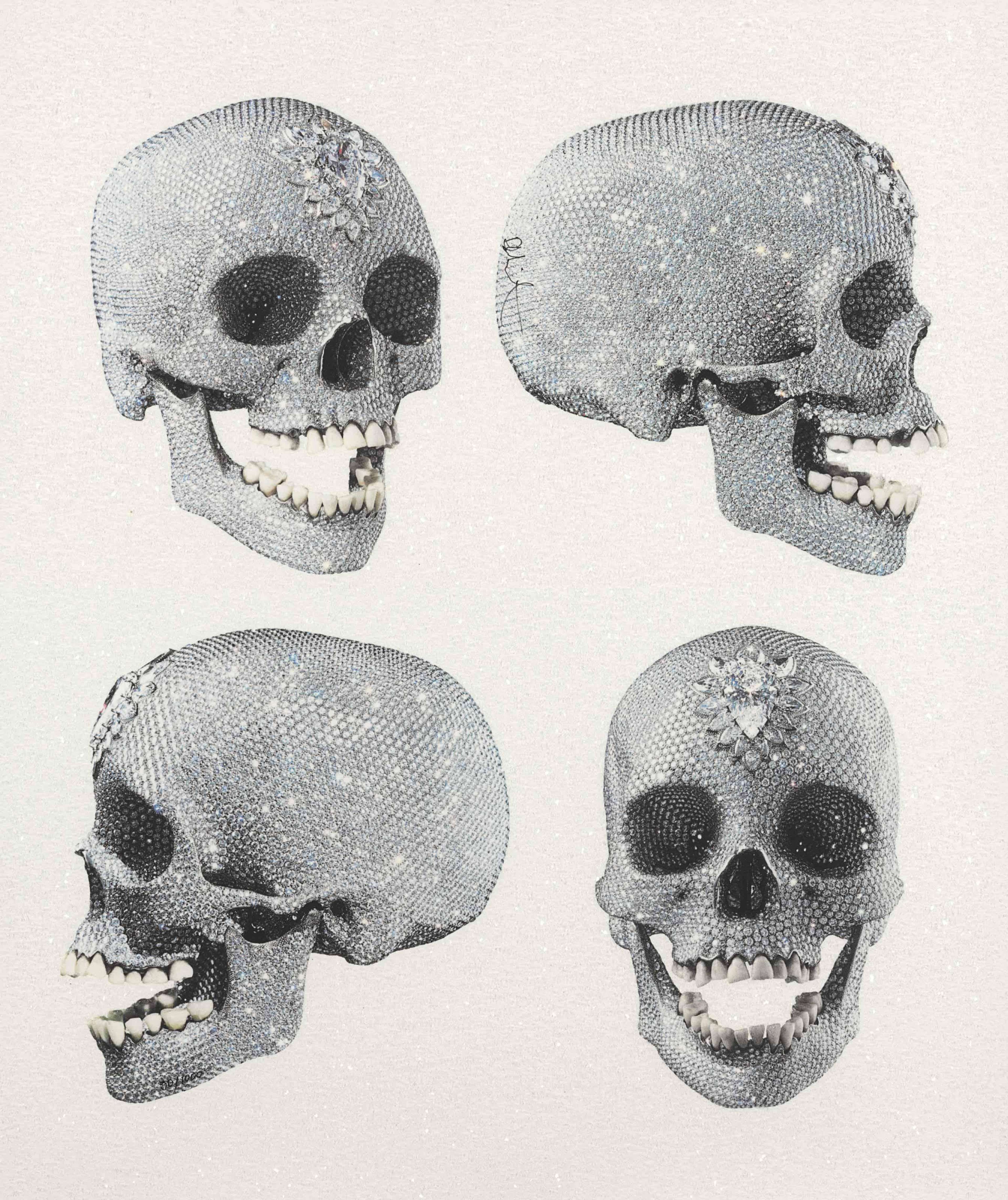

Thanks to the popularity of artists such as Banksy, street art and murals have experienced a resurgence as urban environments increasingly embrace this vibrant form of artistic expression. Public art displays often reflect the culture and values of a community, making them an attractive investment for those looking to support local artists and initiatives. They also provide artists with a unique spotlight, allowing them to engage with an audience that may not be generally interested in art.

Collectible Art: Investing in the Future of Art Markets

Collectible art includes paintings, sculptures, limited edition prints, and other forms of visual art that are considered valuable either due to the reputation of the artist, their historical significance, rarity, or innovative artistic expression. Collectible art is not confined to traditional or mainstream art forms; it also embraces emerging and unconventional art, or even objects. It is an increasingly attractive investment option within the alternative markets; art finance and collecting trends suggest that collectors and investors are seeking new opportunities to diversify their portfolios and support emerging talent. By investing in collectible art from alternative markets, individuals can potentially unlock significant value and contribute to the growth and development of new artistic landscapes.

Moreover, such investments offer a dual advantage: potential financial gain and cultural enrichment. As these emerging artists gain recognition and their work appreciates in value, investors find themselves at the forefront of a new wave of artistry that is redefining the traditional art market. Collectible art from alternative markets is increasingly viewed as a tangible asset that holds emotional and aesthetic value, alongside its financial worth. As the world continues to evolve, these investments become pivotal in shaping the future of art markets.

Challenges and Risks of Investing in Alternative Art Markets

Like most investments, the alternative art market is not without its risks and challenges. Art valuation and appraisal can be complex and subjective, with limited historical data and fluctuating demand making it difficult to determine a fair market value and assess potential returns. Authenticity concerns can also make navigating these markets uncertain. Since alternative art markets often operate outside of traditional channels, there is an increased risk of encountering forgeries, reproductions, and fraudulent practices. Working with a trusted professional and ensuring the authenticity of a piece is crucial for maintaining the value and integrity of an investment.

Additionally, the lack of liquidity in alternative art markets can result in longer holding periods and increased risks associated with market fluctuations and changes in artistic trends, while limited market visibility can impact the ease of buying and selling artworks. However, for those willing to navigate these challenges, alternative art markets offer unique opportunities for art collecting strategies and long-term investments.

The Future of Art Markets

The rise of alternative art markets presents an exciting opportunity for art investors, collectors, and enthusiasts to explore and invest in emerging art scenes outside of conventional galleries and exhibitions. As collectors and investors continue to explore these new avenues, online art market platforms, art startups, and independent art fairs will likely play an increasingly important role in shaping the future of art dealing and art sales. While these markets offer access to diverse and unique artworks, support for local artists and communities, and potential investment opportunities, they also come with their own set of challenges and risks. By understanding the complexities of alternative art markets and navigating the associated risks, investors and collectors can potentially unlock significant value and contribute to the growth and development of new artistic landscapes.

The emergence of alternative markets signals a shift in the global art market landscape. By embracing these changes and supporting the diversity and creativity of artists worldwide, collectors and investors can help usher in a new era of art market growth and innovation.