Market Reports

Key Takeaways

How to Sell an David Hockney Step-By-Step

2025 marked a record year for David Hockney’s print market, reflecting sustained demand for his most recognised and well-positioned works. While volumes varied by series, buyer appetite remained strong across key categories.

For sellers, opportunity now lies in how a print is priced, timed, and brought to market. This guide outlines how value is forming – and how to sell a Hockney print strategically.

Is Now A Good Time To Sell A David Hockney Print?

2025 has delivered record total sales value for Hockney’s print market, confirming sustained buyer demand across established series. In the first half of the year alone, total sales value more than doubled 2024 levels, accompanied by increased trading volume – indicating that stronger prices were being achieved across actively traded works.

This environment supports well-positioned prints brought to market with clarity around pricing, condition, and series identity. Momentum exists, but outcomes are increasingly shaped by how a work is introduced rather than by exposure alone.

David Hockney Market Performance – What Is Driving Value in the Hockney Market?

Hockney’s print market is currently structured around differentiation rather than uniform growth. Works do not perform evenly across his output; instead, value forms according to how a print functions within the market – whether it operates as a price-setting benchmark or as part of the liquidity base that underpins regular trading.

Both traditional and digital works continue to gain recognition, but pricing strength is determined by scarcity, clarity of series identity, and trading frequency. Prints that anchor value respond best to controlled placement, while more liquid works benefit from depth of active demand. Aligning route to market with a print’s role within this internal hierarchy has become central to achieving strong results.

How Much Is My David Hockney Print Worth?

Valuing a Hockney print in 2025 requires looking beyond headline results and assessing how a specific work has traded within its series. Record overall sales value does not mean uniform pricing. Outcomes are being shaped by edition type, recent comparables, and whether a print operates as a benchmark work or part of the market’s liquidity base.

Understanding where a work sits within that structure is central to setting expectations.

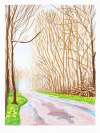

Arrival of Spring Print Value After the 2025 Sotheby’s Sale

The most visible pricing shift occurred within The Arrival of Spring, where Sotheby’s dedicated white-glove sale established new six-figure benchmarks. However, those results were driven by a rare combination of matching edition numbers, timing, and provenance. Individual works from the series must now be valued against recent comparables rather than peak event pricing.

For prints from this collection, condition, placement, and recent trading frequency are critical. Benchmark sales do not automatically translate into repeatable results without similar context.

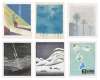

Moving Focus and Swimming Pool Prints: Records, Liquidity, and Price Sensitivity

Within Moving Focus, 2025 saw new records for works including An Image of Celia and An Image of Gregory, particularly where rarer impressions came to market. Scarcity within an edition – such as printer proofs – materially influenced pricing strength.

By contrast, artist’s proofs of Hockney’s lithographic Swimming Pools have softened slightly. This reflects lateral movement within the category, where collectors can trade between variations of similar imagery. In these cases, pricing is sensitive to substitution, and disciplined positioning is essential.

Artist’s Proofs, Trial Proofs, and Complete Sets in Hockney’s Market

Proofs and complete sets remain rare across Hockney’s print output. Trial proofs, printer’s proofs, and full portfolios can command premiums, but their infrequency means comparable data may be limited. When they do appear, outcomes are often determined by specialist placement rather than broad exposure.

Edition size, proof designation, and documentation can significantly influence valuation, particularly at higher price points.

How to Prove Your David Hockney Print Is Real Before Selling

Authenticity in Hockney’s print market is established through recognised market standards rather than formal certification. Unlike some artists, Hockney’s works are not typically accompanied by certificates of authenticity, and their absence does not undermine value. Buyers instead assess provenance, edition structure, and documented production history.

The David Hockney Foundation maintains an extensive archive and supports scholarship, but it does not issue certificates. A comprehensive catalogue raisonné is currently in preparation and will formalise reference material for the artist’s editions once published. Until then, authentication rests on established documentation and market-recognised publishing history.

Provenance remains central. Works acquired through long-standing representatives such as L.A. Louver, Annely Juda Fine Art, or Galerie Lelong carry significant weight. Edition details – including signature, numbering, and publisher blind stamps from workshops such as Gemini G.E.L., Petersburg Press, Editions Alecto, and Tyler Graphics – provide further confidence. For higher-value prints, particularly proofs or complete sets, clear documentation becomes increasingly important, as comparable data may be limited and scrutiny correspondingly higher.

Ensuring that a print’s edition status and provenance are accurately understood before entering the market reduces uncertainty and protects value, particularly at the upper tiers of Hockney’s print market.

How to Conserve Your David Hockney Print to Retain Value

Condition plays a meaningful role in the resale value of a Hockney print, but it must be assessed in context. Hockney’s printmaking spans traditional lithography and etching through to digital and experimental processes, meaning that variations in paper tone, surface texture, or minor undulation are often inherent to the work rather than defects.

The greatest risk to value typically arises from over-intervention. Trimming margins, aggressive cleaning, or undocumented restoration can materially reduce desirability, particularly for works from established series. Where condition issues are present – such as foxing, fading, or paper instability – conservation should be undertaken only with specialist advice and full documentation.

Stable, well-preserved works consistently achieve stronger outcomes, but originality is often more important than cosmetic perfection. Protecting margins, avoiding prolonged light exposure, and maintaining appropriate storage conditions remain the most effective long-term safeguards.

Where Can I Sell My David Hockney Print?

Choosing the right route to market can materially affect outcome. In a structured market such as Hockney’s, pricing, exposure, and timing all influence final results. Sellers typically consider auction, gallery placement, or private sale, each with different levels of risk and control.

Auction vs Private Sale: Risk, Visibility, and Control

Auction offers visibility and the potential for competitive bidding, particularly for rare or highly recognisable works. However, estimates are set publicly, buy-ins are recorded permanently, and timing is fixed within a broader sale context. Even strong prints can underperform if misaligned with catalogue positioning or market sentiment.

Private sale provides greater discretion and pricing control. Works are introduced directly to targeted buyers rather than exposed to open bidding. This can be particularly effective for prints that sit within Hockney’s core liquidity tiers, where depth of demand exists but public volatility is unnecessary.

Gallery placement sits between these models, offering relationship-led sales but often with longer timelines and less pricing transparency.

Why Sell Your David Hockney Print with MyArtBroker

Selling a David Hockney print requires informed pricing, careful placement, and access to active demand. Our approach is structured around reducing friction while protecting net outcome.

Specialist-Led Valuation and Placement

Each print is assessed individually, with pricing grounded in live market data and recent comparables. Series position, edition structure, condition, and trading frequency are all considered before route to market is determined.

Private Sale Model with 0% Seller’s Fees

We specialise in private sales and charge 0% seller’s fees. This avoids public estimate anchoring and buy-in risk while ensuring that agreed pricing reflects the seller’s net result rather than headline optics.

Global Network and Strategic Matching

With an international network of active collectors, institutions, and repeat buyers, works are introduced directly to relevant demand rather than broadcast indiscriminately. Where a print falls outside our core network, we provide impartial guidance on alternative placement.