Dog © Keith Haring 1986

Dog © Keith Haring 1986 Market Reports

In the interim between the May New York auctions and the close of June, Phillips customarily hosts an Evening & Day Editions event, showcasing pieces from highly coveted blue chip artists. Notably, Keith Haring stole the spotlight, while Andy Warhol made a significant presence in terms of volume. Other discernible trends emerged, such as an increasing appetite for Jean-Michel Basquiat's posthumous prints, along with the prominence of rare print works by Roy Lichtenstein and Bridget Riley, setting a defining tone for the sale.

Looking back at the same event, Phillips' June Evening & Day Editions sale has consistently performed well since 2017, often exceeding presale estimates by 15-30%. This sale was no excpetion, with the final hammer reulting in £2.7 million, performing 13% above the low presale estimate. With the inherent nature of prints and editions, we anticipate the setting of numerous new auction records within these sales.

This year saw several new auction records, along with the surprising inclusion of rarer, lesser known works by American Pop and Contemporary artists in place of the trophy works that permeated the prints and editions sales in 2023. Other trends noticed was impressive performances from Banksy prints now that the Banksy market has returned to sustainable and healthy levels. Also, while there was a Lithographic pool piece that performed favourably by David Hockney, there was a notable absence of other Hockney works that we are used to seeing in more substantial volume.

Compared to the previous year, the sale witnessed an 8% surge in total hammer prices, buoyed by a slight uptick in lot count and ambitious presale estimates. Within the sale room, robust bidding activity across various channels propelled final selling prices of a fresh array of prints, diverging from the usual offerings. However, reflecting on the past five years of the same sale, the pinnacle was reached in 2022, with sales hitting £4.1 million. The subdued figures hint at a departure from conventional auction approaches, as sellers increasingly explore private sales, which are particularly advantageous given the current softening market.

Here are the highlights:

Trophy Lots

Keith Haring and Andy Warhol

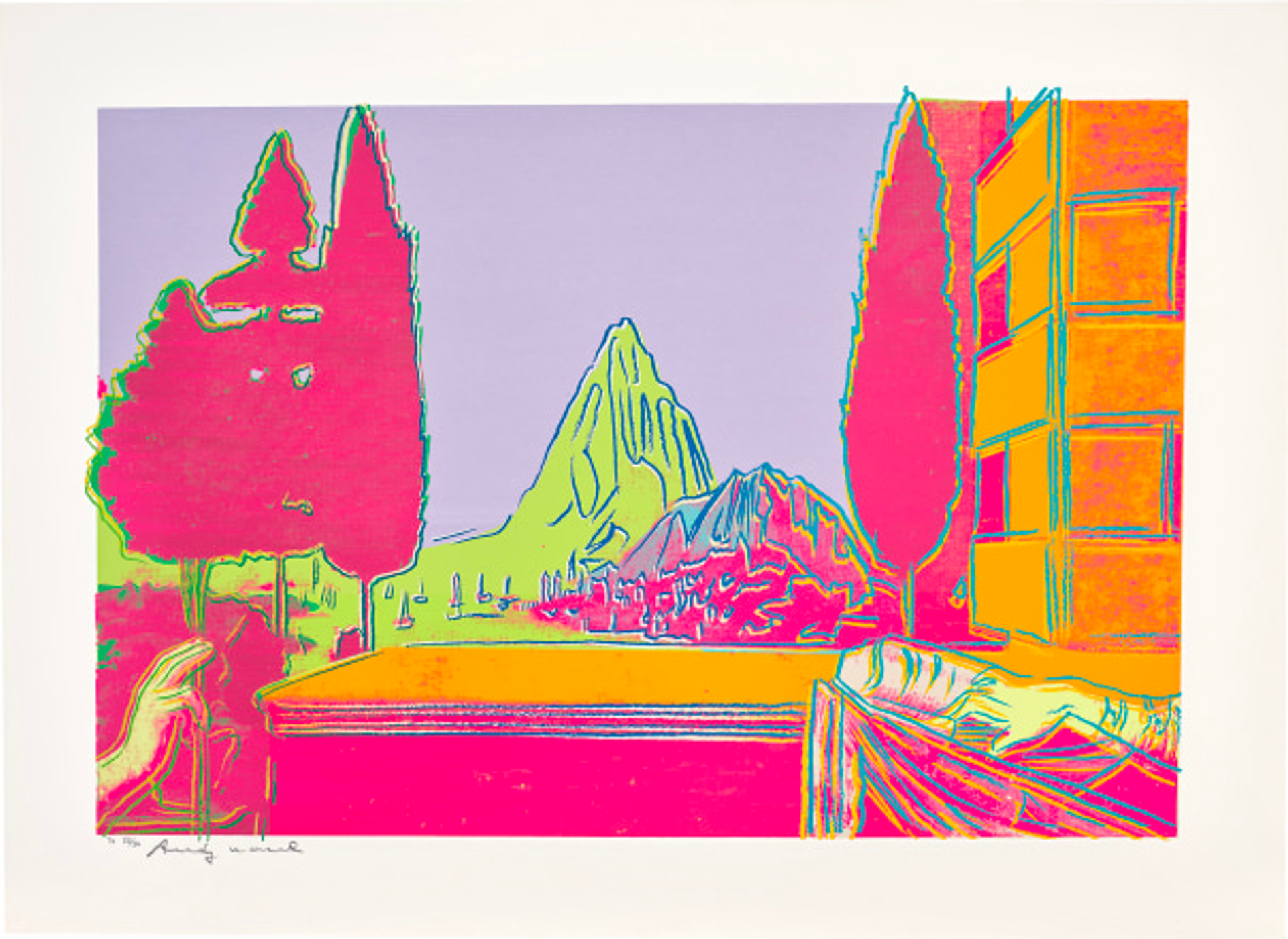

Out of the 323 lots featured across the two-part sale, only two carried a presale estimate above the £100,000 mark: Haring's Dog and Warhol's Queen Elizabeth II. Haring's yellow cutout Dog (1986) is a unique trial proof (TP), part of a small edition of 25 produced in various colours. Fetching an impressive £355,600, this yellow multiple emerged as the star lot of the sale and the only Haring piece offered.

Warhol's Queen Elizabeth II (F. & S. II.334) (1985) fetched £165,100, falling within the estimated range. Since the passing of the late queen in 2022, this work has become more prevalent in the market. This specific colour variant has only been available three times in the past five years, according to our print market database, accessible for free through MyPortfolio, excluding the artist proof (AP) auction record set just after the queen's passing, this sale aligns closely with the average selling price of the last two sales showing the sustained value of this work. For consignors considering their options, the private market offers a viable alternative avenue for sales and pricing. Read our Guide on Auction vs. Private Sale to learn more.

Read the Keith Haring Investment Guide

Browse Haring prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR KEITH HARING PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

While this sale presented fewer of the Warhol works that permeated the print market in 2023, such as Jagger prints and Renaissance Paintings, Warhol's presence was notable by volume. Various Saint Apollonia and Mao prints performed well, showcasing the breadth of Warhol's print market. Other highlights included Sea Turtle (F. & S. 360A), realising £69,580 above the £60,000 high estimate. Red Lenin (F. & S. 403) (AP) and Lenin (F. & S. 402) (PP) achieved expected prices, £57,150 and £48,260, respectively. Goethe (F. & S. 270-273) (TP) realised £63,500 above the £60,000 high estimate, while Dollar Sign Quad (F. & S. II.283) achieved £82,550, consistent with its average selling price as indicated on MyArtBroker’s value indicator. Read our case study to learn more on how our value indicator works.

Read the Andy Warhol Investment Guide

Browse Warhol prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR ANDY WARHOL PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

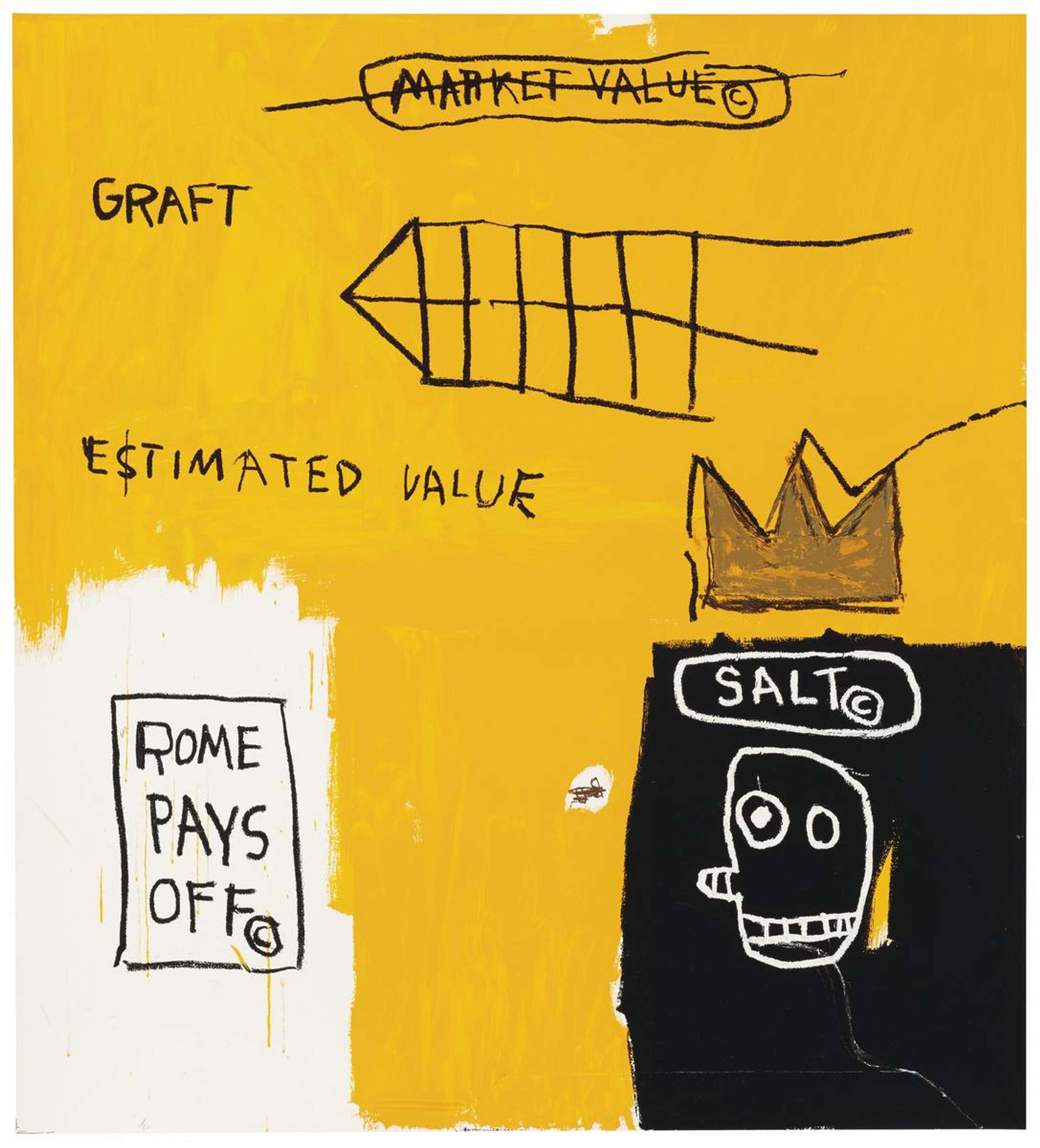

Jean-Michel Basquiat Posthumous Prints

Following Basquiat's remarkable performance in the May New York sales, his posthumous prints remain in high demand. Phillips' editions sale featured three such prints, with Cabeza (2005) emerging as the top performer, sparking a bidding war that culminated in a hammer price at the high estimate of £70,000, ultimately realising £88,900 with fees, aligning closely with MyArtBroker's value indicator estimates. Rome Pays Off (AP) (2004) also made waves, achieving £53,340 and setting a new auction record, surpassing the previous record set in October 2019. Discover more about Basquiat's posthumous print market by tuning in to our podcast, where Louis Denizett explains their sought-after demand and enduring value.

Subscribe and leave us a review at MyArtBrokerTalks

Read the Jean-Michel Basquiat Investment Guide

Browse Basquiat prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR BASQUIAT PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

Rare To Market Works: Roy Lichtenstein and Bridget Riley

Also notable in this sale was the absence of Lichtenstein’s Nudes and Landscapes, Moonscapes, Seascapes which dominated the market in 2023. Phillips offered a refreshing perspective with the lesser-seen Composition series by Lichtenstein, featuring two works that performed favourably. Composition I (1996) achieved £40,640, squarely within the estimated values, while Composition III (1996) realised £21,590, setting a new auction record compared to its most recent sale in June 2023. MyArtBroker’s value indicator indicates an upward trend in value for both of these rare-to-the-market artworks.

Read the Roy Lichtenstein Investment Guide

Also achieving remarkable success and sparking a bidding frenzy was Riley’s Untitled (Oval Image) (S. 3, T. & G. 4) (1964). This piece, part of an edition of fifty, represents a rare and formative work in Riley’s oeuvre. Strategically offered as the second lot of the sale, it was expected to attract attention, as evidenced by the intense bidding war that drove its final price to £82,550 against a £35,000 estimate, making it one of the highest standout performers of the sale in terms of hammer price to estimate ratio. For further insights into the value of Riley’s monochromatic formative works, tune in to our podcast featuring our sales specialist, Jasper Tordoff.

Subscribe and leave us a review at MyArtBrokerTalks

Read the Bridget Riley Investment Guide

Browse Bridget Riley prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR BRIDGET RILEY PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

Market Momentum: Damien Hirst and Banksy

While Damien Hirst's prints encompass various subjects like spots, skulls, and butterflies, his Virtues series stands out as the most sought-after in the market. In the recent April print sales, Control H9-8 (2021) surpassed expectations, fetching $27,940 against a $12,000 high estimate. Complete sets of these works are even more coveted. This sale featured a complete set with a high estimate of £80,000, ultimately selling for £101,600 with fees. MyArtBroker’s value indicator confirms the enduring value of these prints. Additionally, Hirst's Butterfly works maintain collector interest, with Big Love (2010) reaching £48,260 and Blue Butterfly from In The Darkest Hour There May Be Light (2006) achieving £16,510 demonstrating a remarkable hammer-to-estimate ratio.

Read the Damien Hirst Investment Guide

While Banksy was notably absent from the May New York sales, Phillips featured two unsigned prints by the artist. Pulp Fiction (2004) achieved £30,480, surpassing its high estimate of £20,000, and Toxic Mary (2004) realised £20,320, also exceeding its high estimate of £15,000. Although these results may fall short of auction records set during Banksy's peak years, both sales surpassed the most recent sales of these unsigned prints demonstrating sustained healthy demand for Banksy's works. For a comprehensive overview of Banksy’s print market, explore The Banksy Report: Seven Years in the Banksy Print Market.

Browse Banksy prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

LOOKING TO SELL YOUR BANKSY PRINTS?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.